In today’s comprehensive EURCZK forecast, we will examine the Czech Republic’s current economic conditions. Then, we will meticulously examine the technical analysis of the EUR/CZK pair.

Czech Republic’s Producer Inflation Rate Hits Lowest

Bloomberg – In September 2023, the Czech Republic saw a decrease in its annual producer inflation rate, which measures the average price change received by domestic producers for their output. The rate dropped to 0.8% from 1.8% in the previous month, marking the lowest rate since January 2021. This was slightly below market forecasts, which had predicted a rate of 1.1%.

Here’s a breakdown of what happened in different sectors:

- Mining & Quarrying: Prices eased in this sector, with the inflation rate dropping from 45% in August to 42.5% in September.

- Electricity, Gas, Steam & Air-Conditioning Supply: This sector significantly decreased prices, with the inflation rate falling from 11.7% to 4.4%.

- Manufacturing: This sector’s deflation (negative inflation) rate decreased slightly from -2.2% to -1.6%. This means that prices fell at a slower pace than before.

- Water Supply: Inflation remained steady in this sector at 16.3%.

Producer prices increased by 0.3% monthly, following a 0.2% rise in August. This was closely aligned with market forecasts, which had predicted an increase of 0.4%.

This information is crucial for understanding economic trends and making informed decisions in various sectors.

EURCZK Forecast: A Technical Outlook

The EUR CZK (Euro currency against Czech Koruna) has been experiencing a positive trend since May 2023. This bullish momentum has seen the EURCZK price break free from its previous bearish channel, and it is currently trading within a narrow bullish channel near the pivotal 24.73 mark. The Stochastic oscillator, a popular momentum indicator, is overbought (Weekly chart). This suggests we might be on the cusp of a trend reversal or a price correction.

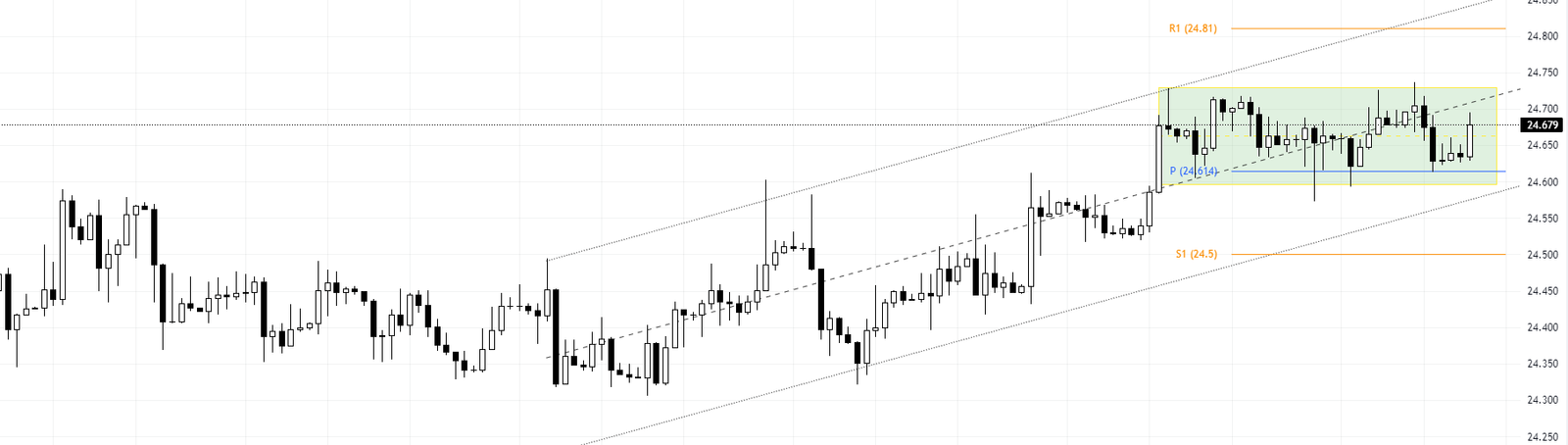

Zooming into the 4-hour chart provides a more detailed view of the EURCZK forecast and price action.

You’ll notice that EURCZK is trading within a specific range, highlighted in a box. This currency pair is nearing the significant 24.73 barrier on the weekly chart, and the Stochastic oscillator remains in the overbought zone. Technical indicators suggest that bearish momentum is gaining strength, so it’s advised not to go long unless the EURCZK bulls break out of the pivot and close above it.

In this forecast, we’re primarily focusing on the bearish scenario. Therefore, FxNews analysts suggest that if the EURCZK closes below the box (under the 24.5 area), we can expect the decline to continue to S1 (24.5), followed by the lower line of the bullish channel.

This analysis provides valuable insights for traders and investors looking to navigate the volatile world of forex trading. It’s always important to stay updated with market trends and make informed decisions based on comprehensive technical analysis.