The French CAC 40 index dropped by 0.8%, landing at 7,421 this Wednesday. This downturn marks the second day of losses, reaching the lowest point in a month. The major reason was a significant drop in high-end fashion stocks.

CAC 40 Technical Analysis – 16-October-2024

The CAC 40 4-hour chart below shows the price bounced from the 50% Fibonacci retracement level at $7,423. Meanwhile, the Awesome Oscillator histogram is red below the signal line, suggesting the bear market prevails.

From a technical perspective, the primary trend remains bearish if the price is below the 100-period simple moving average. Additionally, the downtrend will likely be triggered by targeting the 68.8% Fibonacci retracement level at $7,331 if the CAC 40 price falls below 50% Fibonacci.

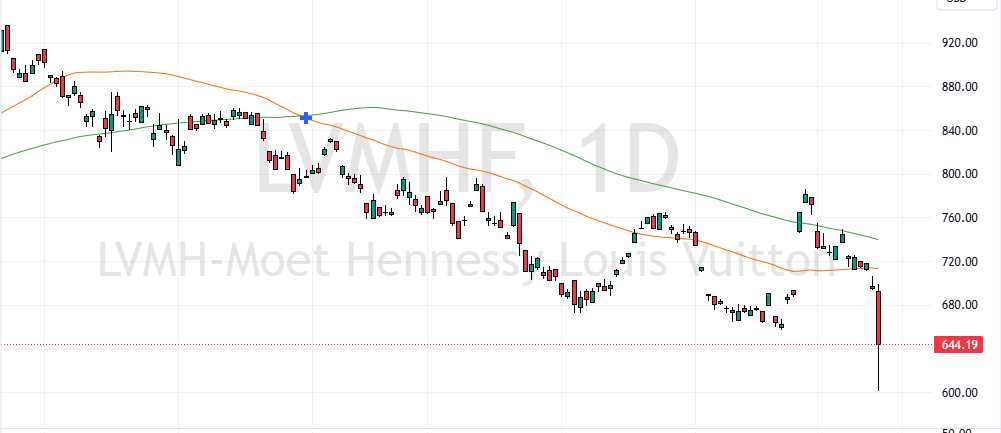

€19B Revenue Drop Triggers LVMH Stock Slide

LVMH was at the forefront of the decline, losing 5.4% and hitting its lowest price in almost a month. This came after they announced a quarterly revenue of about €19 billion, 3% less than before.

Other leading luxury companies, such as Kering, L’Oréal, and Hermès, also saw their values fall by 4.3%, 3.7%, and 2.7%, respectively.

Market Slump but Teleperformance, TotalEnergies Gain

Despite the overall market slump, some companies did see gains. Teleperformance increased by 2.5%. Energy firm TotalEnergies and media group Vivendi each enjoyed rising stock prices, up 1.5% and 1.4%, respectively.

Investors are now focusing on the European Central Bank’s upcoming decision. There is a widespread expectation of a rate decrease by 25 basis points, which could influence future market movements.