FxNews—WTI crude oil prices climbed to approximately $69 per barrel on Thursday, continuing a more than 2% increase from the previous session. A surprising decrease in U.S. crude reserves fueled this rise.

Contrary to expectations of a 2.3 million barrel increase, last week’s Energy Information Administration (EIA) data revealed a reduction of 0.5 million barrels. Furthermore, stocks of gasoline and distillates also showed declines.

Israel’s Military Leader Signals Tough Response to Iran

At the same time, the market is closely monitoring ongoing tensions in the Middle East. Recent warnings from Israel’s military leader about a possible severe retaliation against Iran if it conducts another missile strike have heightened concerns.

OPEC+ May Delay Oil Production Boost Amid Low Demand

On the other hand, the outlook remains cautious due to continued low demand from China. Additionally, speculation that OPEC+ might postpone their planned boost in oil production scheduled for December by at least a month adds another layer of uncertainty.

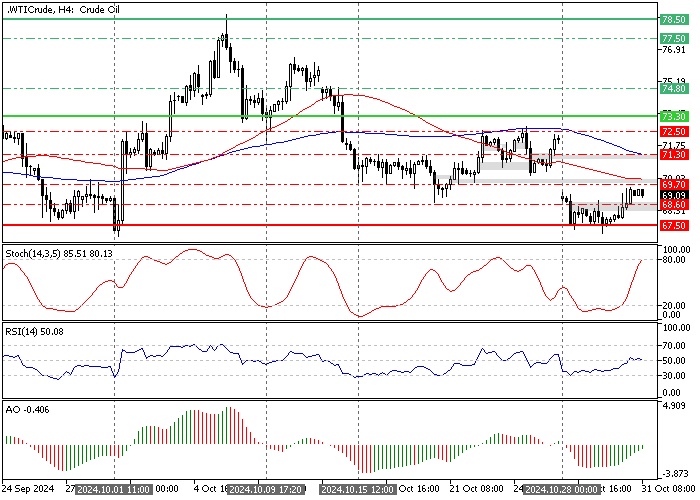

Crude Oil Technical Analysis – 31-October-2024

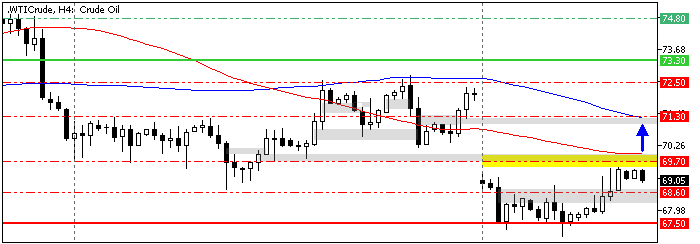

In the previous Oil analysis, we stated that the market is oversold and that the price has the potential to erase some of its losses and fill the Monday morning gap. That scenario played out, and Oil rose from $67.5 critical resistance, testing the $69.7 barrier in today’s trading session.

That said, the primary trend should be considered bearish because the price is below the 50- and 100-period simple moving averages. Additionally, the Awesome Oscillator histogram is green and is about to flip above the signal line. Concurrently, the RSI 14 shifted above the median line, showing bullish signals.

Overall, the technical indicators suggest that while the primary trend is bearish, crude Oil has the potential to rise further.

Crude Oil Price Forecast

The immediate resistance is at the October 15 low, $69.7. From a technical perspective, the current uptick momentum could extend to the 100-period SMA at $71.3 if bulls pull the Oil price above that mark.

Conversely, if bears push the price below the critical $67.5 resistance, the downtrend will likely be triggered again. In this scenario, the next bearish target could be the September 10 low at $65.5.

Crude Oil Support and Resistance Levels

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 67.5 / 65.5

- Resistance: 69.7 / 71.3 / 72.5