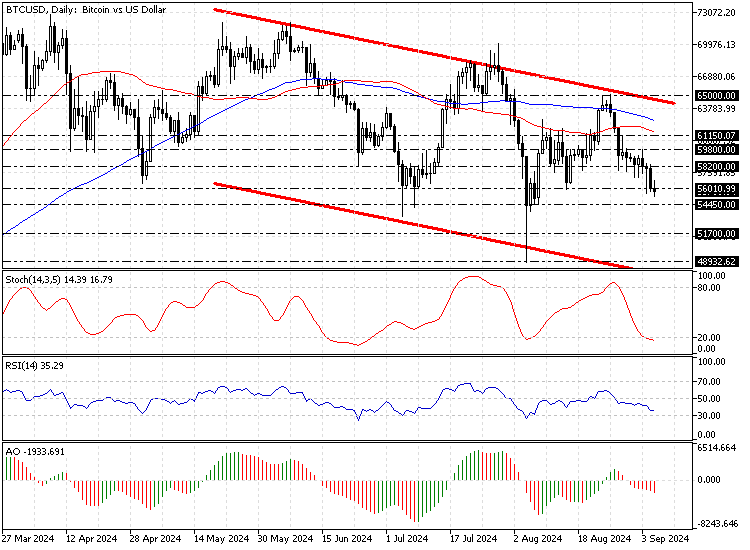

FxNews—Bitcoin trades in a bear market at approximately $55,780 in today’s trading session. Meanwhile, the stochastic oscillator signals an oversold BTC/USD daily chart market.

The chart below demonstrates the price, key support and resistance levels, and technical indicators utilized in today’s analysis.

Bitcoin Technical Analysis – 6-September-2024

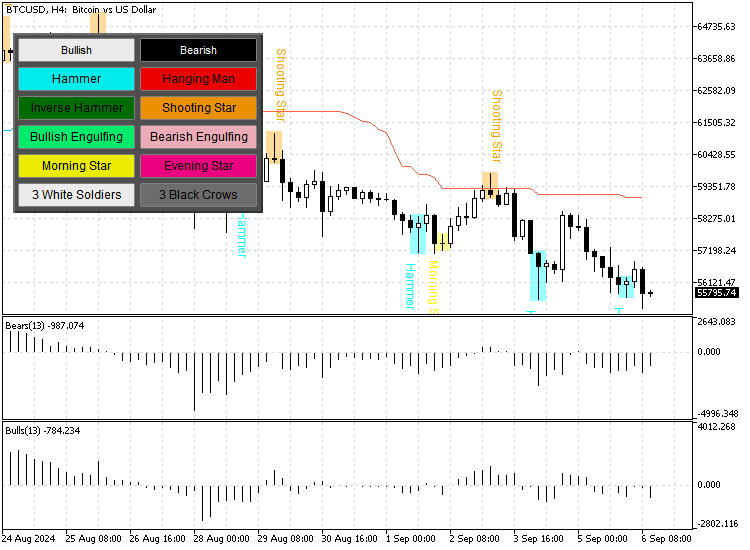

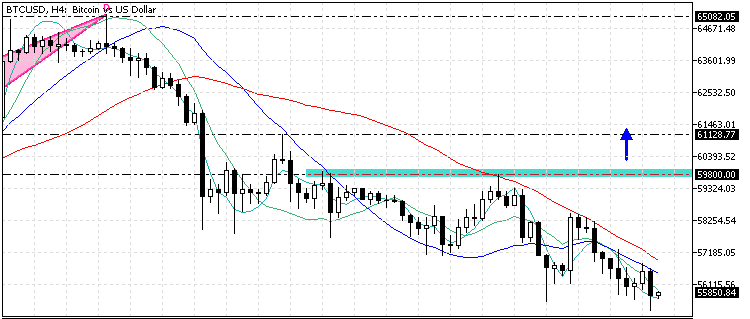

Zooming into the BTC/USD 4-hour chart, we notice that the price of digital gold is below the 50– and 100-period simple moving average, meaning the primary trend is bearish. Interestingly, bears are testing the lower band of the bearish flag, slightly below the September 4 low of $56,000.

- The awesome oscillator bars are red and below the signal line, suggesting the strength of the bear market.

- The stochastic and the relative strength index indicators are nearing the oversold territory, depicting 19 and 35, respectively. These numbers show that Bitcoin has not yet been oversold in the smaller time frame. Therefore, the downtrend could resume.

There is no data on the harmonic pattern chart. However, bulls formed a bullish hammer candlestick pattern in the 4-hour chart, meaning the current downtrend might ease.

Overall, the candlestick pattern and the oversold stochastic in the daily chart suggest that Bitcoin’s price will consolidate near the upper resistance levels.

Bitcoin Price Forecast – 6-September-2024

The primary trend is bearish, but the 4-hour and daily charts show signs of a price consolidation phase. Therefore, joining the bear market at the current price comes with a significant risk.

Hence, traders and investors should patiently wait for the price to consolidate near the 50-period simple moving average and the upper line of the bearish flag, which is about $58,200.

In this scenario, the 4-hour chart should be monitored closely for bearish signals, such as a bearish long wick candlestick or a bearish engulfing pattern. If the primary resistance at $59,800 holds, the downtrend will likely resume with the August 8 low ($54,450) as its next target.

Furthermore, if the selling pressure exceeds $54,450, the next supply level will be $51,700.

- Also read: USD/SEK Forecast – 5-September-2024

Bitcoin Bullish Scenario – 6-September-2024

The September 3 high ($59,800) is the key resistance to the current bear market. This barrier is robust in conjunction with the 100-period simple moving average. If the bulls (buyers) close and stabilize the price above the 100-period SMA ($59,800), the trend should change from bearish to bullish. If this scenario unfolds, the road to the August 26 high ($65,000) will be paved.

Bitcoin Support and Resistance Levels – 6-September-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $54,450 / $51,700

- Resistance: $59,800 / $61,150 / $65,000