In today’s comprehensive EURAUD forecast, we will first examine the current economic conditions in Australia. Then, we will meticulously delve into the details of the EURAUD pair’s technical analysis. Stay tuned for insightful observations and key takeaways.

Australia’s 10-Year Bond Yield Hits Week’s High.

Bloomberg—Australia’s 10-year bond yield recently climbed over 4.5%, marking a week’s high. This increase mirrors the rise in US bond yields, fueled by the robust US economy. This strength in the US economy supports the belief that the Federal Reserve will maintain high-interest rates for longer. In Australia, the Reserve Bank’s recent meeting minutes revealed they contemplated adjusting their policy rate in October.

However, they chose to keep it at 4.1% due to insufficient new data. The board observed that inflation is significantly above the 2% goal and will likely remain so for a while. They also recognized that growth in Australia’s labor market and overall output has peaked.

Investors eagerly await comments from RBA Governor Michele Bullock and the upcoming jobs report for September.

EURAUD Analysis – Australia’s 10-Year Yield Peaks

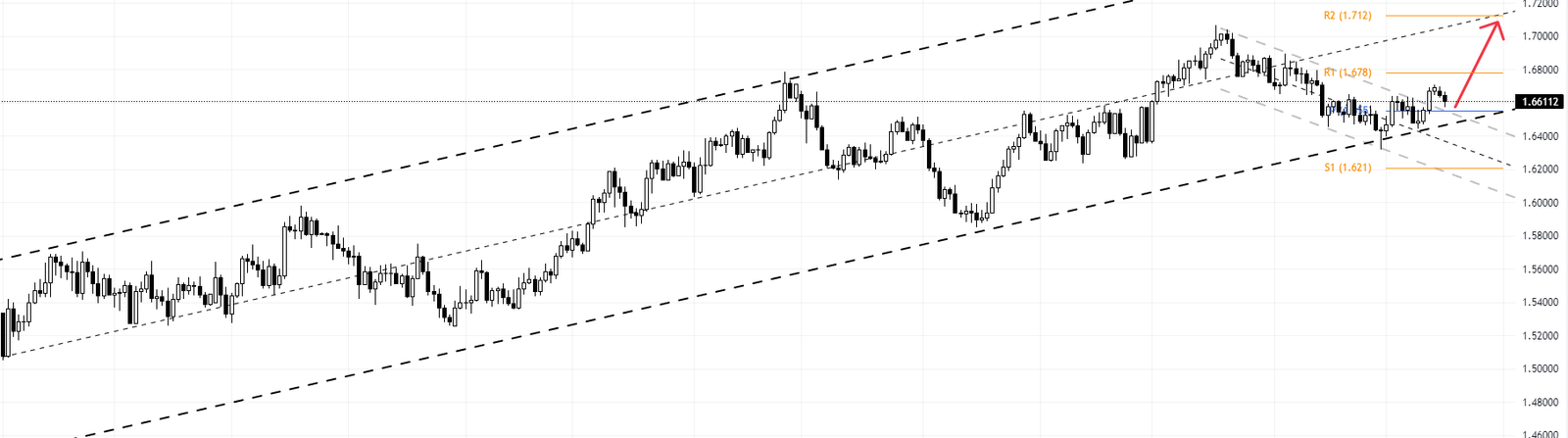

In our latest EURAUD analysis, we’ve observed that the EURAUD pair has maintained a bullish channel for over a year. This trend is a testament to the pair’s resilience and determination to retain its primary direction. The recent bounce from the lower line of the bullish channel further reinforces this observation.

The EURAUD pair is undergoing a critical test at the 1.655 pivot point. This point has historically acted as a strong support to the pair, helping it maintain its upward trajectory. The bullish channel’s support for the price is a positive indicator for those invested in EURAUD.

Looking ahead, our EURAUD analysis suggests that with the continued support of the bullish channel, we could see another rise in the EURAUD pair. This rise is expected to target resistance 1 initially, followed by resistance 2 in the upcoming trading sessions.

This EURAUD analysis provides traders with insights into the potential future movements of the EURAUD pair. However, as with all trading strategies, it’s essential to use this analysis with other indicators and tools to maximize trading success.