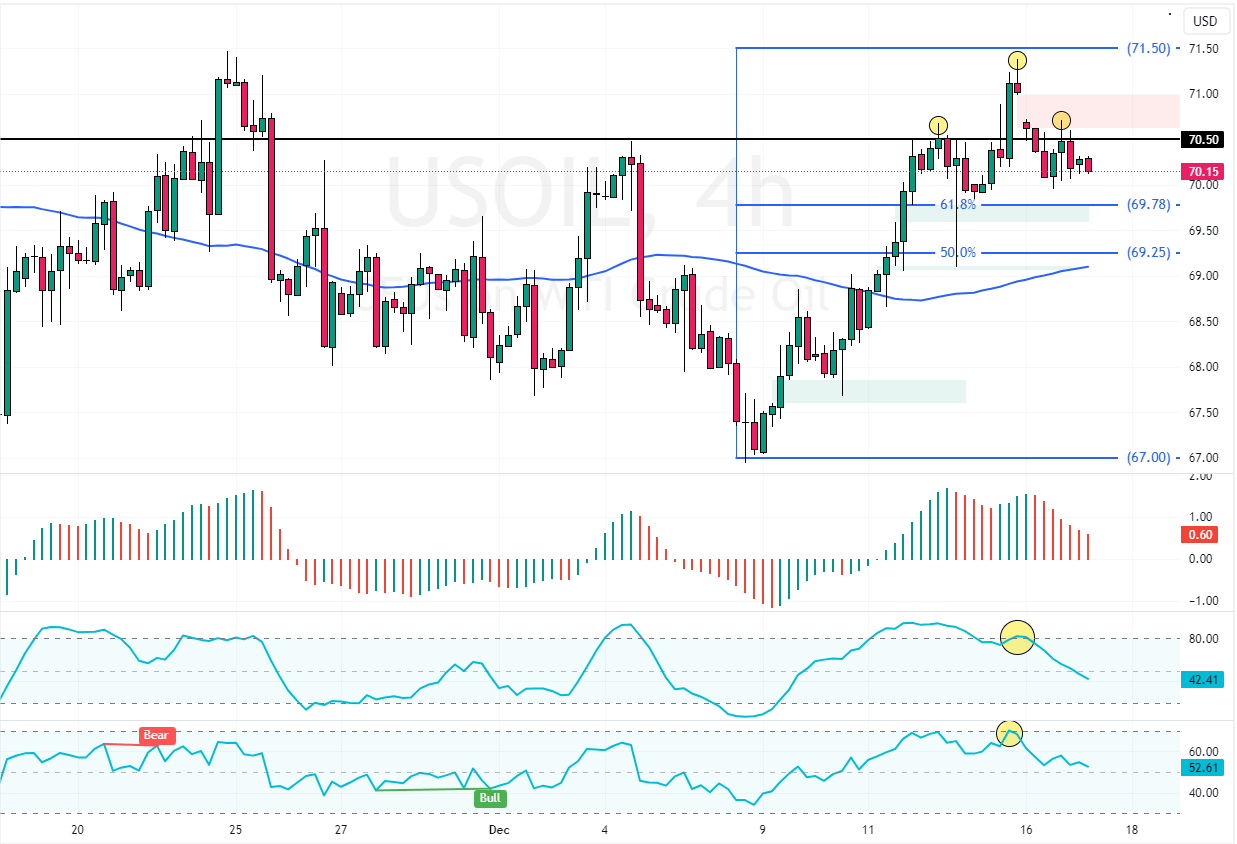

Crude oil formed a head and shoulders pattern in the 4-hour chart, hinting at further drop. Immediate support is at $69.7. A dip below this deck could trigger a new bearish wave toward the 50.0% Fibonacci at $69.2.

Crude Oil Technical Analysis – 17-December-2024

The recent price decline in the commodity from $71.5 was expected because the Stochastic Oscillator and RSI 14 hinted at an overbought market. The dip from that price resulted in the 4-hour chart forming a head and shoulders pattern, meaning a new bearish wave could be on the horizon.

As for the technical indicators, the Awesome Oscillator histogram is red and declining. Additionally, the Stochastic and RSI 14 are dropping, meaning the bear market is strengthening.

On the other hand, Crude Oil prices are above the 75-period simple moving average, indicating that the primary trend is bullish.

Overall, the technical indicators suggest that while the primary trend is bullish, the price can dip toward lower support levels.

Bearish Wave Possible as Crude Oil Nears Key Support

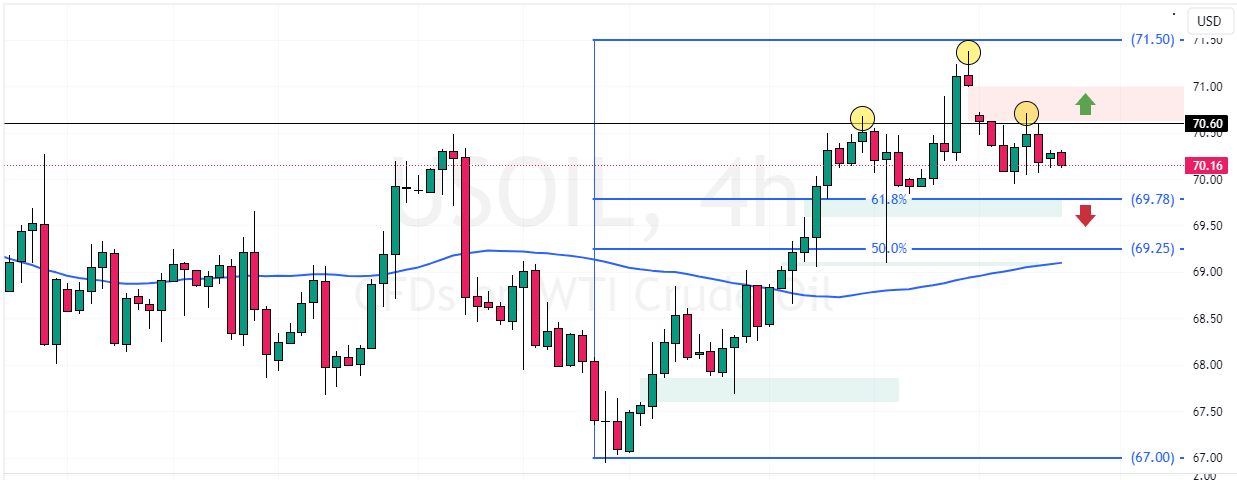

The immediate support is at the 61.8% Fibonacci support level at $69.7. From a technical perspective, oil prices could dip if bears close and stabilize below this level.

In this scenario, the black gold could test the 50.0% Fibonacci level at $69.2 as the next supply area.

The Bullish Scenario

Please note that the bearish outlook should be invalidated if Crude Oil closes and stabilizes above the $70.6 resistance. If this scenario unfolds, the bullish trend will likely resume, targeting the $71.5 high as resistance.