As the EUR/USD currency pair struggles near its recent two-year low of about $1.05, traders are closely monitoring the European Central Bank’s upcoming decision. Many expect the ECB to cut its key deposit rate by another 25 basis points, potentially bringing it down to 3%.

If repeated at each meeting through June, this move may lower rates further to 2%. These steps hint at concerns over the region’s future growth in a changing global environment.

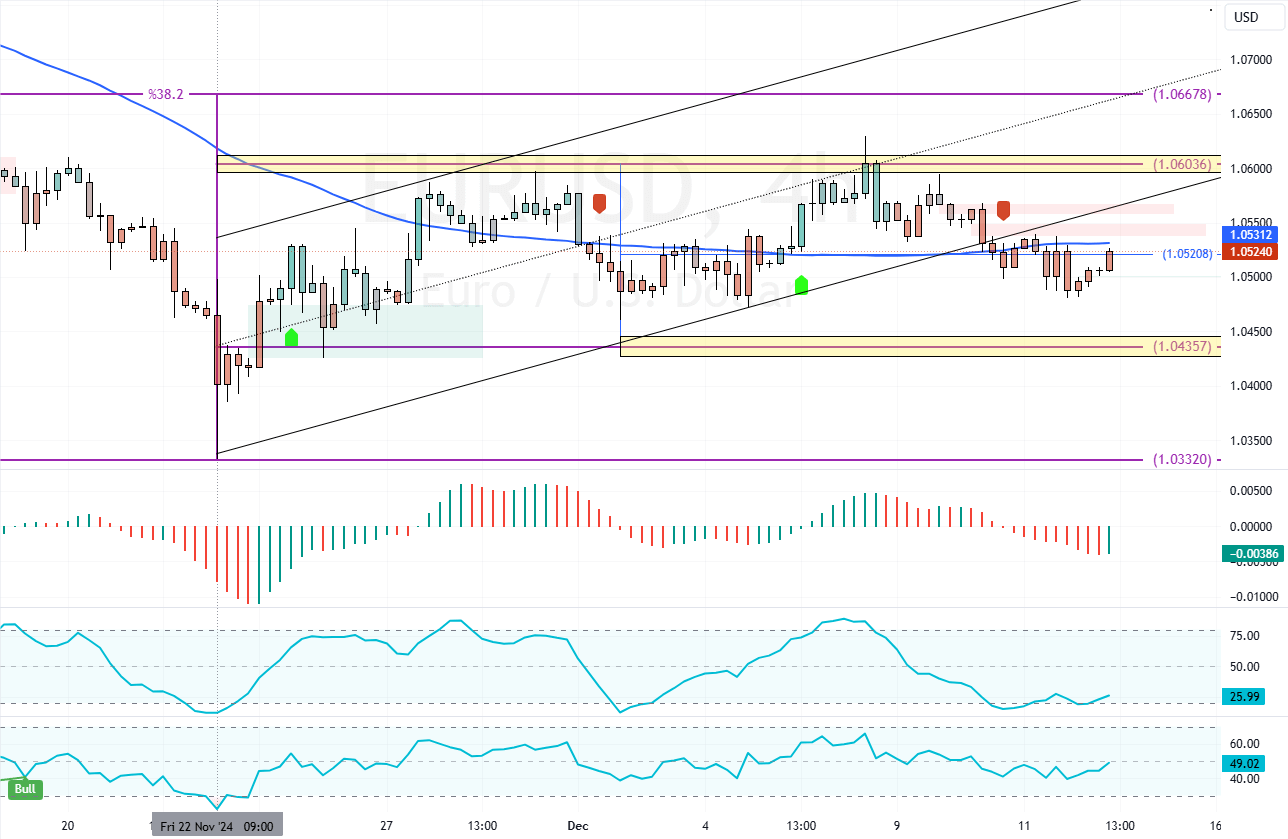

- Euro clings to near two-year lows

- ECB expected to cut rates again

- Faster pace of policy easing predicted

- Eurozone facing political and economic uncertainty

Eurozone Growth Slows as Risks Rise

The Eurozone economy continues to show weakness, struggling under political uncertainty in key members like France and Germany. Recent geopolitical tensions, heightened by the aftermath of Donald Trump’s election, only add to the unease.

- Good reads: USDJPY Dips to 153 Ahead of Fed Rate Decision

During a recent hearing, ECB President Christine Lagarde warned of a slowdown in the months ahead, noting that downside risks overshadow the medium-term outlook.