FxNews—WTI crude oil prices remained below the $69.7 resistance, the October 24 low. The recent decline in oil prices is due to investors’ concerns that the market could be saturated with supplies.

Furthermore, the International Energy Agency (IEA) noted that the oil reservation might have a surplus next year. In addition to the surplus concerns, the biggest oil consumer, China, slowed in demanding oil, resulting in the depreciation of the WTI prices.

OPEC+ Production Hike May Lower Oil Prices Further

We might see a further decline in the trend if Opec+ decides to increase production, adding more to global oil supplies. That said, the U.S. dollar strengthened after Donald Trump returned to the White House, planning to raise tariffs on imports and revive the U.S. dollar’s power in global trading.

U.S. Crude Surplus Exceeds Forecasts

The EIA data and records show that the U.S. Crude stockpiles also unexpectedly surged by 2.1 million barrels last week, exceeding the forecast by 0.2 million. On the other hand, Gasoline reserves declined by 4.4 million, the lowest level in ten years.

Crude Oil Technical Analysis – 15-November-2024

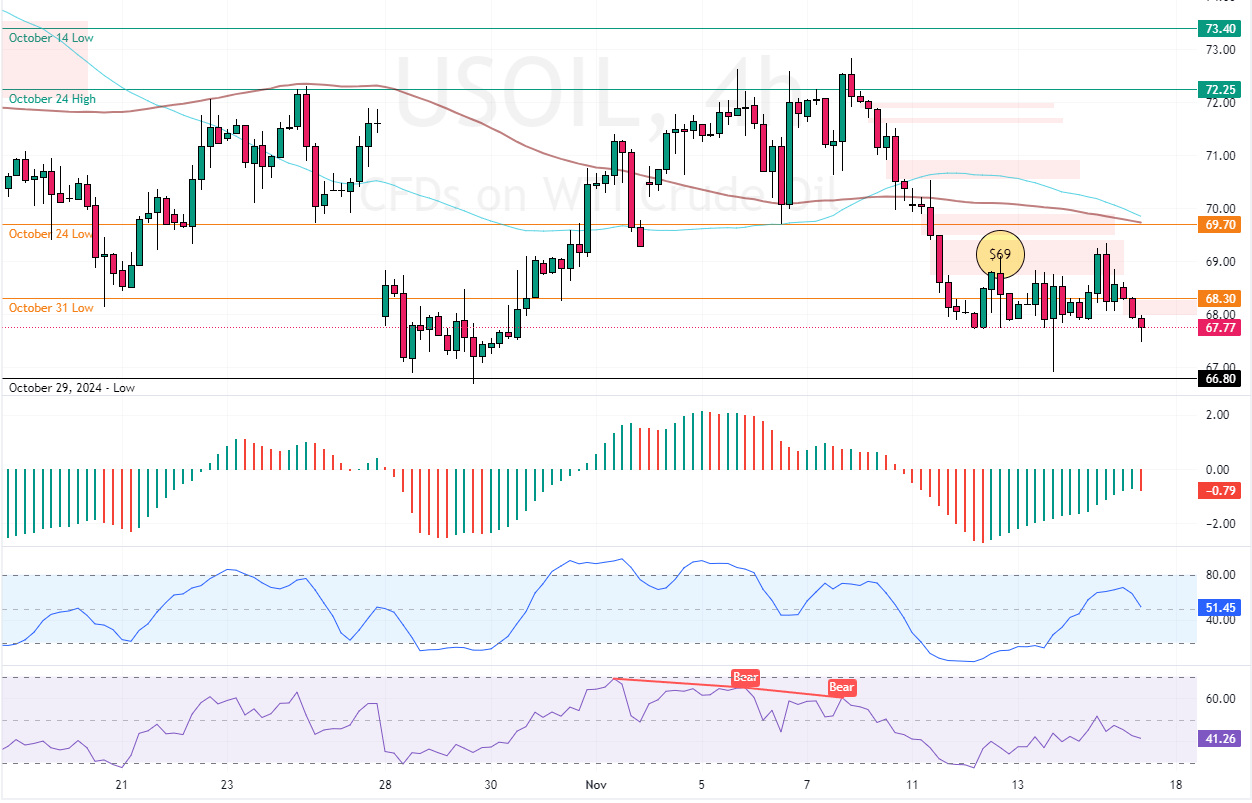

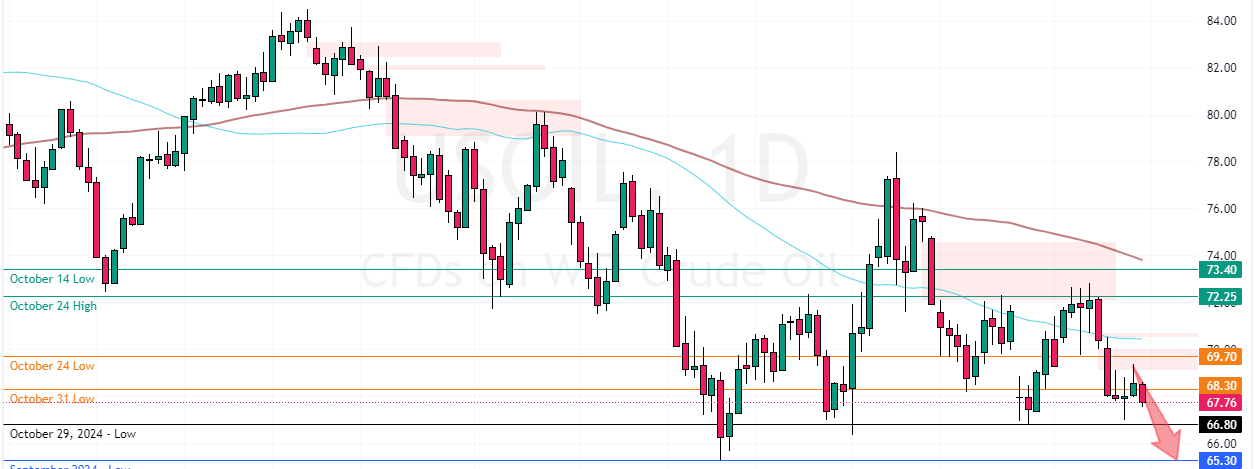

Crude oil’s primary trend should be bearish because the prices are below the 50- and 100-period simple moving averages. The Awesome Oscillator indicator’s last bar also turned red, signaling a downtrend.

That said, the immediate resistance that divides the bear market from a bull market rests at the October 24 low, the 69.7 mark, backed by the moving averages. Therefore, the outlook of the Crude oil trend remains bearish as long as it trades at less than $69.7.

- Also read: Oil Slides to $67 After Testing Bearish Gap

Oil Prices Eye October Low as Downtrend Persists

From a technical perspective, the downtrend is likely to revisit the October 29 low at $66.8 if the immediate resistance remains intact. Furthermore, if the selling pressure pushes the oil prices below $66.8, the downtrend could extend to the September low at $65.3.

- Support: 66.8 / 65.3

- Resistance: 68.3 / 69.7