EURCHF Forecast – Swiss PMI Recovery Amidst Challenges

In today’s comprehensive EURCHF forecast, we will first examine the current economic conditions in Switzerland. Then, we will meticulously delve into the details of the technical analysis of the EURCHF pair.

Swiss PMI Recovery Amidst Challenges

Bloomberg—In November 2023, the Swiss manufacturing industry showed signs of recovery. The procure.ch and Credit Suisse Manufacturing Purchasing Managers’ Index (PMI) rose to 42.1, an improvement from the 40.6 figure recorded in October and in line with what market analysts had predicted, which was around 42.

The improvement in the PMI was primarily due to better performance in specific areas:

- Production Growth: The production gauge significantly increased to 46.6, up from 40.4 in October. This suggests that the production activities in the manufacturing sector have picked up pace.

- Order Book Expansion: Order books also improved, with the index rising to 38.1 from 35.2. This indicates that more orders are being placed, a positive sign for future production.

However, not all aspects were positive:

- Employment Concerns: The sector continued to face challenges in terms of employment, with job numbers falling to their lowest since October 2020. This indicates ongoing layoffs or a hiring freeze in the industry.

- Decrease in Purchasing Volume: Manufacturers’ purchases declined for the thirteenth consecutive month, reflecting caution in spending due to uncertain market conditions.

Economic Implications

The partial recovery in Switzerland’s manufacturing sector is a positive sign for the economy. Increased production and order books can lead to more job opportunities and higher economic output in the long run. However, the current decline in employment and purchasing volume is a concern. It suggests that manufacturers are still cautious about the future, which could impact the overall economic growth and stability.

EURCHF Technical Analysis and Forecast

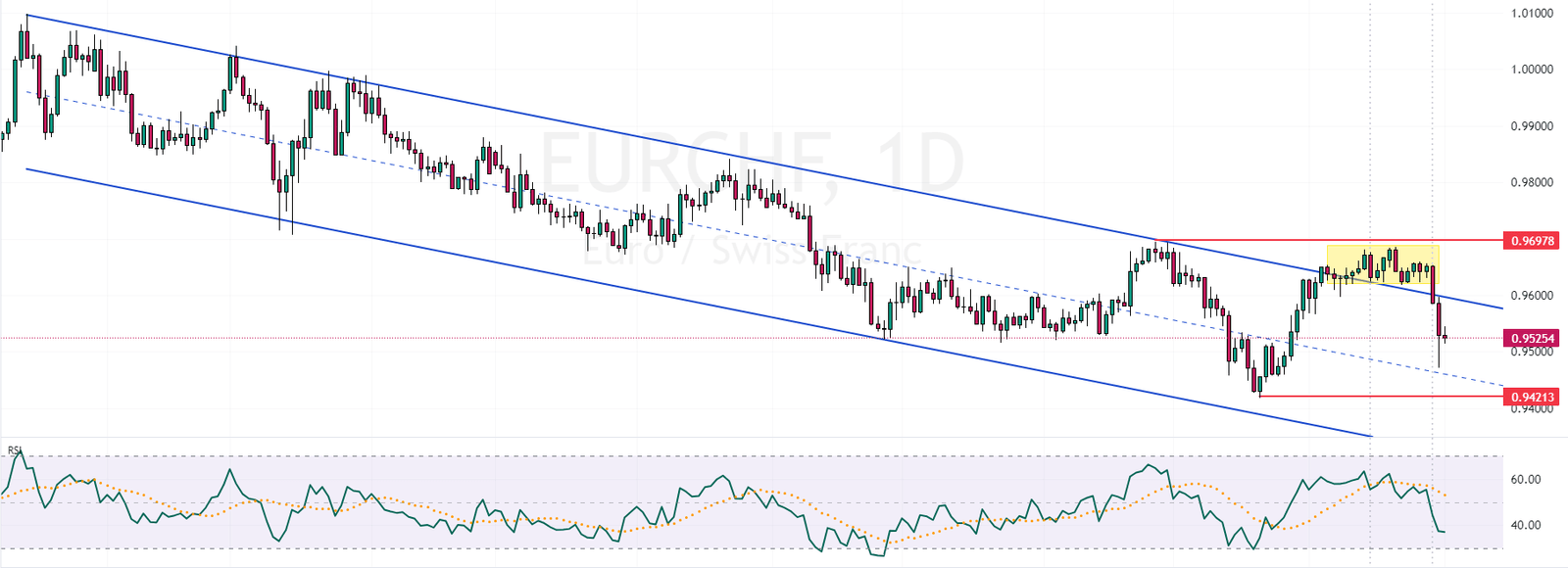

FxNews – On November 15, EURCHF attempted to break out of its bearish channel. However, this effort failed on November 29, as the bulls could not push the price above the 0.9697 resistance. Consequently, a long bearish candlestick with a full body drove the price back into the bearish channel. The strong bearish momentum then eased near the median line of the channel.

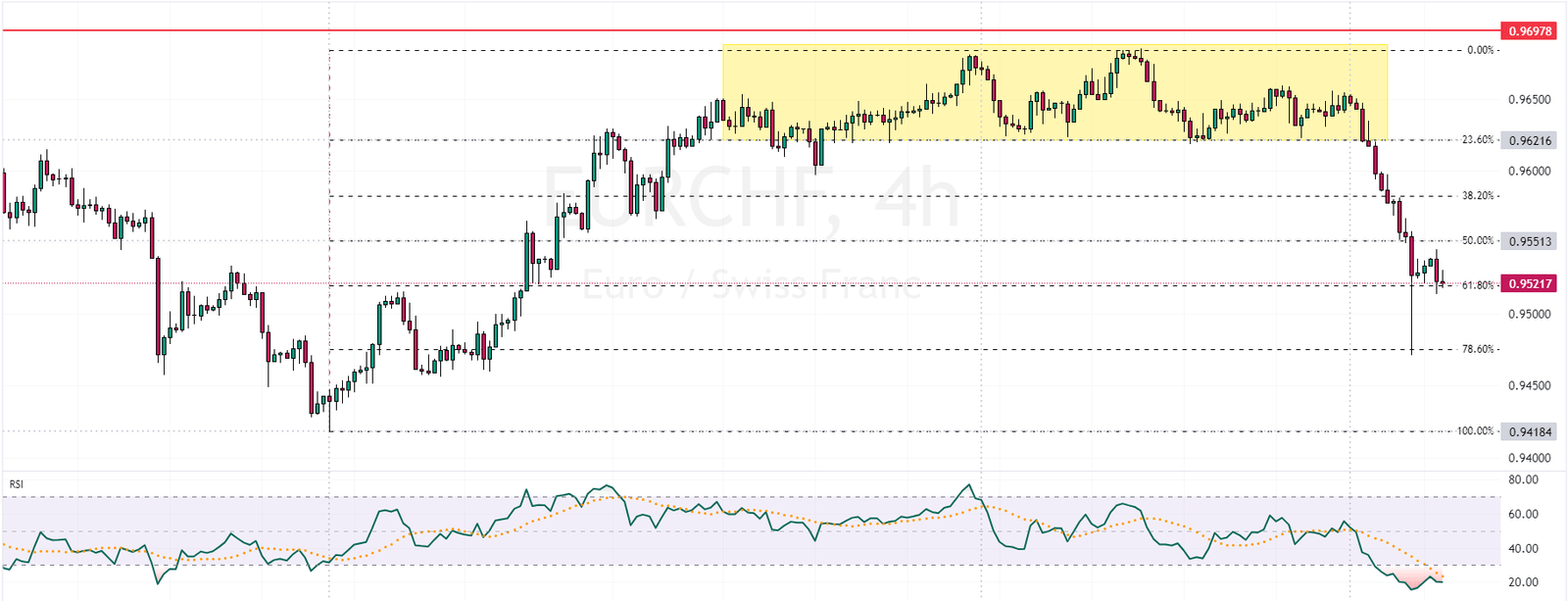

Examining the 4-hour chart is essential for a deeper understanding of the EURCHF forecast. The 50% level of the Fibonacci retracement tool plays the pivot. If the price stays below 0.9551, the bearish target could be the October 20 low, around the 0.9418 mark.

Conversely, if the pair closes above and stabilizes at the 50% level of the Fibonacci retracement tool, the price could rise and test the 23.6% level, which aligns with the 0.9621 mark.

J.J Edwards is a finance expert with 15+ years in forex, hedge funds, trading systems, and market analysis.