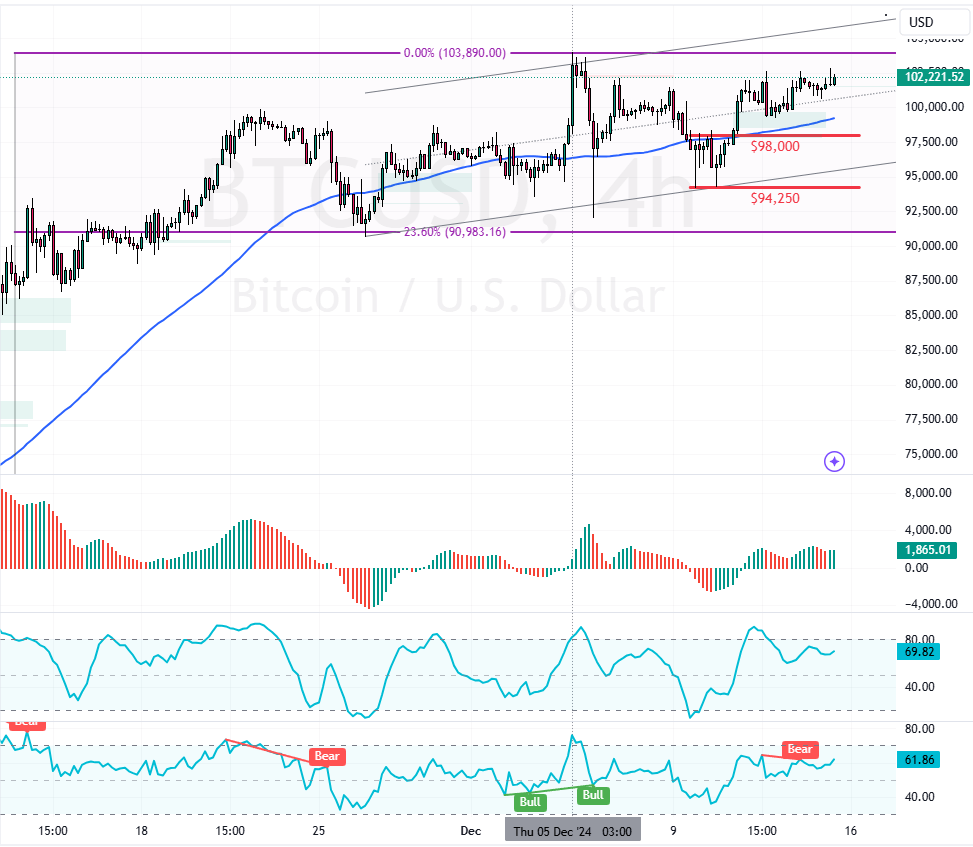

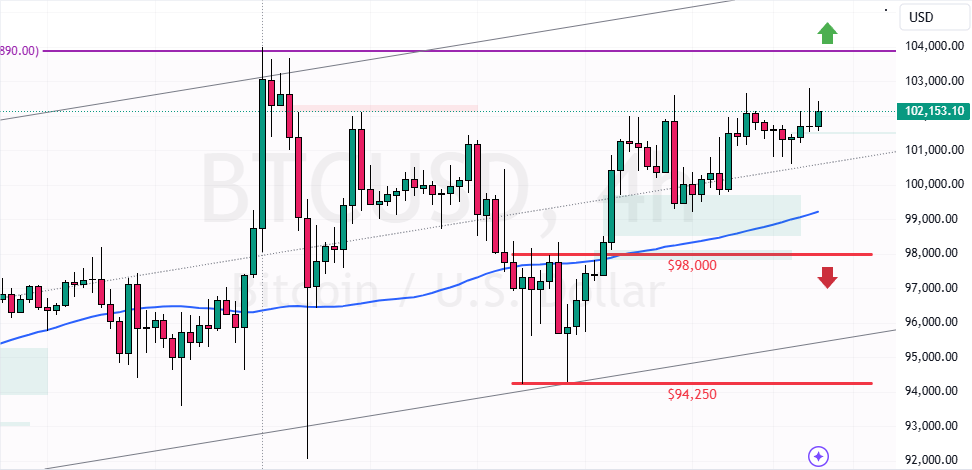

Bitcoin trades bullish, but RSI 14 signals bearish divergence, meaning the digital gold could begin a consolidation phase. The market outlook remains bullish as long as BTC trades above $97,700.

A close above the $103,000 resistance could trigger the uptrend, targeting $105,000.

Bitcoin Technical Analysis – 15-December-2024

FxNews—BTC/USD is in a strong bullish market, above the 75-period simple moving average. As of this writing, the cryptocurrency is trading at approximately $102,300, nearing its all-time high value.

As for the technical indicators, RSI 14 in the 4-hour chart hints at a bearish divergence, suggesting Bitcoin prices could step into a consolidation phase or dip from this point.

Bitcoin Shows Bullish Trends with Risks of Pullback

The immediate support is at $98,000. The Bitcoin trend should be considered bullish as long as the prices are above this level. That said, the immediate resistance rests at $103,900.

From a technical perspective, the uptrend could be resumed if bulls close and stabilize BTC/USD above the immediate resistance ($103,900). In this scenario, the next bullish target could be $105,000.

The Bearish Scenario

A new consolidation phase will likely begin if bears (sellers) close and stabilize the Bitcoin prices below the immediate support ($98,000). If this scenario unfolds, the cryptocurrency in discussion could dip toward $94,250.