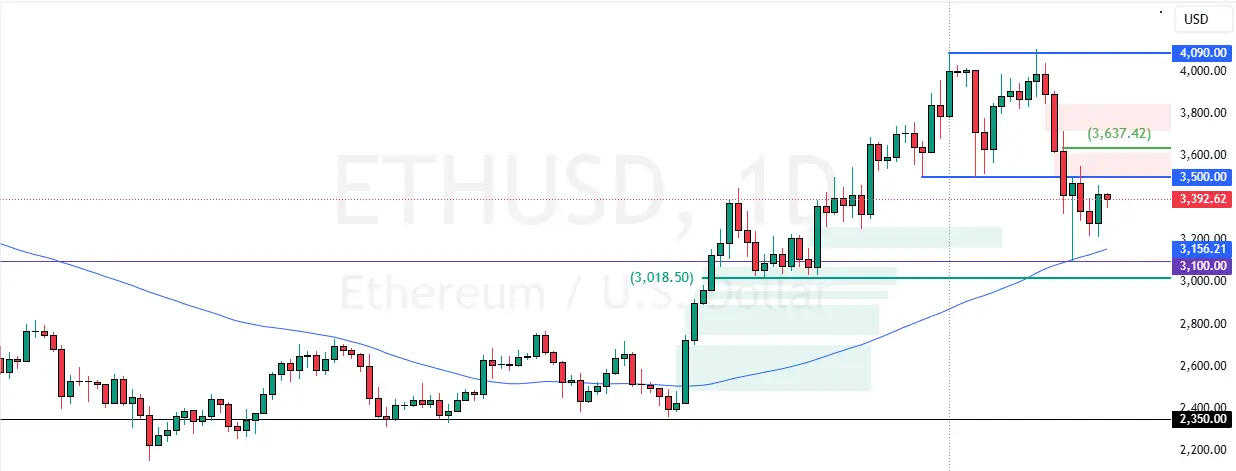

Ethereum bounced from $3,100 in a bear market and faces the $3,500 resistance. Technical indicators show signs of a mild bullish sentiment. If ETH closes and stabilizes above the $3,500 barrier, the current uptick in momentum could extend to $3,600.

Ethereum Technical Analysis – 24-December-2024

Ethereum is in a bear market, below the 75-period simple moving average, and is trading at approximately $3,380 as of this writing. The Stochastic Oscillator and RSI 14 records show 59 and 47 in the description, meaning the bull market strengthened.

Additionally, the Awesome Oscillator histogram is green, nearing zero, and interprets as the bear market weakened.

Overall, the technical indicators suggest Ethereum is in a bear market, but the pull-back from $3,100 could extend to higher resistance levels.

Ethereum To Target $3600 if $3210 Holds Firm

The immediate support is $3,210, and the immediate resistance is $3,500. From a technical perspective, the current uptick in momentum could resume if ETH/USD exceeds the immediate resistance ($3,500).

In this scenario, the cryptocurrency pair could rise toward $3,600, a resistance backed by the 50-period SMA.

- Good read: Solana Down %5.0 Testing $182 Key Resistance

The Bearish Scenario

Please note that the bullish scenario should be invalidated if ETH falls below $3,210. If this scenario unfolds, the downtrend will likely resume, targeting $3,100 followed by $3,000.