Fx News – In today’s EURAUD forecast, we start with the latest economic updates from Australia, followed by a detailed examination of the EURAUD’s behavior on the 4-hour chart.

Australia’s Bond Yields and Inflation

Bloomberg—The yield on Australia’s 10-year government bonds recently dropped, reaching a seven-week low of below 4.4%. This decline mirrors a similar trend in the US, where bond yields have also fallen. The main reason behind this trend in the US is the recent comments from American policymakers.

These officials suggest a more cautious approach, indicating that the Federal Reserve might not increase interest rates further and could reduce them next year. Policymakers often make such statements as ‘dovish,’ which means they favor lower interest rates to stimulate economic growth.

In Australia, new economic data reveals some changes in inflation rates. The monthly inflation rate for October was reported at 4.9%, a decrease from September’s 5.6% and lower than the predicted 5.2%. This slowing down in inflation, especially in goods and travel expenses, significantly affects the bond yields. Generally, bond yields tend to increase when inflation rates are high as investors seek higher returns to offset the impact of inflation.

Adding to the mix is Michele Bullock, the Governor of the Reserve Bank of Australia, who recently highlighted a growing concern. She noted that domestic demand in Australia is increasingly pushing up inflation. She suggests that interest rates may need a “substantial” increase to manage this. This is crucial because central banks like the Reserve Bank of Australia often raise interest rates to cool down inflation by making borrowing more expensive and reducing spending and demand.

Investors and market analysts are now closely watching the situation. They estimate there’s about a 50% chance that the Reserve Bank of Australia will raise interest rates again next year. This estimation is important because it helps businesses and consumers prepare for potential changes in borrowing costs, impacting everything from mortgage rates to business loans.

EURAUD Forecast – Likely Reverse Amid Bearish Trend

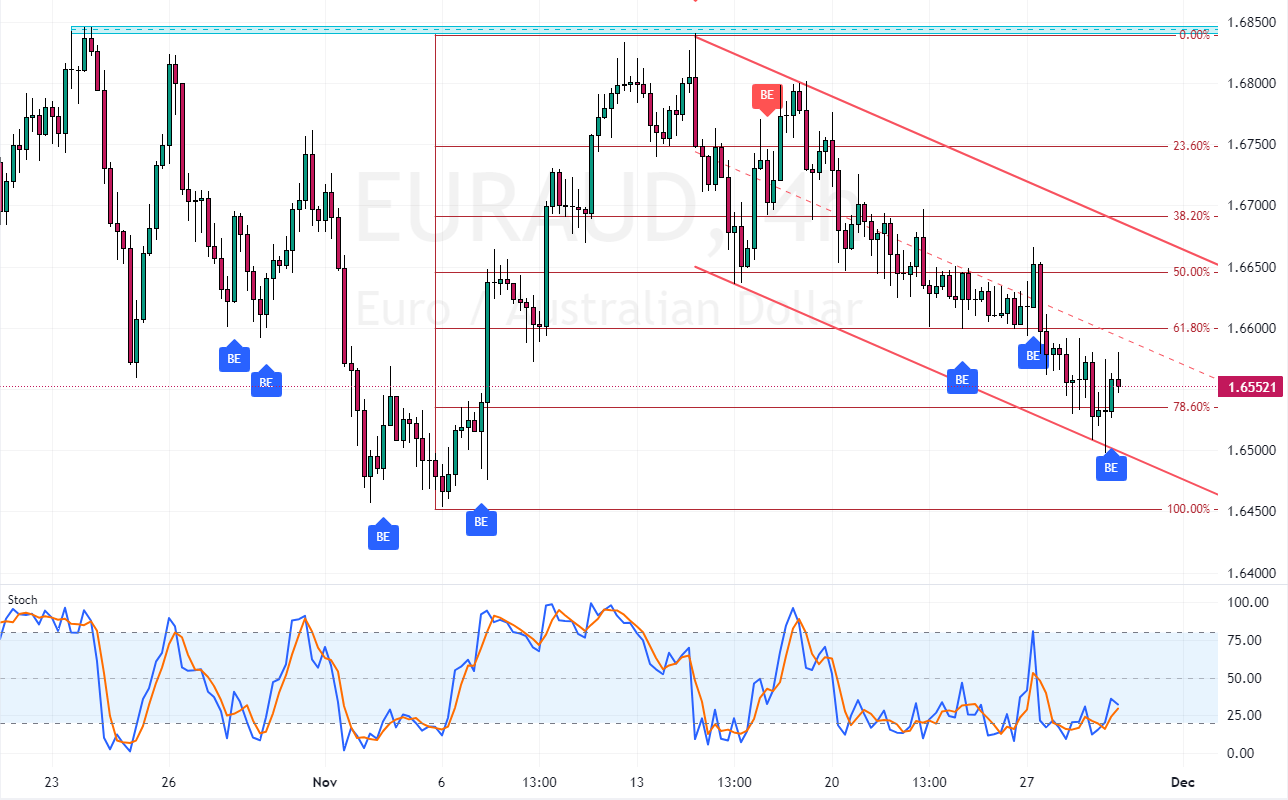

The EURAUD pair dipped below the 78.6% Fibonacci retracement level during today’s trading. Despite this, the bears could not maintain lower prices, as indicated by a bullish engulfing pattern on the 4-hour chart, suggesting a potential reversal. This is also supported by the stochastic oscillator moving out of the overbought zone.

However, the overall trend remains bearish unless the pair surpasses the 1.665 level (the 50% Fibonacci point). The present price movements, indicators, and candlestick patterns hint at a possible upward swing in EURAUD, targeting the 1.665 mark.

Should the pair close below the 78.6% Fibonacci level and stabilize, this EURUAD forecast bullish would become invalid.