FxNews—It is not a secret that moving averages are one of the most popular technical indicators for uncovering the direction of a trend on a price chart. Therefore, we picked a unique technical tool combined with two moving averages that can aid Forex traders with finding the primary trend quickly and without hassle.

Mehran Sepah Mansour developed this indicator, Comprehensive Moving Averages. Thanks to his great work and generosity, it is free to download from the MQL 5 website, the MT5 platform, or the link below.

Customize Your MA: Options from Simple to Kaufman

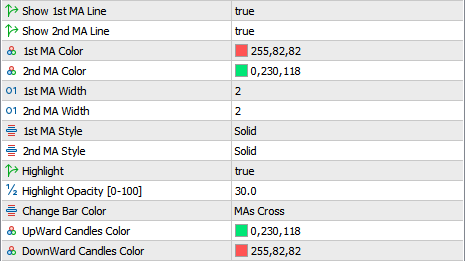

The indicator is merged with two moving averages. The type of moving averages can be changed in the indicator’s input menu. The alternative options are as follows:

- Simple, exponential, smooth, linear weighted, volume-weighted, hull, double EMA, triple EMA, least square, Arnaud Legoux, Wiler’s MA, Tillson, Kaufman adaptive, variable index dynamic average.

Forex traders can change the moving average type from the ‘method’ input in the settings to discover which one suits their strategies. By default, the ‘method’ refers to the ‘simple moving average,’ widely regarded as the most popular.

Dual-Color Moving Averages: Quick Chart Analysis Tools

The Comprehensive Moving Average indicator features eye-catching colors, which help new and experienced traders read the price chart quickly.

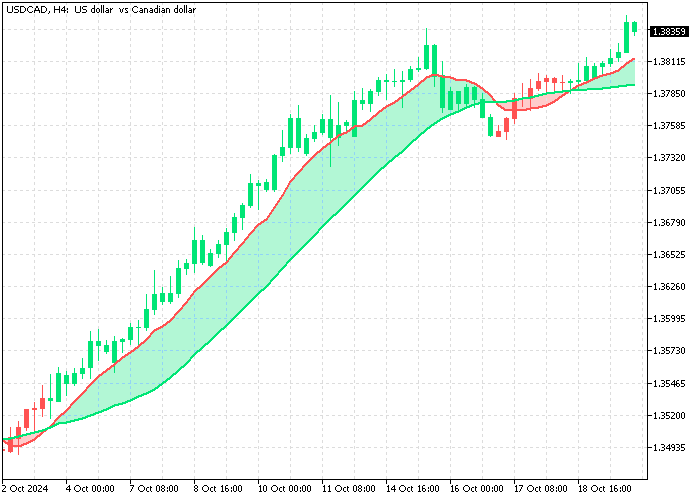

The moving averages are shown on the chart in red and green. The fast-moving average is highlighted in red, while the slow-moving average is emphasized in green.

The gap between the two moving averages is filled with green if the market is bullish and the price is above the moving average and red if the market is bearish or below the moving average.

Additionally, the indicator paints the candles based on the trend direction for clarity. The candles are green in a bull market and red in a bear market, making the trend direction as visible as possible.

Moving Average Golden Cross: Stay Updated with Alerts

One of the most popular signals for using two or more MAs on a price chart is the moving average golden cross, where one MA crosses another.

Furthermore, the comprehensive moving average indicator conveniently alerts users to shifts in trend direction when such events occur on a price chart.

The Comprehensive Moving Average Indicator is armed with pop-up alerts, push notifications, and email alerts for when the moving averages signal a bullish or bearish golden cross signal.

Traders can apply the comprehensive moving average indicator on multiple charts or trading instruments, minimize the MetaTrader 5 windows, do their daily errands, and receive a notification when a new signal is detected.

Furthermore, the alert is not limited to the Golden Cross signal. The Comprehensive Moving Average indicator alerts if the price crosses or touches any moving averages. This alert is crucial for uncovering decent trigger points for joining the main trend.

How to Trade Moving Average Indicator

Moving averages typically generate two critical signals: the Moving Average Golden Cross and the Moving Average Price Rejection.

Moving Average Golden Cross

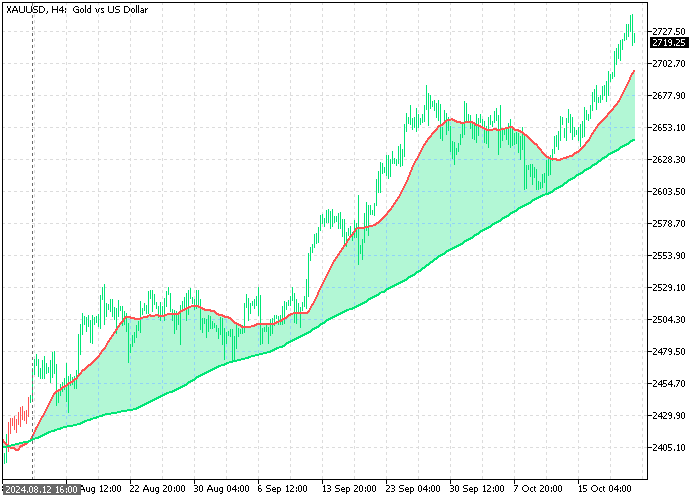

One of the most popular trading strategies with Moving Averages is featuring a chart with two or more SMA (Simple Moving Average) or EMA (Exponential Moving Average). One moving average is faster than the other. For instance, the first moving average is a 25-period SMA, and the second is a 50-period SMA.

- A sell signal is generated when the fast SMA crosses below the slow SMA.

- On the contrary, if the fast SMA crosses above the slow SMA, the indicator generates a buy signal.

The 4-hour XAU/USD (Gold) price chart above features the Comprehensive Moving Average indicator. The image shows that the Gold price exceeded the 25-period SMA (red line) on August 12. Consequently, the fast SMA crossed above the slow SMA, called the Moving Average Golden Cross. T

The chart clearly illustrates that the gold price increased, and the uptrend resumed.

Moving Average Price Rejection Signal

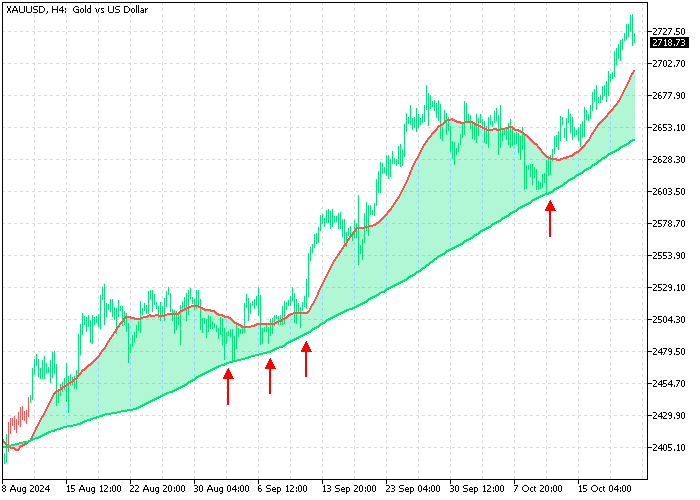

Moving averages, especially slow SMAs such as 50, 100, or 200-period, can act as strong support or resistance levels. When the price of trading security nears a 200-period SMA and if it fails to break through it, the Moving Average Price Rejection Signal occurs. This is when the price bounces back in the opposite direction.

In this context, the moving average acts as a dynamic support or resistance level, serving as a supply area if the price is above it and as a demand zone below it.

The 4-hour price chart above represents the XAU/USD (gold) with 25- and 150-period simple moving averages. The slow-moving average (150-SMA) acts as a dynamic support. Consequently, the gold price bounced from it four times, highlighted with arrows in the image.

Final Words

Traders worldwide, regardless of their experience level, usually utilize moving averages in their technical analysis. The indicator is simple and gives useful data about the bullish or bearish trend. Additionally, the Comprehensive Moving Average Indicator performs as an active support and resistance level, shedding light on the zones where the price can bounce.

I hope this article assists you, dear readers, in improving your trading portfolio by filtering false signals on the price chart. I endeavor to share my experience and knowledge in forex and CFD trading with fellow traders worldwide. Learning should be free, and thank you for staying with me in this article.

If you have any questions about these indicators, please feel free to message me or contact me.