In this EURAUD forecast, we will meticulously examine the key indicators and the demand and supply levels to provide a comprehensive perspective on the EURAUD’s price action.

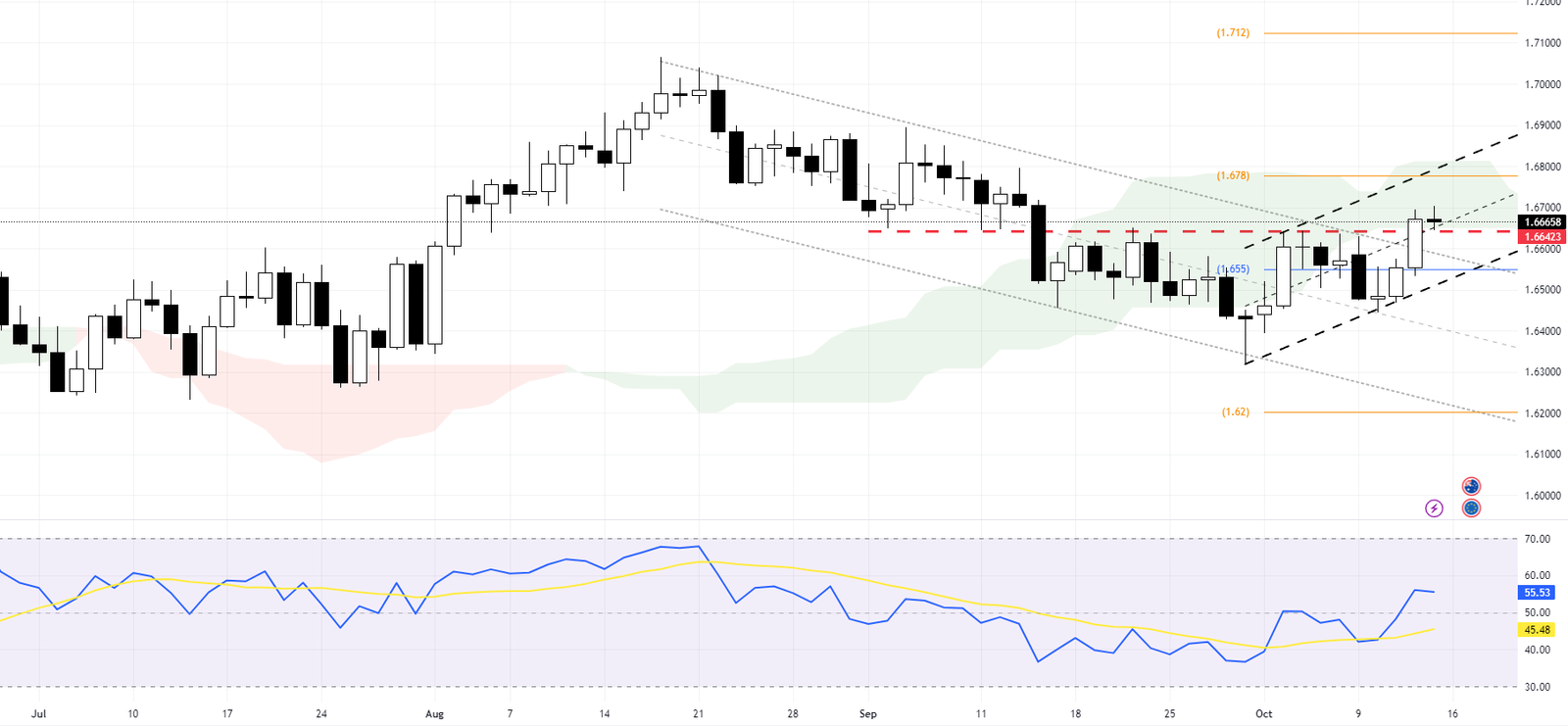

FxNews – The EURAUD currency pair has recently made a significant move by breaking the bearish channel from above. This has resulted in a close above the 1.6642 resistance level, marking a potential shift in market dynamics. The RSI indicator hovers above the mid-line, suggesting that the upward trend will likely continue.

The next targets for this uptrend are 1.678 and, subsequently, 1.712.

When we delve deeper into the 4-hour chart, our daily EURAUD forecast is further reinforced. The currency pair trades above the Ichimoku cloud, indicating a bullish market sentiment. However, it’s worth noting that the RSI indicator is in the overbought area. This suggests that there might be a temporary pause in the upward momentum. As such, the currency pair might test the Ichimoku cloud before continuing to rise.

The overall outlook for the EURAUD pair remains bullish unless market dynamics shift. A potential bearish signal would be if the bears close below the 4-hour pivot at 1.654.

In conclusion, our EURAUD forecast indicates a bullish trend with potential resistance levels at 1.678 and 1.712. However, traders should monitor the RSI and Ichimoku indicators for possible shifts in market sentiment.