Fxnews—The CAC 40 Index rose 0.5% on Wednesday, ending at 7,560 points. This uptick is a rebound from the previous day’s downturn, as market participants eagerly anticipated new economic reports from the United States.

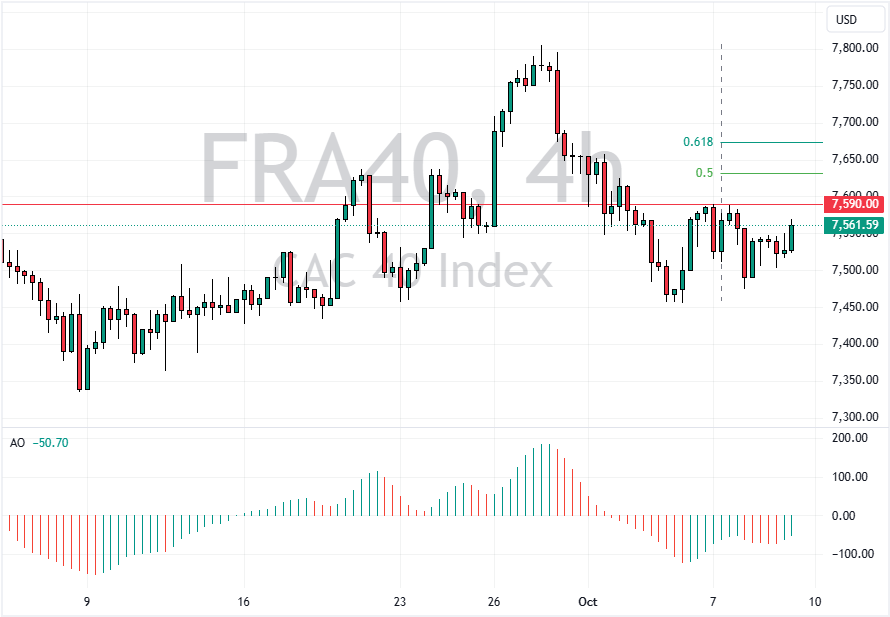

The CAC 40 (FRA 40) 4-hour chart below demonstrates the current price, as well as the key Fibonacci retracement levels. The immediate barrier rests at $7,590. The uptick momentum can potentially target the %50 Fibonacci retracement level at $7,630 if bulls pull the price above the immediate resistance.

Anticipation Builds for Economic Updates

Investors are keenly awaiting the publication of the latest Federal Open Market Committee (FOMC) meeting minutes. This document is pivotal as it will offer insights into the U.S. Federal Reserve’s current thoughts and potential future actions concerning interest rates.

Furthermore, the upcoming U.S. Consumer Price Index (CPI) data, set to be released tomorrow, is highly anticipated. This report will help clarify whether inflation trends are accelerating or slowing down, influencing the Federal Reserve’s next steps in monetary policy.

European Central Bank’s Expected Moves

In Europe, attention is turning to the European Central Bank (ECB), which is predicted to lower its borrowing rates by 25 basis points next week.

Among the standout performers in the CAC 40 was Renault, which saw its shares surge by 3.4%. This significant increase came following the announcement that Renault’s Ampere division is set to purchase a 40% interest in E2-CAD, a French engineering firm. This acquisition is part of a broader initiative to enhance its capabilities in embedded electronics, signaling a strategic expansion in Renault’s operations.

Other companies such as Vinci, Legrand, and Stellantis also enjoyed gains, with their stock prices increasing by 2% to 2.2%, highlighting a strong performance day for the French market.