FxNews—WTI crude oil prices dropped to around $71 per barrel this Wednesday after a brief rise. The drop was mainly due to a surprising increase in U.S. oil stockpiles.

According to API data, these inventories grew by 1.6 million barrels last week—far exceeding the expected growth of 0.7 million. While gasoline and other distillate fuel stocks declined, this was insufficient to stabilize prices.

Current events in the Middle East are also influencing oil markets as ongoing conflicts in Gaza and Lebanon continue.

China Lowers Interest Rates to Stabilize Oil Prices

On another front, China has attempted to stabilize its economy by lowering key interest rates, which has helped support oil prices somewhat. Despite these efforts, there are ongoing concerns about China’s future oil demand and the possibility that the global oil market may have excess supply in the upcoming months.

Additionally, there is less anticipation of interest rate cuts in the U.S., which could affect market dynamics.

Crude Oil Technical Analysis – 23-October-2024

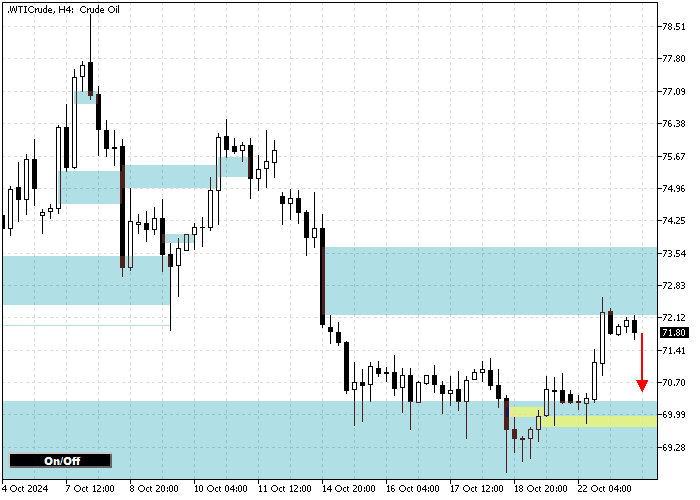

The Crude oil price bounced from $68.7. The uptick momentum that began on October 18 eased when the price neared the 100-period moving average at $72.5, backed by the Fair Value Gap (FVG), an active resistance area. Furthermore, this resistance zone is in conjunction with the 38.2% Fibonacci retracement level, making it a robust barrier for the bull.

Meanwhile, the Stochastic Oscillator signals Oil might be overpriced in the short term. That said, oil trades are below the Ichimoku Cloud and the 100-period simple moving average, making the primary trend bearish.

Overall, the technical indicators suggest the primary trend is bearish, and Oil is overpriced. Therefore, the market will likely pull back from this price point.

Crude Oil Price Forecast – 23-October-2024

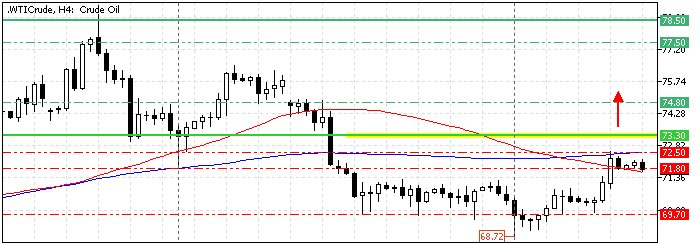

The immediate resistance is at $72.5, the 38.2% Fibonacci retracement level, backed by the 100-SMA and Ichimoku Cloud. From a technical standpoint, a new bearish wave will likely begin at $72.5 if bears or sellers maintain the oil prices below the immediate resistance.

If this scenario unfolds, the bears will likely target the recent low of $68.7, followed by the October 1 low of $67.5. Please note that the bearish scenario should be invalidated if the oil price exceeds the $73.3 critical resistance.

Crude Oil Bullish Scenario

If bulls close and stabilize the price above the 38.2% Fibonacci retracement level ($72.5), the uptick momentum could extend to the next resistance area at $73.2 (September 24 High), a strong resistance site.

Furthermore, if the buying pressure exceeds $73.3, the next bullish target will likely be $74.8.

Crude Oil Support and Resistance Levels – 23-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $71.8 / $69.7 / 67.5

- Resistance: $73.3 / $74.8 / $77.5