FxNews—Recently, there’s been a lot of talk about Bitcoin ETFs potentially exceeding the holdings of Bitcoin’s mysterious creator, Satoshi Nakamoto. In this context, BlackRock has reached a notable point in its Bitcoin collection.

Investment Giant Holds $27 Billion in Bitcoin

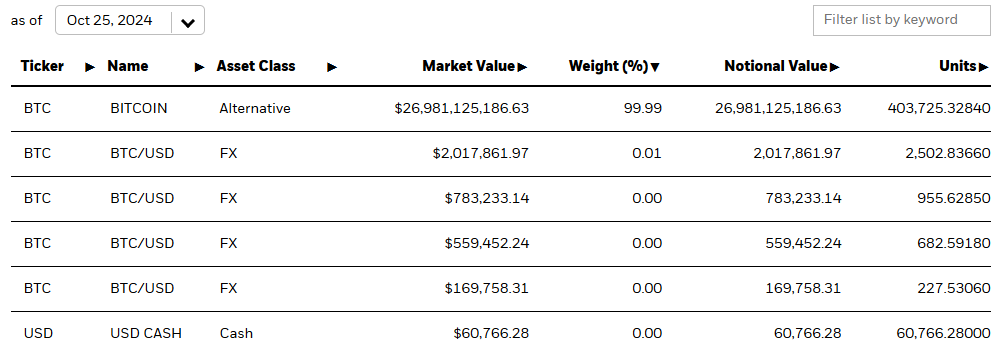

Recent data from Lookonchain shows that the investment behemoth now owns more than 400,000 Bitcoins, valued at around $26.98 billion.

In the last two weeks, BlackRock has boosted its Bitcoin stash by 34,085 BTC, valued at about $2.3 billion. This significant addition underscores BlackRock’s prominent role in cryptocurrency as it continues to build up its Bitcoin assets.

IBIT Gains $400 Million Daily as Investors Trust BlackRock

Meanwhile, BlackRock’s Bitcoin ETF, known as IBIT, has experienced impressive growth, surpassing $23 billion in value, reports Farside Investors. Since October 14, IBIT has consistently attracted new investments, with inflows reaching up to $400 million on certain days.

This demonstrates strong investor trust and interest in BlackRock’s Bitcoin strategy, marking a strategic move amidst Bitcoin’s broader acceptance.

Also read: Elon Musk Weighs in as XRP Ledger Transaction Surge

Bitcoin Investors See Gains as 92.88% are in Profit

Further insights from IntoTheBlock, shared by AMBCrypto, indicate that about 92.88% of Bitcoin owners are “in the money,” meaning their investments are currently worth more than their original purchase prices.

Conversely, only 2.45% of owners are “out of the money,” showing strong market confidence and hinting at possible future price increases.

Will BlackRock Start a Bitcoin Split War?

There is ongoing speculation about future “Bitcoin wars,” with some suggesting that major players like BlackRock might one day attempt to create a split from the original Bitcoin chain to establish their version as the authentic one.

Although it might sound like a far-fetched idea, BlackRock’s rapid Bitcoin accumulation has sparked worries about its increasing sway in the market.

Bitcoin Bulls Eye $69,580 as Uptrend Gains Momentum

Bitcoin is trading bullish, testing the $68,750 market as resistance. The Stochastic and RSI 14 have room to become overbought, meaning the uptrend will likely resume. Additionally, the Awesome Oscillator and Boom and Crash Gold miner indicators signal buy with their histogram green and blue, respectively.

From a technical standpoint, the current bullish wave can potentially target $69,580 (October 21 High) if bulls pull the price above the $68,750 resistance. Furthermore, if the buying pressure exceeds $69,580, the next bullish target could be the $75,000 mark.

Please note that the bullish outlook should be invalidated if BTC/USD falls below the 100-period simple moving average at approximately $66,710.