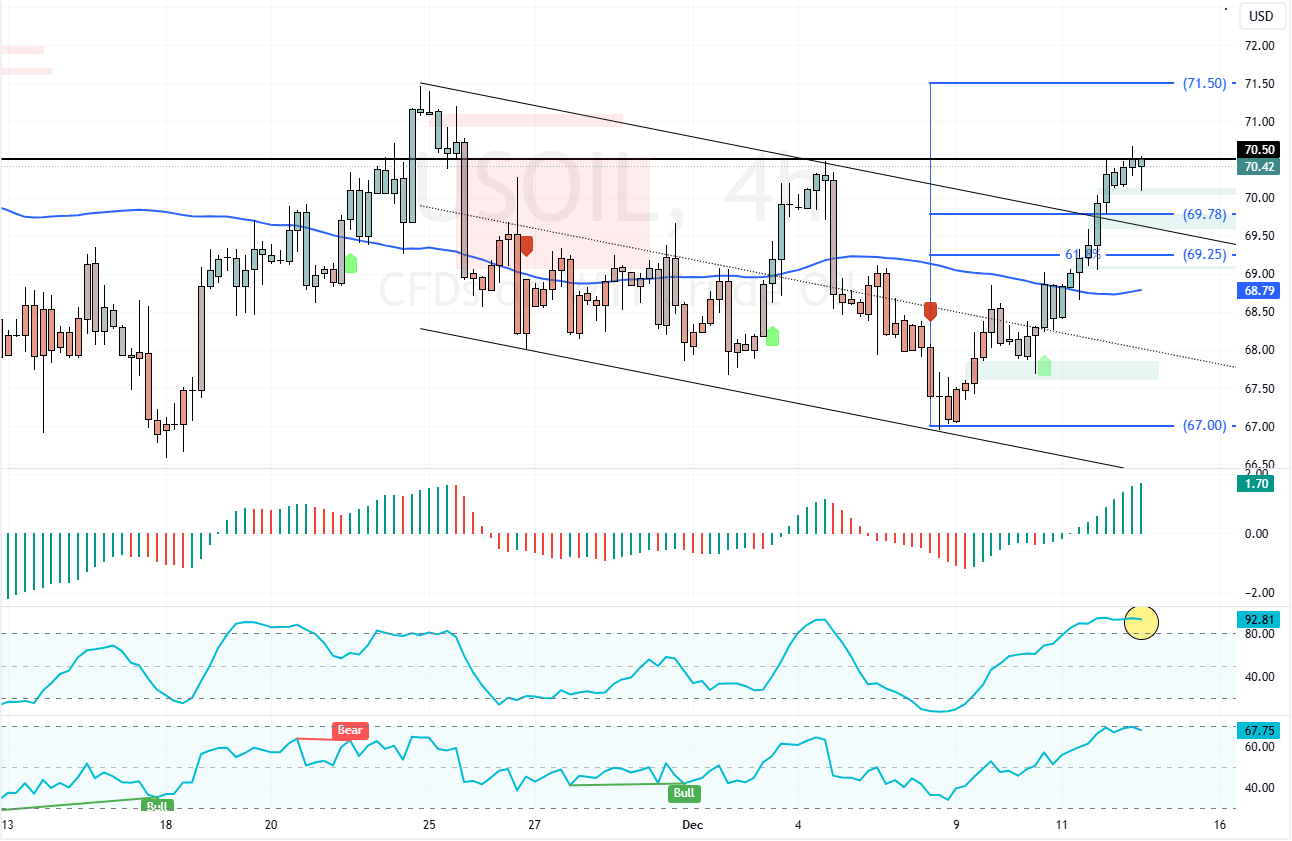

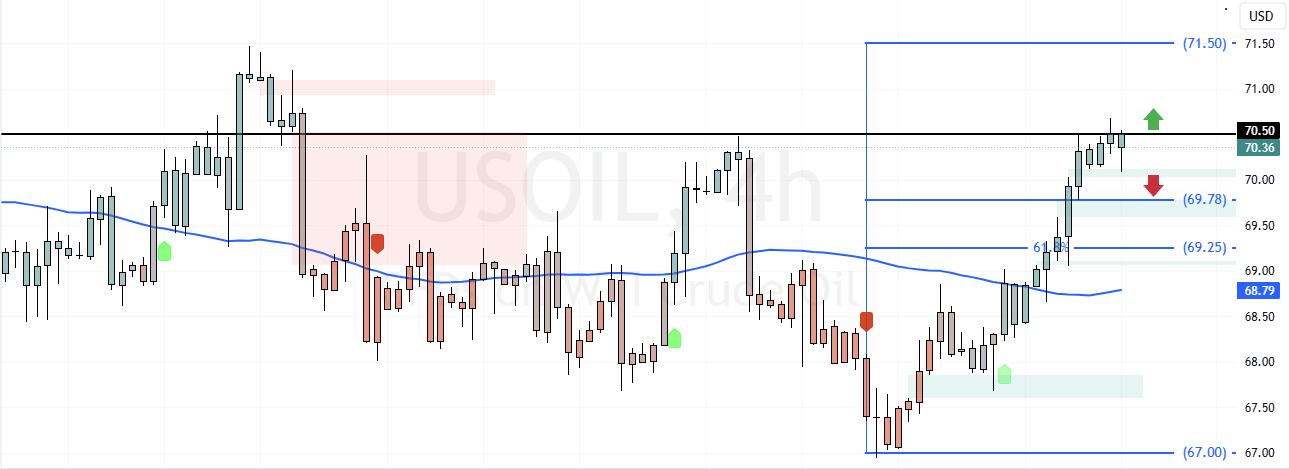

FxNews—Crude Oil trades bullish, above the 75-period simple moving average. The uptrend resumed after the prices exceeded the 61.8% Fibonacci resistance level.

But, the robust buying pressure drove the Stochastic Oscillator into the overbought territory, depicting 92 in the description. This means WTI Crude Oil is overpriced, at least temporarily.

Crude Oil Technical Analysis – 12-December-2024

As of this writing, the black gold tests the $70.5 resistance amid overbought signals, hinted by Stochastic and RSI 14. Therefore, markets expect the prices to consolidate near lower support levels before the uptrend resumes.

In this scenario, Crude Oil could dip toward the $69.7 support, followed by the 61.8% Fibonacci at $69.2. These levels provide a reasonable bid price to join the uptrend, strategically targeting $71.5. Therefore, retail traders and investors should monitor these levels for bullish signals, such as candlestick patterns.

Please note that the bullish outlook should be invalidated if Oil prices dip below the 69.2 mark or the 75-period SMA.