Crude Oil price dipped from $75.24, testing the %50.0 Fibonacci retracement level at $72.8 at the time of writing. Despite an initial dip, prices stabilized as traders balanced the impact of growing US fuel stocks against supply shortages.

US Crude Oil Supplies Fall for Seventh Week

Recent data from the Energy Information Administration (EIA) revealed that US crude oil supplies decreased for the seventh week in a row, this time by nearly 1 million barrels. However, gasoline and distillate inventories rose significantly by 6.3 million and 6.1 million barrels, respectively.

Oil Production Slips as UAE and Russia Reduce Output

Production cuts contributed to the tension in the oil markets. OPEC’s oil production dropped last month due to maintenance activities in UAE fields and despite Nigeria boosting its output.

Russian oil production also fell, not meeting the OPEC+ group’s agreed targets. Its oil exports have reached a new low since August 2023.

Colder US Weather Boosts Fuel Demand

In the US, the onset of colder weather is expected to heighten the demand for heating fuels. On the other hand, recent figures from China indicate a stagnation in consumer price inflation, which points to weak domestic spending and stirs fears of deflation in this vital market.

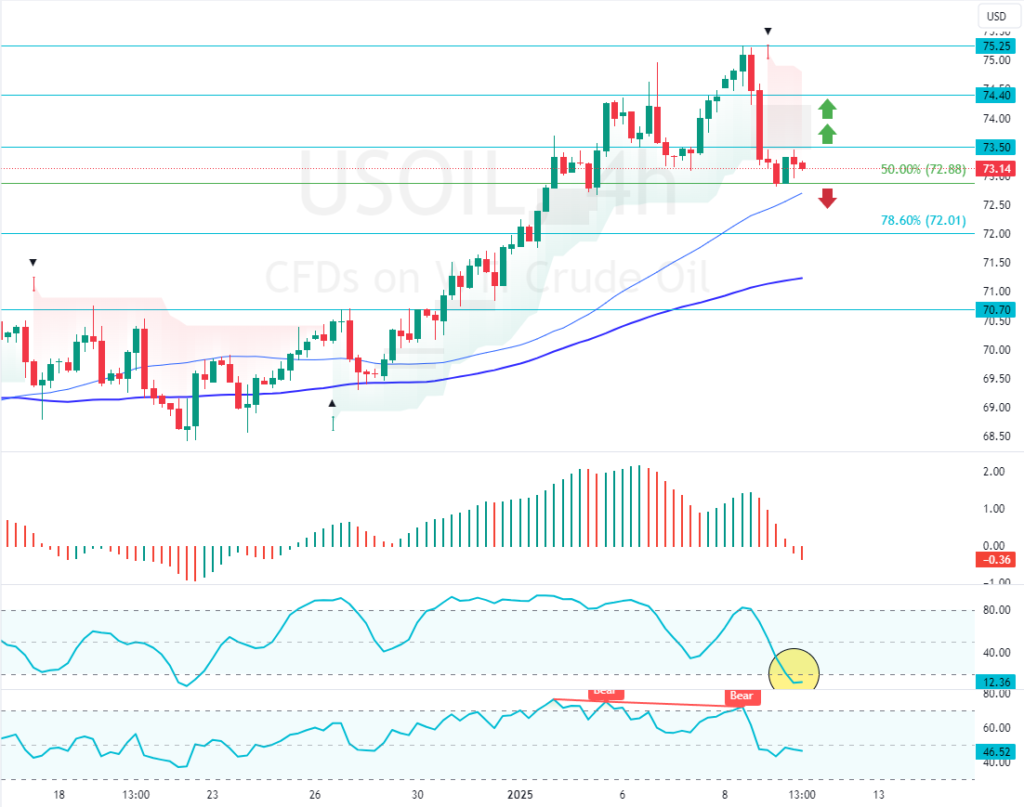

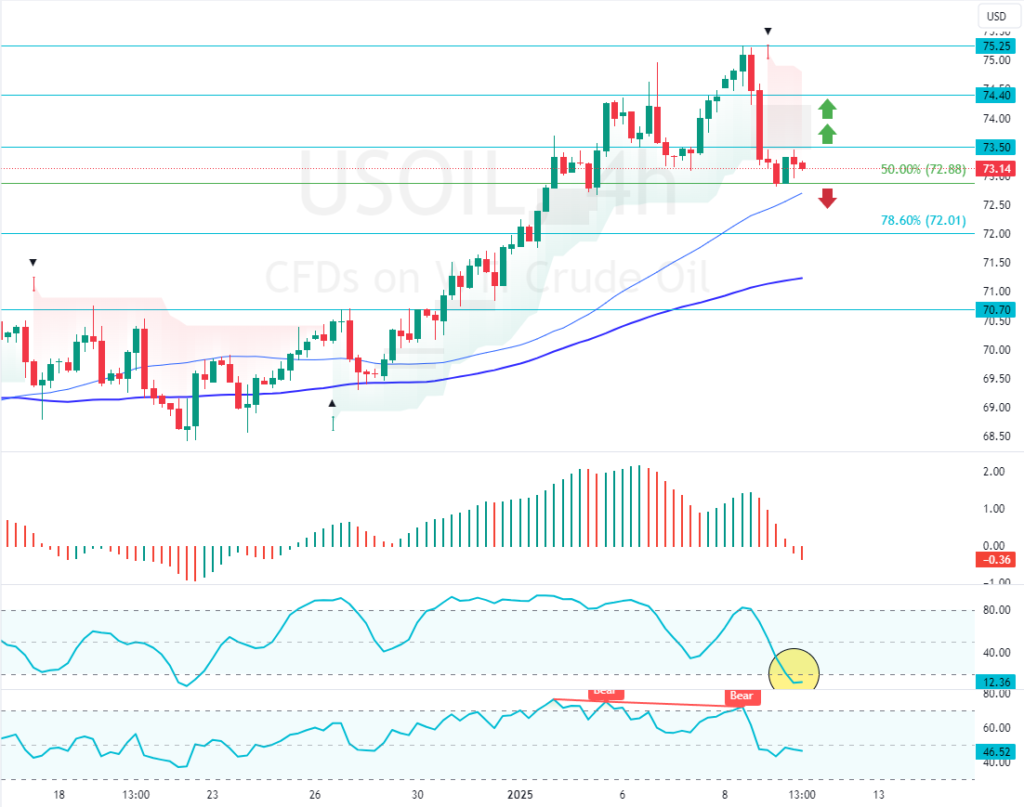

Crude Oil Technical Analysis – 9-January-2025

The recent decline in oil prices was anticipated because the RSI 14 signaled a bearish divergence. However, the downtrend from $75.25 eased near the %50.0 Fibonacci retracement level at $72.8.

Currently, the Stochastic Oscillator hovers in the oversold territory, signaling trend reversal. That said, the immediate resistance is at $73.5.

From a technical perspective, the uptrend could extend to a higher resistance level if bulls (buyers) pull the prices above $73.5. in this scenario, the next bullish target could be the $74.4 resistance.

The Bearish Scenario

Please note that the bullish outlook should be invalidated if Crude Oil dips below the %50 Fibonacci support level ($72.8). If this scenario unfolds, the commodity‘s downtrend from $75.2 will likely spread to the 78.6% Fibonacci support area at $72.0.