In today’s comprehensive EURCAD forecast, we will first scrutinize the current economic conditions in Canada. Following that, we will meticulously delve into the details of the technical analysis of the EURCAD pair. Stay tuned for insightful observations and key takeaways.

S&P/TSX Steady Amid Lower Inflation

Bloomberg – On Tuesday, the S&P/TSX Composite index was nearly steady at 19,600, maintaining the previous session’s gains. It outperformed its US peers as lower inflation data fueled speculation that the Bank of Canada might hold off on further interest rate hikes. In a surprising turn, headline inflation dropped to 3.8% in September, despite market expectations of a steady 4%. This sparked optimism for disinflation in Canada’s economy, even with rising energy prices.

Mixed Results for Tech Stocks Amid Market Fluctuations

Tech stocks sensitive to interest rates showed mixed results. Shopify saw a modest increase of 0.4%, balancing the dovish outlook for the Bank of Canada against a hawkish Fed due to stronger-than-anticipated US retail sales data. Meanwhile, Barrick Gold benefited from higher bullion prices, rising by 2.5%. However, losses in the banking sector offset these gains in Toronto’s main index.

EURCAD Analysis – Comprehensive Outlook for October 2023

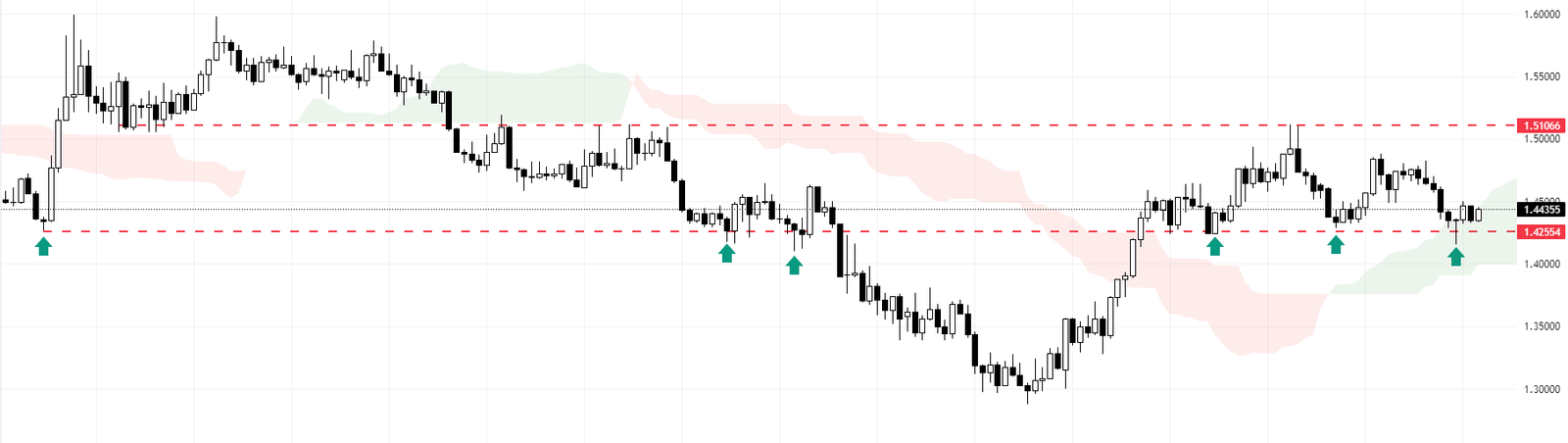

In our comprehensive EURCAD analysis, we’ve observed that the EURCAD currency pair has shown remarkable resilience. Despite several attempts, it hasn’t been able to close below the 1.4255 support level. This support level has proven to be a formidable barrier, with the price bouncing back from this area six times, as evidenced in our EURCAD weekly chart.

The EURCAD price is currently hovering above the Ichimoku cloud, indicating a bearish outlook for the currency pair. This observation is a key part of our EURCAD analysis and provides valuable insights into potential future movements.

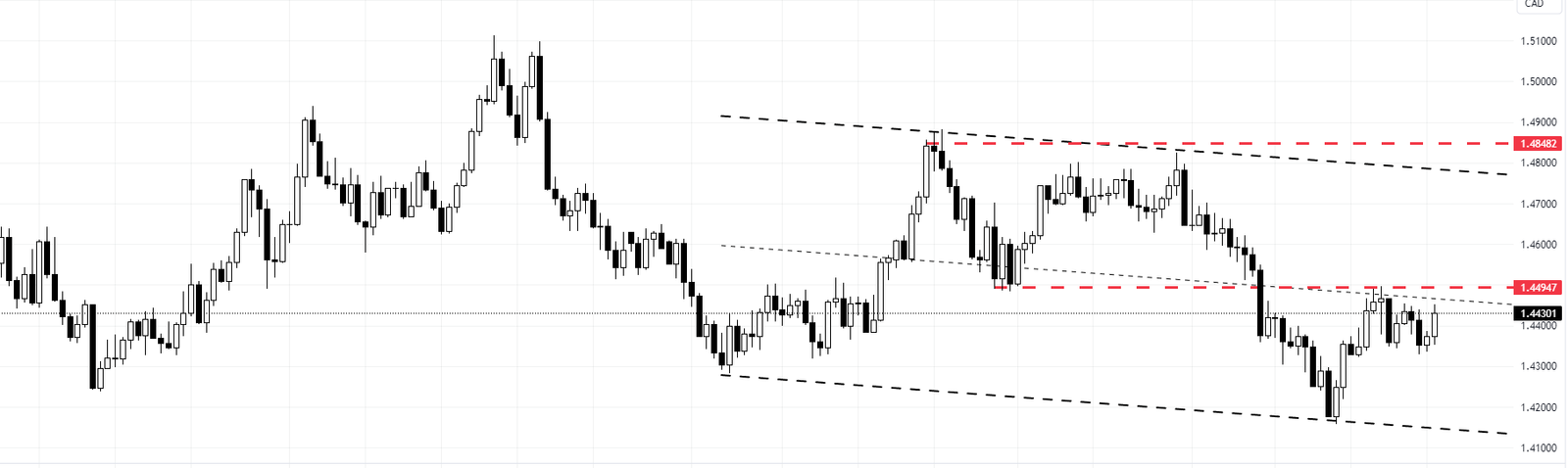

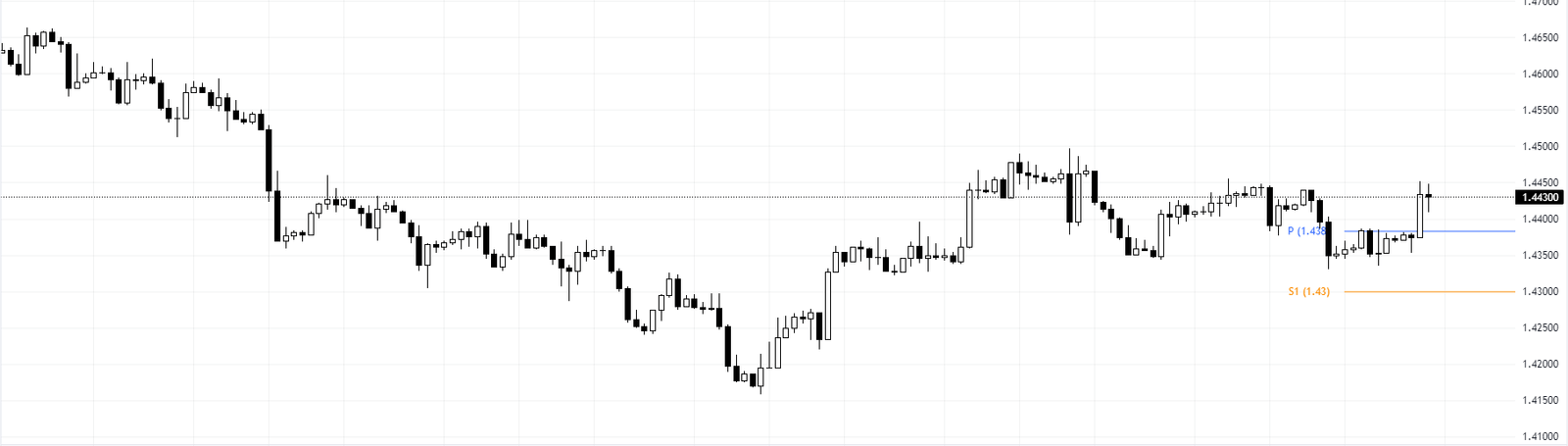

We zoom in on the daily chart for more detailed insight into the EURCAD pair. Here, the currency pair is moving between 1.48 and 1.42. The bulls’ minor resistance is at 1.4494. A close above this level could pave the way for EURAUD to reach 1.467, followed by 1.4848.

However, our EURCAD analysis wouldn’t be complete without considering potential risks. The 1.43 level supports the bullish scenario. If the bears manage to close below this level, it could invalidate the bullish scenario.

This EURCAD analysis provides traders with a comprehensive understanding of the current market conditions and potential future movements of the EURCAD pair.

Remember, while this content is SEO-optimized and effectively uses your focus keyword, it is crucial to ensure it fits into your overall content strategy.