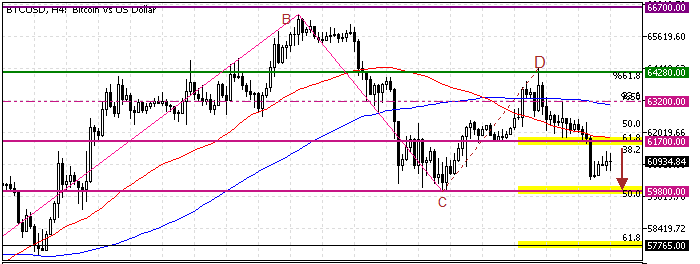

FxNews—Bitcoin‘s bearish momentum from $64,280 resulted in the price breaking the ascending trendline and the $61,700 resistance. As of this writing, the BTC/USD pair trades at approximately $60,700, stabilizing below the CD wave’s 61.8% Fibonacci retracement level.

The daily chart below demonstrates the price, support, resistance levels, and technical indicators utilized in today’s analysis.

Bitcoin Technical Analysis – 10-October-2024

The primary trend is bearish since the price is below the 50- and 100-period simple moving averages. Consequently, robust selling pressure drove the Stochastic oscillator into oversold territory, indicating that the market could bounce from this point.

Additionally, the Awesome oscillator’s latest bar turned green, signifying bullish momentum. This suggests the price could rise and test the upper resistance levels.

Overall, the technical indicators suggest the primary trend is bearish, but Bitcoin has the potential to erase some of its recent losses before the uptrend resumes.

Bitcoin Price Forecast – 10-October-2024

The immediate resistance rests at $61,700, neighboring the 50-period simple moving average. If bears keep the BTC/USD rate below this level, the current downtrend will likely extend to the AB wave’s %50 Fibonacci retracement level at $59,800.

Furthermore, if the selling pressure exceeds $59,800 (October 3 Low), the next bearish target could be the 61.8% Fibonacci retracement level at $57,765. Please note that the bear market should be invalidated if Bitcoin’s value exceeds $61,700.

Bitcoin Bullish Scenario

If bulls (Buyers) pull the bitcoin price above the CD wave’s 61.8% Fibonacci, the current bounce could extend to the BC wave’s 50% Fibonacci at $63,200. Furthermore, if bullish momentum strengthens and exceeds $63,200, the next target will likely be $64,280.

Bitcoin Support and Resistance Levels – 10-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $59,800 / $57,765

- Resistance: $61,700 / $66,200 / $64,280