In today’s comprehensive EURCAD forecast, we will first scrutinize the current economic conditions in the Euro area. Then, we will meticulously delve into the details of the technical analysis pertaining to the EURCAD pair.

Bloomberg—In November 2023, there was a noticeable improvement in how people in the Euro Area felt about the economy. Specifically, the consumer confidence indicator, a tool used to measure people’s optimism about the economy, increased by 0.9 points from the previous month. This rise brought the indicator to -16.9, marking the highest level of consumer confidence in three months. This uplift in sentiment wasn’t just a one-time event; it matched the initial predictions.

The Impact of EU Increased CCI

This wave of optimism wasn’t confined to the Euro Area alone. The entire European Union (EU) also saw a similar positive shift. Consumer sentiment across the EU went up by 1.1 points, reaching -17.5. This improvement was largely due to people feeling better about their household’s financial situation, both in the past and looking ahead. Additionally, they had a more positive view of their country’s overall economic condition.

However, it wasn’t all rosy. Despite these positive feelings, people’s intentions to make large purchases, like buying a house or a car, slightly declined.

Economic Implications of Improved Consumer Confidence

This rise in consumer confidence in the Euro Area and the broader EU is a good sign for the economy. When people feel more confident about their financial situation and the economy, they’re more likely to spend money. This spending stimulates economic growth. However, the reluctance to make major purchases indicates some lingering caution among consumers, which could slow economic growth.

EURCAD Technical Analysis and Forecast

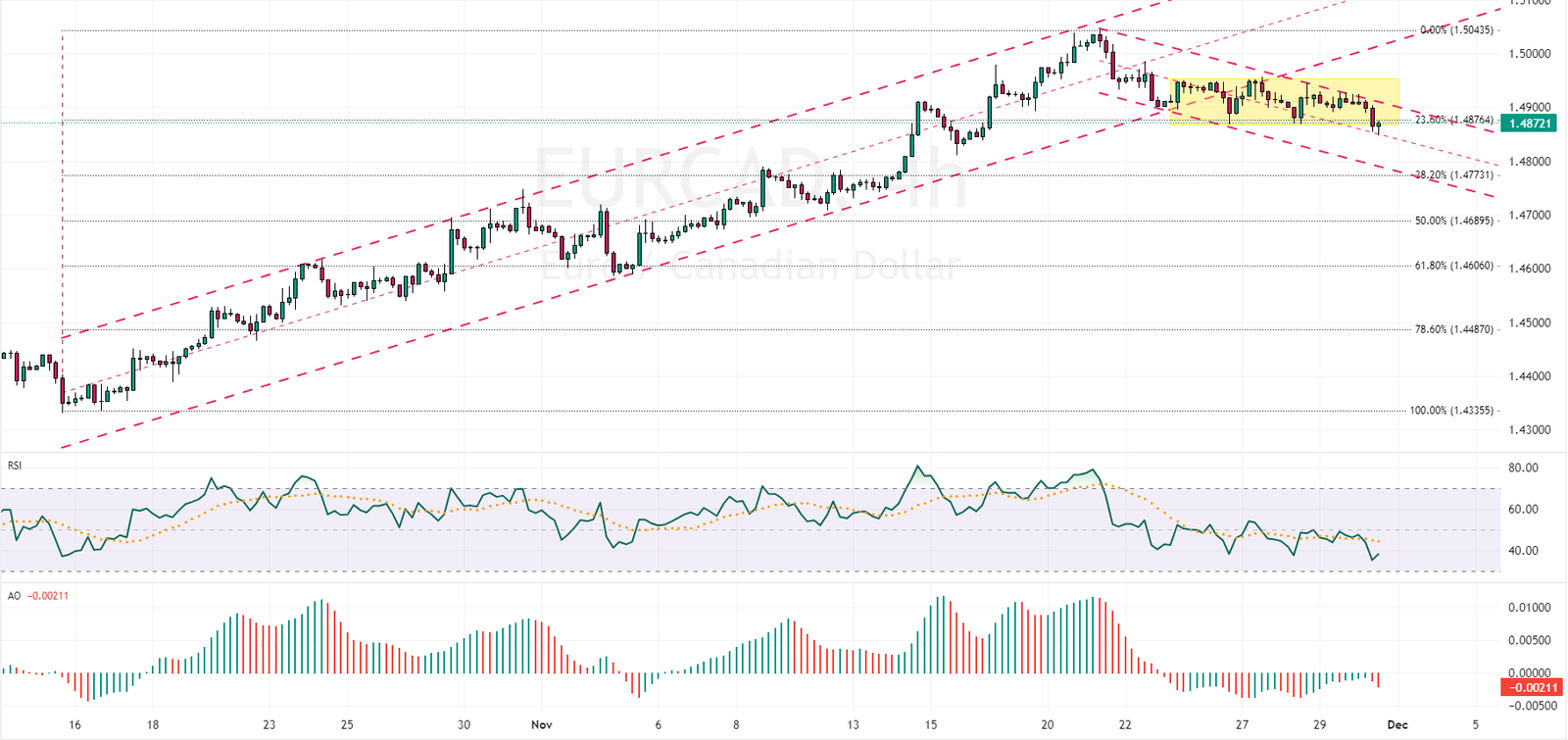

The EURCAD downward momentum has eased near the 23.6% level of the Fibonacci retracement. The current bearish bias in the EURCAD is weak and slow, but the bears could close below the 1.476 support level in the current trading session. Concurrently, the awesome oscillator’s bar turned red, supporting the bearish trend that began in late November.

FxNews analyst forecasts that the bearish trend will likely continue, and the next target will be the 38.2% Fibo level (1.4773 mark). The bearish scenario is invalidated if the bulls cross above the bearish flag.