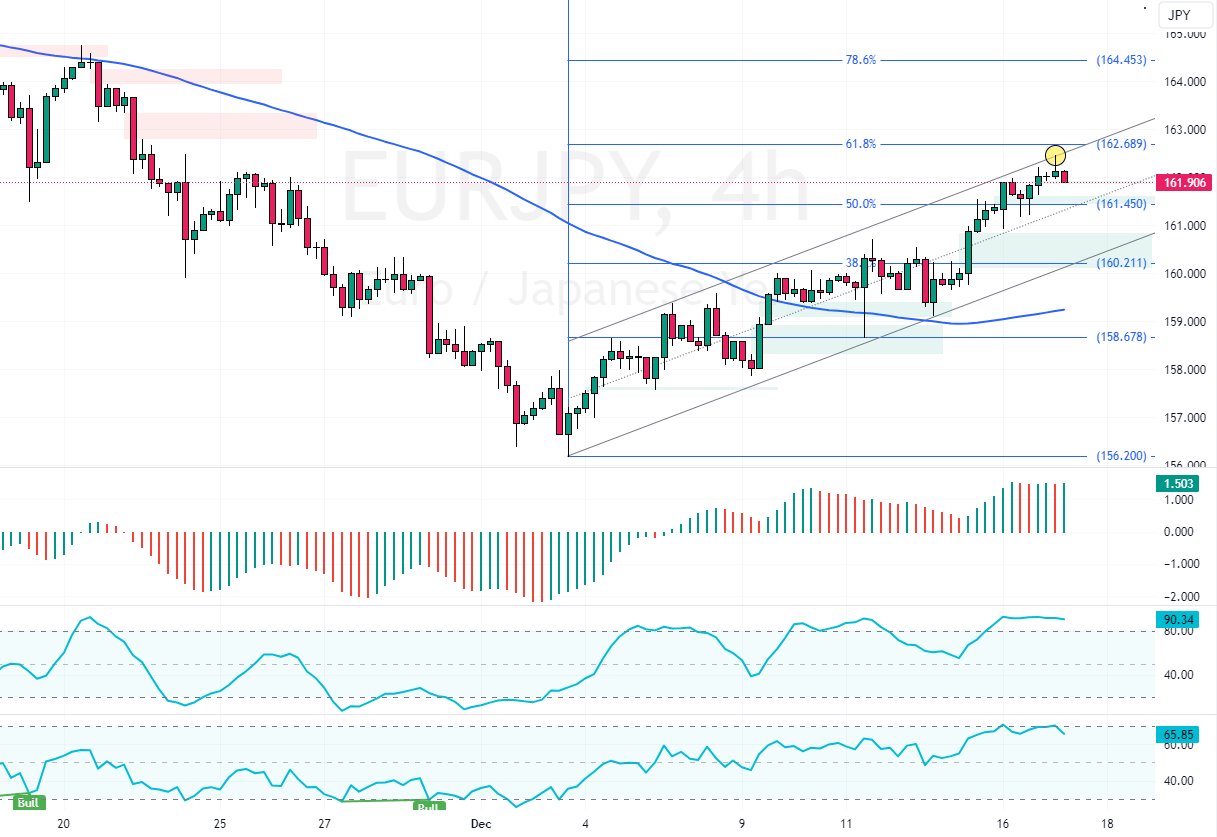

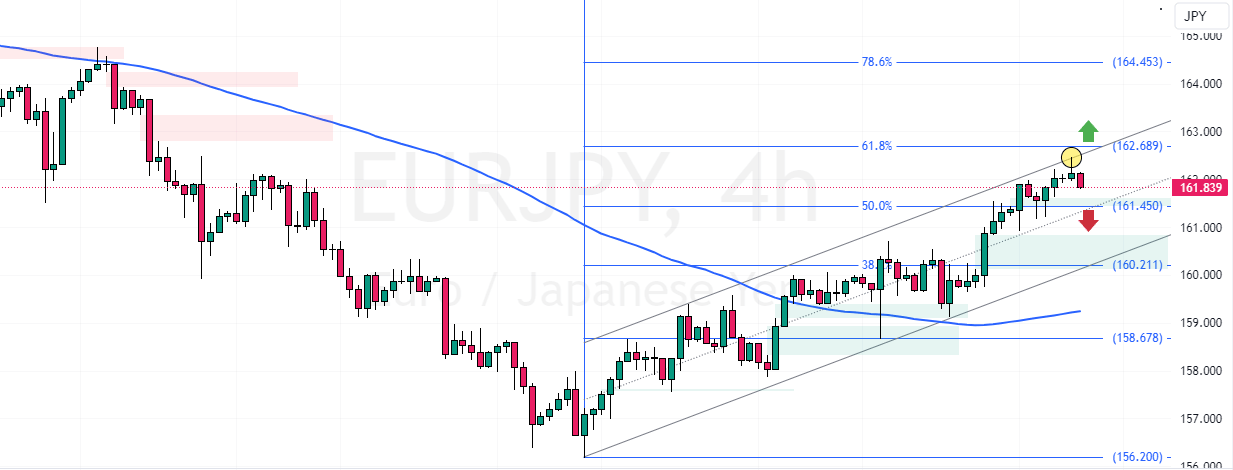

EUR/JPY trades bullish, testing the 61.8% Fibonacci level as resistance amid overbought signals from the momentum indicators. A break below 161.4 support could trigger a consolidation phase toward the 38.2% Fibonacci level at 160.2.

EURJPY Technical Analysis – 17-December-2024

The European currency is in a bull market against the Japanese Yen, above the 75-period simple moving average. As of this writing, EUR/JPY trades at approximately 161.8, returning from the 61.8% Fibonacci resistance level (161.6).

As for the technical indicators, the Stochastic Oscillator depicts 90 in the description, hinting at an overbought situation. This means the euro is overpriced against the Yen.

Additionally, the RSI 14 returned from the overbought territory, recording 64 in the description, indicating the bear market is slightly strengthening.

Potential EURJPY Dip Toward 38.2% Fibonacci Level

The immediate support is at 161.4. From a technical perspective, EUR/JPY may begin a consolidation phase if bears push the prices below 161.4. In this scenario, the prices could dip toward the 38.2% Fibonacci at 160.2.

- Also read: Watch EURUSD for a Potential Drop to $1.039

The Bullish Scenario

The primary trend is bullish, with immediate resistance at 162.6. If bulls (buyers) close and stabilize above the 162.6 mark, the uptrend will likely extend to higher barriers.

If this scenario unfolds, EUR/JPY could rise toward the 78.6% Fibonacci resistance level at 164.4.