FxNews—The Bitcoin bullish momentum that began at $52,670 has extended to the August 29 high ($61,190), above the 100-period simple moving average.

As of this writing, the BTC/USD pair is trading at approximately $59,700. Meanwhile, the stochastic oscillator and the relative strength index indicator signal overbought.

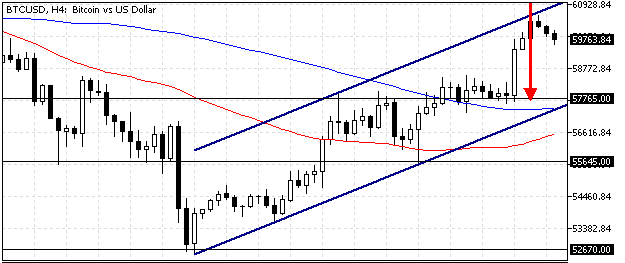

The 4-hour chart below demonstrates the price, key support and resistance levels, and the technical indicators utilized in today’s analysis.

Bitcoin Technical Analysis – 14-September-2024

Digital gold is overbought; hence, it is not advisable to join the market when it could be saturated with buyers. On the other hand, the Awesome oscillator bars are green and above the signal line, meaning the primary trend is bullish.

But, we suggest traders and investors wait patiently for the Bitcoin price to consolidate near lower support levels before joining the bull market.

Bitcoin Bearish Scenario

The immediate resistance rests at $61,190 (August 29 High). The Bitcoin price is falling back from the upper band of the bullish flag. Since Stochastic and RSI signal an overbought market, we expect the price to test $57,765 before the uptrend resumes.

Please note that the $57,765 resistance is in conjunction with the 100-period simple moving average, and if the BTC/USD price dips below it, the trend direction should be considered bearish.

Bitcoin Bullish Scenario

From a technical perspective, the uptrend will likely resume if the bulls (buyers) close and stabilize the price above the $61,190 resistance. If this scenario unfolds, the next resistance levels will be $62,770, followed by $65,110, the August 26 high.

Bitcoin Support and Resistance Levels

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $57,765 / $55,645 / $52,670

- Resistance: $61,190 / $62,770 / $65,110