In this article, we provide a comprehensive EURCAD forecast, meticulously examining the fundamental and technical factors that influence the dynamics of this currency pair.

Canadian Borrowers Face Real Estate Hurdles Amid Rising Rates

Reuters—The Office of the Superintendent of Financial Institutions (OSFI), Canada’s primary banking regulator, has raised concerns about the increasing risk of elevated borrowing costs to the country’s financial system. This risk is particularly evident in the real estate sector, including housing and commercial properties. OSFI’s latest report highlights the pressure higher interest rates place on retail, corporate, and commercial borrowers, affecting their ability to service their debt.

The report also identifies signs of deteriorating credit quality, especially within the commercial real estate sector. As higher interest rates continue to impact the economy, consumers and businesses will face challenges in adapting to the current rate environment, especially as loans mature in the coming years.

Higher borrowing costs have created challenges for consumers in the mortgage market. The report notes that home prices in Canada have steadily risen for years, experiencing significant surges during the COVID-19 pandemic when interest rates were at historically low levels. While the housing market experienced a downturn, the national benchmark home price had doubled over the past decade, reaching USD 757,600 as of August. Additionally, there is uncertainty surrounding the long-term value of commercial properties, given the persistence of remote and hybrid work arrangements.

The report specifically highlights the risks associated with different commercial real estate (CRE) segments, with the office, construction, and development sectors identified as particularly vulnerable. However, it notes that all commercial property types face increased risks due to higher interest rates. The credit quality of variable-rate and fixed-payment mortgages has shown signs of deterioration.

Many Canadian borrowers hold variable-rate loans, which are tied to the Bank of Canada’s policy rate, and the cost of fixed-rate mortgages has also risen alongside government bond yields. OSFI is particularly concerned about the approximately $250 billion in mortgages with reported amortization periods of 35 years or longer. Some of these mortgages are “negatively amortizing,” meaning the borrower’s balance increases. Some borrowers may face significantly higher payments as these mortgages come up for renewal. OSFI is engaging with senior leaders at commercial banks to address and mitigate this issue.

EURCAD Analysis – Canada Financial Stability at Risk

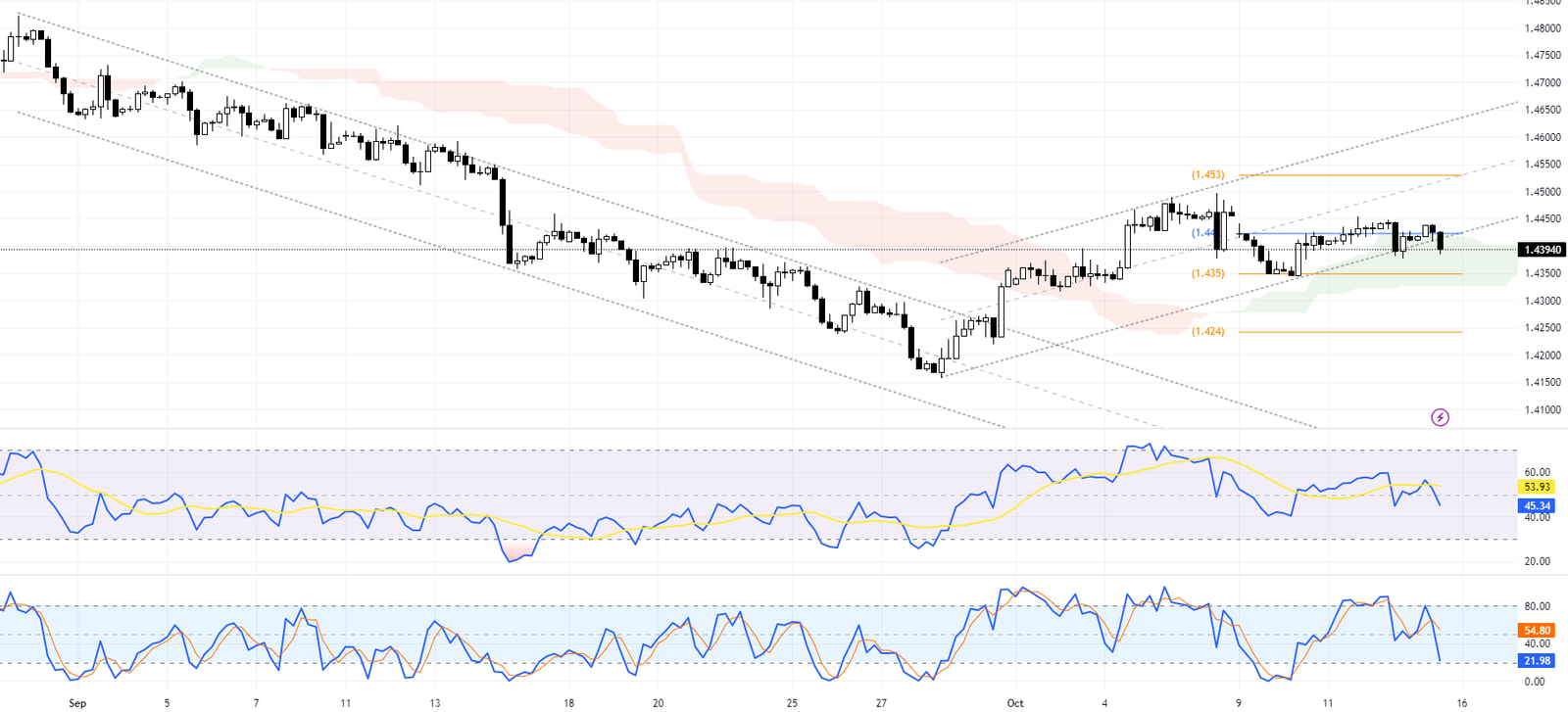

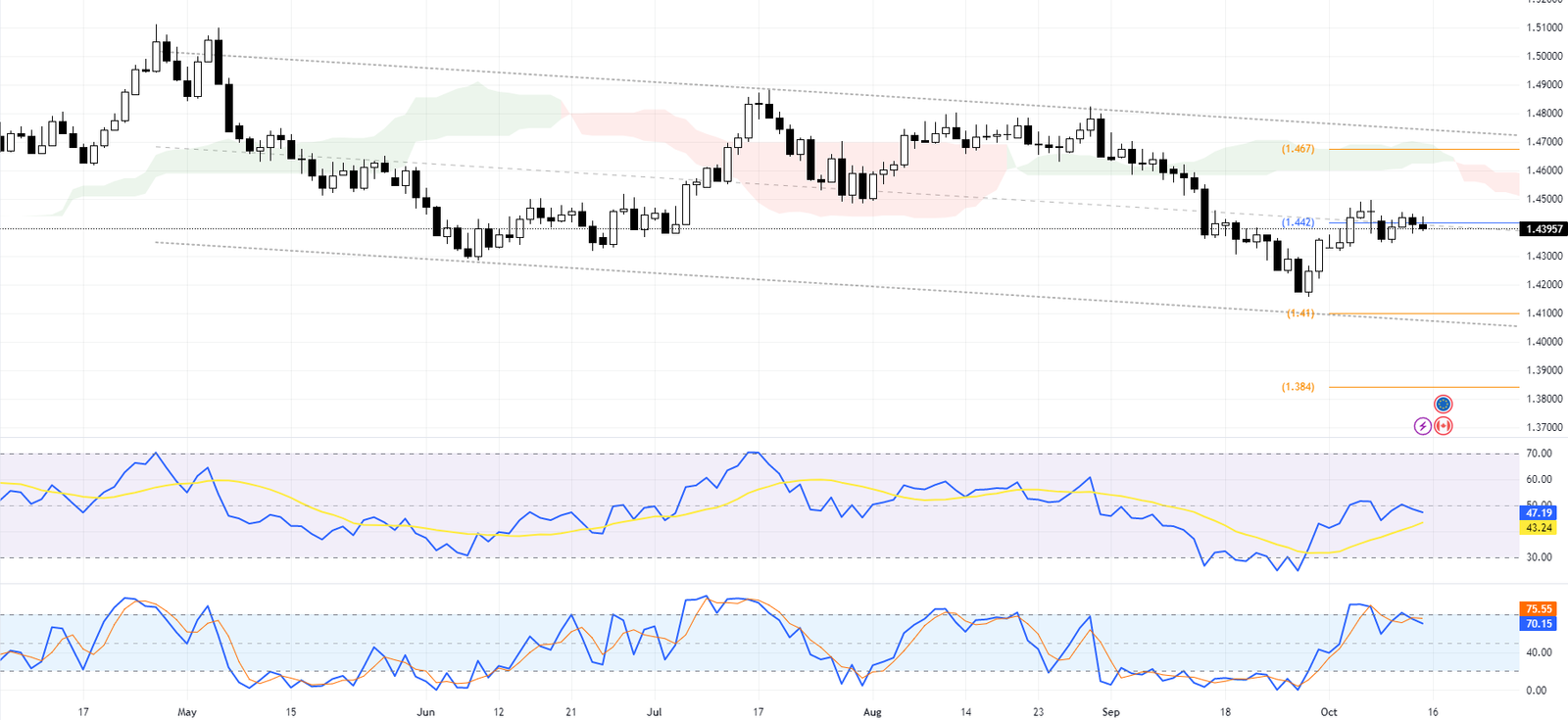

FxNews – The pair trades within a bearish channel on the daily chart, struggling to gain momentum around the 1.442 pivot point.

Our technical indicators on the daily chart indicate an increase in selling pressure. The Stochastic oscillator (a momentum indicator that compares a particular closing price of a security to a range of its prices over a certain period) has turned down from the overbought area. This suggests the market may be overvalued and primed for a price pullback.

In addition, the Relative Strength Index (RSI), another momentum oscillator that measures the speed and change of price movements, is hovering just below the midline. This indicates that sellers are gaining ground against buyers.

When we zoom into the 4-hour chart for a more granular view of the EURCAD pair, we see it attempting to breach the bullish channel and close below it. The RSI indicator in this timeframe flips below the 50 line, which often signals a potential bearish reversal.

If the EURCAD bears can muster enough strength to close below 1.435 on the 4-hour chart, we’ll likely see a continuation of this bearish bias. The next target for the bears would be 1.424, serving as a second checkpoint or support level.

As always, traders must monitor these levels and indicators closely, as they can provide valuable insights into potential future price movements. Stay tuned for more updates and in-depth EURCAD Analysis.