FxNews—On October 11, 2024, US crude oil reserves decreased by approximately 2.19 million barrels. This change was unexpected as experts initially predicted an increase of 2.3 million barrels. The data comes from the latest EIA Petroleum Status Report.

Gasoline and Distillate Inventory Drops

Furthermore, gasoline reserves also fell significantly by about 2.20 million barrels, surpassing the anticipated decline of 1.4 million. Additionally, distillate inventories, which include key fuels like diesel and heating oil, were reduced by 3.53 million barrels—exceeding the forecasted 2.5 million barrel drop.

Conversely, crude stock levels at the Cushing, Oklahoma, storage facility saw a minor increase of 0.108 million barrels. This follows a previous build of 1.247 million barrels, marking a notable shift in storage trends.

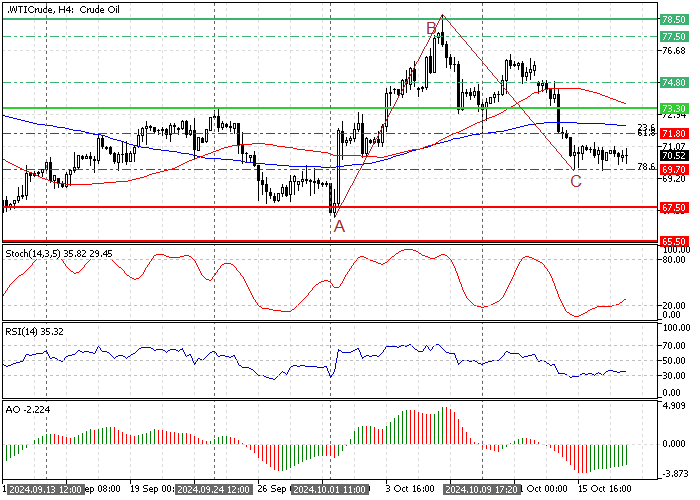

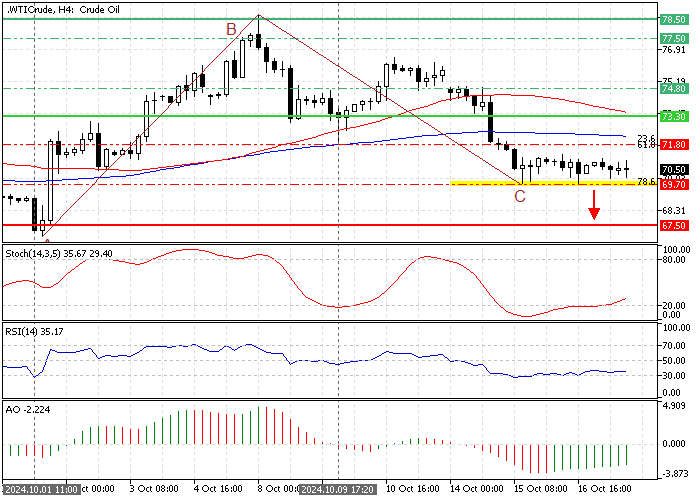

Crude Oil Technical Analysis – 17-September-2024

Crude Oil trades bearish below the 50- and 100-period simple moving averages. The downtrend eased when the price reached the 78.6% Fibonacci retracement of the AB wave at $69.7.

Consequently, oil prices consolidated narrowly, while the stochastic, RSI, and awesome oscillator showed bullish momentum.

Crude Oil Price Forecast – 17-September-2024

Immediate support rests at the $69.7 mark. From a technical perspective, the downtrend will likely be triggered if Oil dips below $69.7. The next bearish could be the October 1 low at $67.5 in this scenario.

Furthermore, if the bearish pressure pushes the black gold’s price below $67.5, the decline could spread to the September 2024 low at $65.5.

Crude Oil Bullish Scenario – 17-September-2024

The immediate resistance is at $71.8, the October 9 low, backed by the 100-period SMA. If bulls pull the oil price above this resistance, the consolidation phase that began yesterday can extend to the $73.8 (September 25 high).

Please note that the general market outlook remains bearish as long as Oil trades below the $73.3 critical resistance, the September 24 low.

Crude Oil Support and Resistance Levels – 17-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $69.7 / $67.5 / $65.5

- Resistance: $71.8 / $73.3 / $74.8