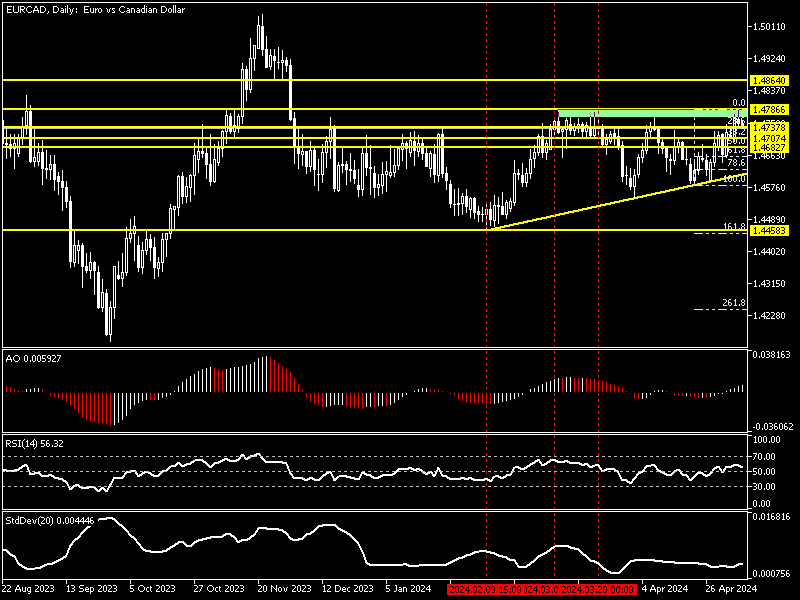

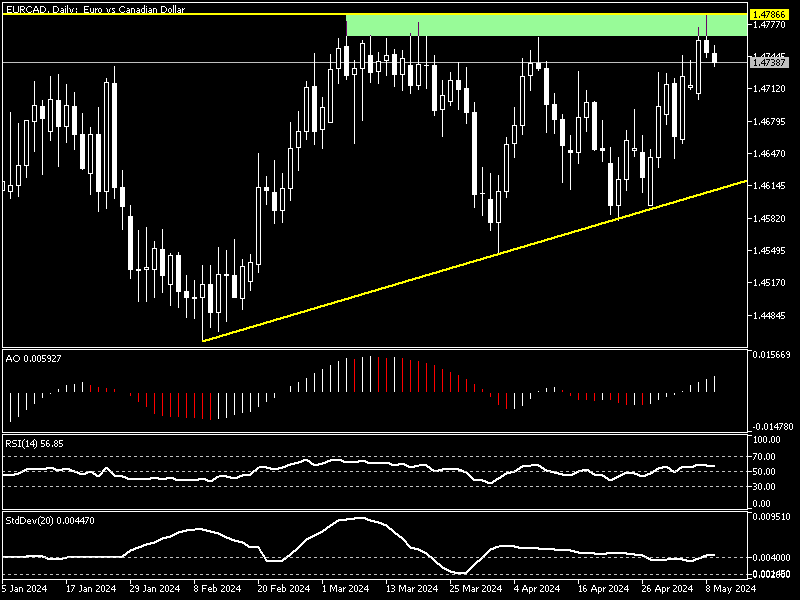

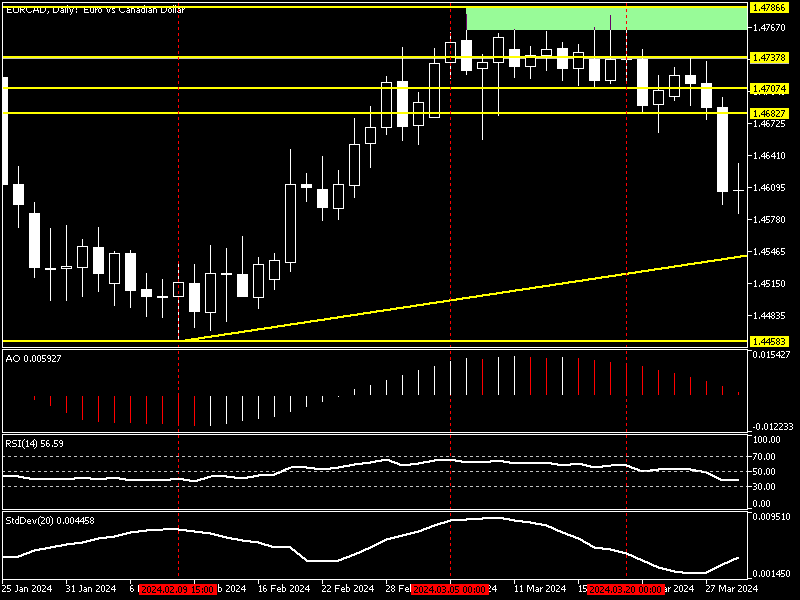

The European currency, the Euro, is dipping from 1.478, robust resistance against the Canadian dollar. The daily chart below shows that the EURCAD trend reversed from a bull market to a bear market twice this year after the price peaked at the 1.478 barrier.

EURCAD Tests 1.473 Support Amid Bearish Signals

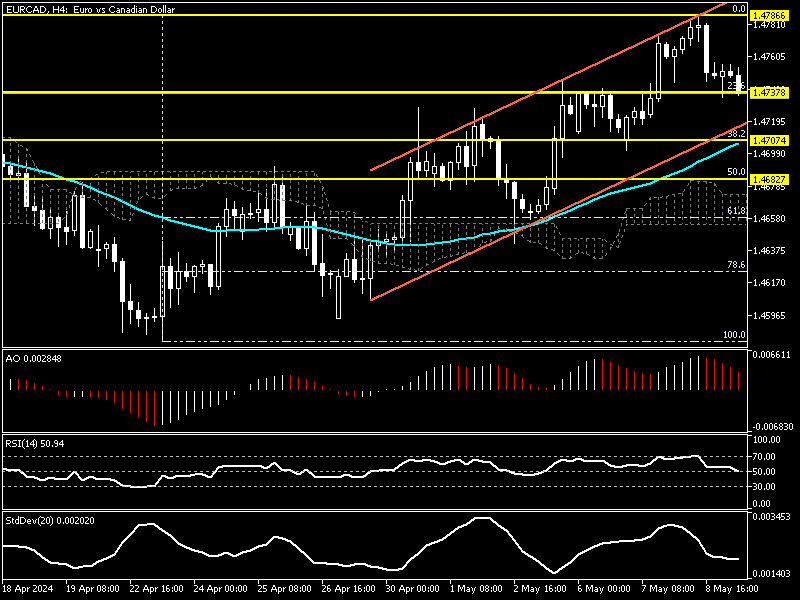

As of writing, the EURCAD pair trades at about 1.473, which clings to the 23.6% Fibonacci retracement level. While the sellers try to break down the 1.473 support, the technical indicators promise a downtrend in the 4-hour chart.

The awesome oscillator bars are in red and approaching the zero line from above, and the RSI is about to cross below the median line. This indicates that traders and investors should consider taking the selling pressure from the strong resistance at 1.478 more seriously.

EURCAD Forecast – Eyes on the 1.47 Support

From a technical perspective, for the downward momentum to extend further, the EURCAD price must dip and stabilize itself below the 1.473 key support. If this scenario comes into play, selling pressure will likely increase, boosting the Canadian dollar to revisit the 38,2% Fibonacci retracement (the 1.470 mark), a supply level with the EMA 50 as its backup.

The possibility of a trend reversal will remain valid if the EURCAD price remains below 1.478, which might happen in today’s trading session or sometime next week.

Our forecast is based on this year’s EURCAD price action and volatility history. The daily chart below shows that the currency pair in discussion was trading sideways from March 5 to March 20 this year after the bulls encountered the 1.478 barrier, and the price started to dip on May 21.

The Bullish Scenario

On the other hand, if the EURCAD exchange rate crosses above the key resistance of 1.478, the uptrend that began on February 9 from 1.445 will resume. If this scenario comes into play, the bearish technical analysis should be invalidated, and consequently, the bull’s path to 1.486 will be paved.