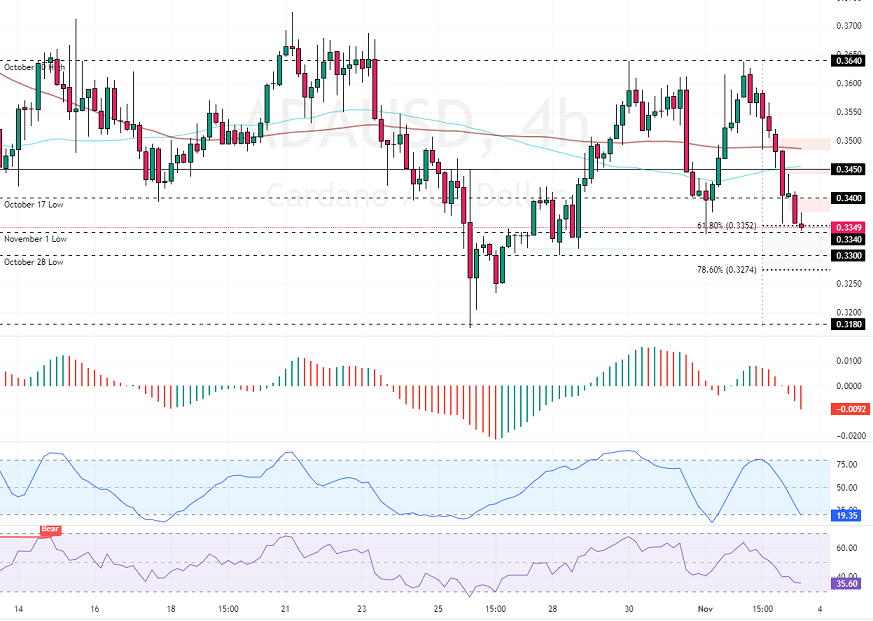

FxNews—Cardano, or ADA, lost 3.2% of its value in today’s trading session due to a new bearish wave that began at $0.364. As of this writing, the ADA/USD pair trades at approximately $0.336, nearing the November 1st low, in conjunction with the %38.2 Fibonacci retracement level.

The daily chart below demonstrates the price, support, and resistance levels, as well as the technical indicators utilized in today’s analysis.

Cardano Technical Analysis – 3-November-2024

The primary trend is bearish because the price is below the 50- and 100-period simple moving averages in the 4-hour and daily charts.

The Stochastic Oscillator records show 19 in the description, meaning the market is oversold. On the other hand, the RSI depicts 36, which is not oversold, suggesting the downtrend would resume. In addition to the RSI’s signal, the Awesome Oscillator histogram is red, below the zero line, which interprets that the bear market should prevail.

Overall, the technical indicators suggest that while the primary trend is bearish, the Stochastic’s oversold signal might cause the Cardano price to consolidate before the downtrend resumes.

Cardano Forecast – 3-November-2024

The immediate support is at $0.334, neighboring the 61.8% Fibonacci retracement level. The bearish trend would resume if bears (sellers) close and stabilize Cardano’s price below $0.334. In this scenario, the next bearish target could be the October 28 low at $0.33, followed by $0.327, the 78.6% Fibonacci retracement level.

Please note that the bearish outlook should be invalidated if the price exceeds the 50-period simple moving average of approximately $0.345.

- Next read: Is Solana $159 Support Level About to Break?

Cardano Support and Resistance Levels – 3-November-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 0.334 / 0.333 / 0.327

- Resistance: 0.34 / 0.345