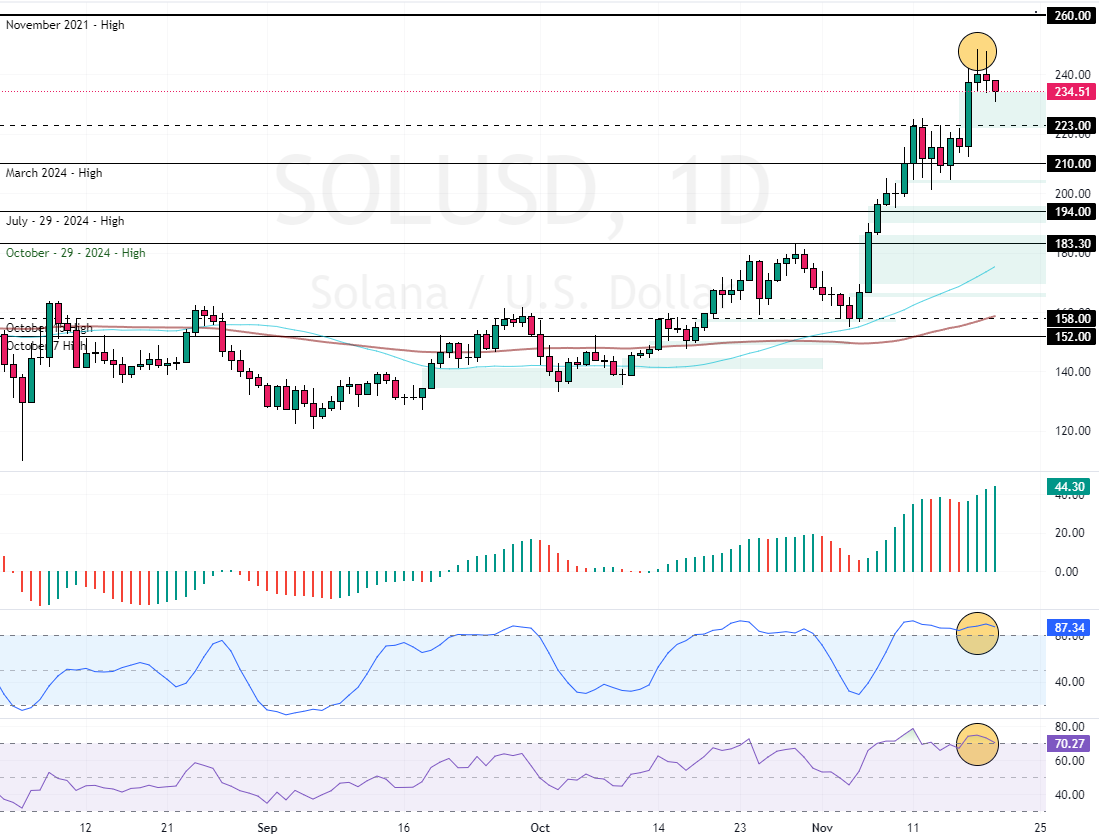

FxNews—Solana trades in a strong bull market, above the 50-period simple moving average. However, the uptrend eased yesterday when the prices neared the November 2021 high at approximately $260. Consequently, the Solana 4-hour chart formed a longwick bearish candlestick pattern.

As of this writing, SOL/USD trades at approximately $234.0.

Solana Technical Analysis

Yesterday’s bullish momentum resulted in the prices leaving a bullish fair value gap behind, which could magnetize the market into itself before the uptrend resumes. This scenario is backed by Stochastic and RSI 14, both of which hover in overbought territory.

- Stochastic Oscillator depicts 87 in the description.

- RSI 14 records show 70.6, which is inside the overbought territory.

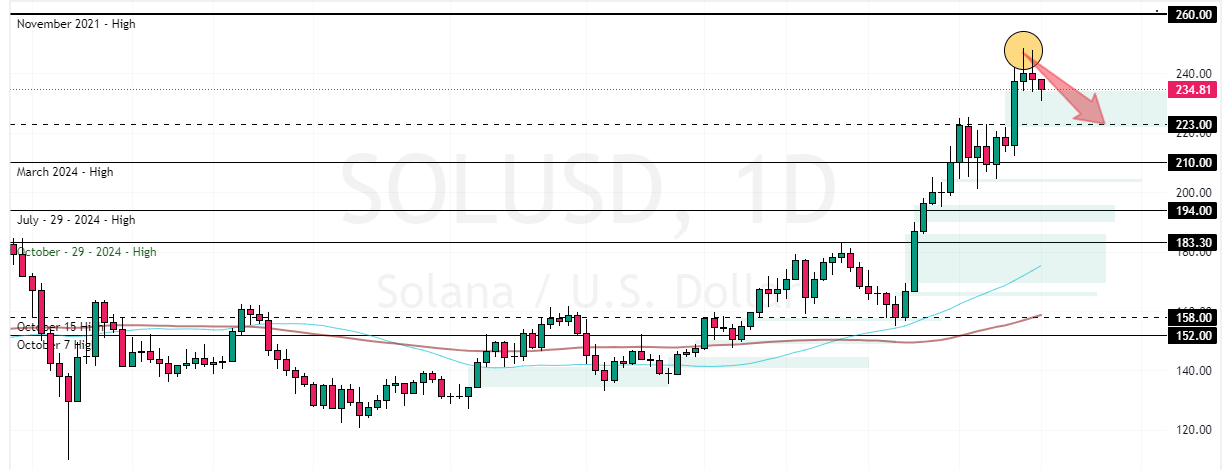

Buy Solana Smartly – Wait for Price Consolidation

From a technical perspective, joining a bull market when it is saturated with buyers is not advisable. Therefore, we suggest waiting for Solana prices to consolidate near the immediate support at $223, backed by the bullish FVG, as this zone offers a low-risk entry point to join the bull market.

That said, the trend outlook remains bullish as long as prices are above the March 2024 high at $210, targeting the 260.0 resistance.

- Also read: Will Ethereum Bulls Overcome $3190 Hurdle

Please note that the bullish scenario should be invalidated if SOL/USD falls below the 210.0 critical support.

- Support: 223.0 / 210.0 / 194.0

- Resistance: 260.0 / 270.0 / 300.0