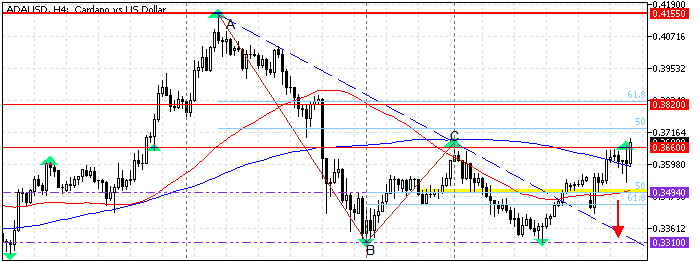

FxNews—Cardano trades sideways in a wide area between $0.331 support and the $0.366 resistance. The new bullish wave from $0.331 eased when the price reached the $0.366 critical resistance. Interestingly, Cardano’s price bounced or pulled back from this hurdle a minimum of 4 times before.

The 4-hour chart below demonstrates the price, support, resistance levels, and technical indicators utilized in today’s analysis.

Cardano Technical Analysis – 15-October-2024

The Stochastic oscillator gives an interesting signal. The %K period records 81 in the description, above 80, meaning Cardano is overpriced in the short term. Furthermore, the Awesome Oscillator histogram turned green, and the value is dropping toward the signal line, indicating a new bearish wave could be imminent.

On the other hand, the price flipped above the 100-period simple moving average, which is a strong bullish signal.

Additionally, the 4-hour chart demonstrates that ADA/USD tries to fill the fair value gap, which expanded from $0.362 to $0.382, meaning the price can potentially increase to fill the FVG.

Overall, the technical indicators suggest that while the primary trend could have been reversed from bearish to bullish, there is still a strong possibility of the Cardano price experiencing a new bearish wave.

Cardano Price Forecast – 15-October-2024

The September 7 high at $0.366 is the immediate resistance. If bulls (buyers) pull the price above $0.366, the uptrend will likely resume. In this scenario, the next bullish target could be $0.382.

Notably, the $0.382 aligns with the FVG’s final resistance area and the 61.8% Fibonacci retracement of the AB wave, making it a robust barrier.

Cardano Bearish Scenario

The immediate support rests at the %50 Fibonacci retracement level of the BC wave, the $0.349 mark. If bears (sellers) push the price below $0.349, the trend should be reversed to bearish.

In this strategy, the new bearish trend could spread to the October 3 low at $0.331, a strong resistance that Cardano’s price bounced from at least five times.

Cardano Support and Resistance Levels – 15-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $0.349 / $0.331

- Resistance: $0.366 / $0.382