Crude Oil remained below $70.0, stabilizing at approximately $69.8 a barrel this Friday. Notably, the prices have found some support following China’s announcement of new economic initiatives.

This includes the flexibility to assign government bonds for economic growth, which could increase demand from the world’s largest oil consumer.

US Crude Stockpiles Drop Fifth Week in a Row

Recent figures from the American Petroleum Institute revealed a continuous reduction in US crude stockpiles for the fifth week, with official confirmation expected soon.

Meanwhile, the World Bank has updated its economic growth forecasts for China for 2024 and 2025. However, it has cautioned that ongoing concerns in the real estate sector and low consumer confidence could dampen the growth.

Europe’s Energy Strategy Prefers Oil for Quick Gains

In Europe, leading energy firms favor oil and gas projects over renewable energy sources to secure short-term financial returns, a strategy likely to extend through 2025. Despite these factors, Oil is set to close the year with a nearly 3% decrease in price, remaining relatively flat since mid-October.

- Gold Exceeded $2665: Now Overbought!

- Bullish Symmetrical Triangle Signals NATGAS Breakout

- Crude Oil Holds at $72.8 After Initial Price Dip

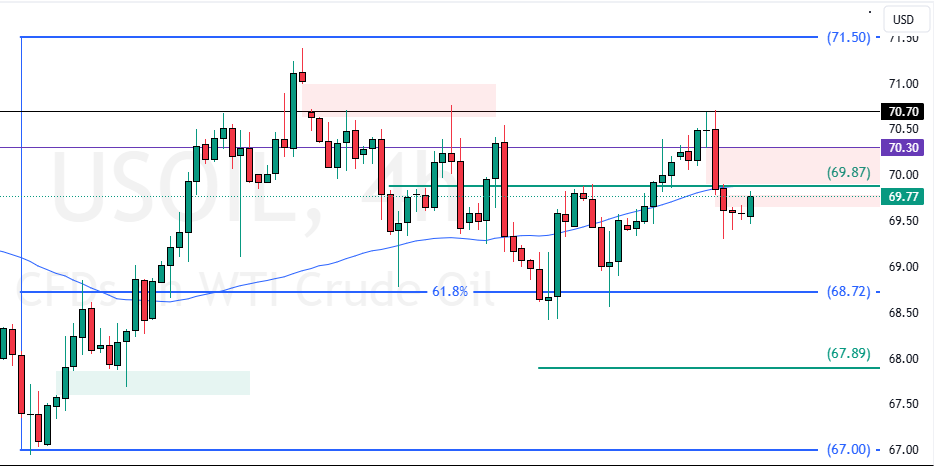

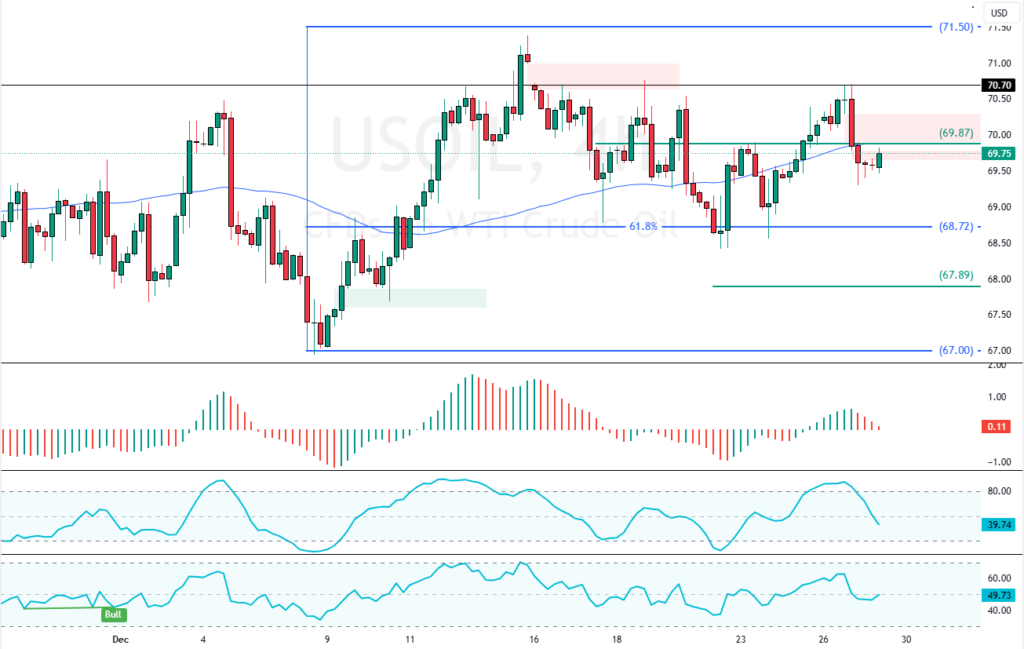

Crude Oil Technical Analysis – 27-December-2024

Oil’s primary trend should be considered bearish because the prices are below the 75-period simple moving average. Additionally, the Awesome Oscillator histogram is nearing zero, meaning the bear market should prevail.

Furthermore, the Stochastic Oscillator flipped below the median line, which indicates that the market is not oversold and that the downtrend can potentially resume.

Overall, the technical indicators suggest that the primary trend is bearish and should resume.

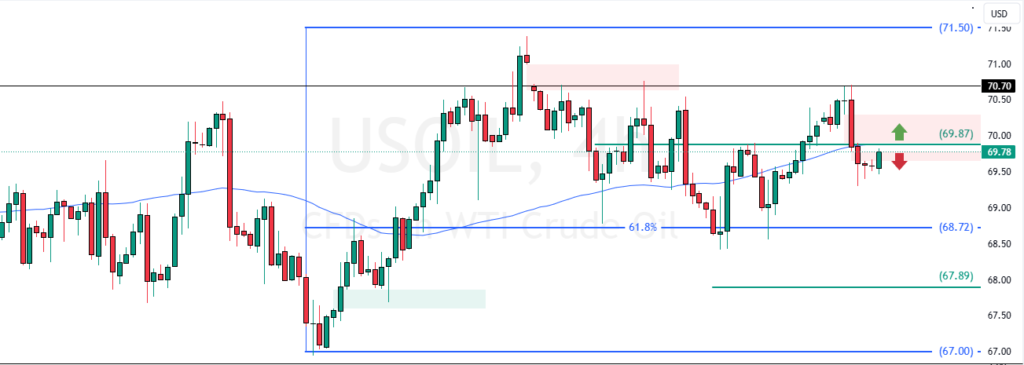

Crude Oil Remained Below $70: Next Target?

The immediate resistance is at $69.8. From a technical perspective, the commodity‘s downtrend from $70.7 could extend to a lower support level if immediate resistance is maintained.

The next bearish target in this scenario could be the 61.8% Fibonacci support level at $68.7.

The Bullish Scenario

Please note that the downtrend should be invalidated if Crude Oil prices climb above $70.3. In the bullish scenario, the black gold could target $70.7.

Furthermore, if the buying pressure exceeds $70.7, the bulls’ path to $71.5 will likely be paved.

Crude Oil Support and Resistance Levels – 27-December-2024

Traders and investors should closely monitor the key WTI Crude Oil levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

| Crude Oil Support and Resistance Levels – 27-December-2024 | |||

|---|---|---|---|

| Support | $69.3 | $68.7 | 67.8 |

| Resistance | $69.8 | $70.3 | $70.7 |