FxNews—The European currency is experiencing a downtrend against the Japanese Yen. The EUR/JPY currency pair trades below the 50—and 100-period simple moving averages at approximately 155.5, nearing the September 11 low.

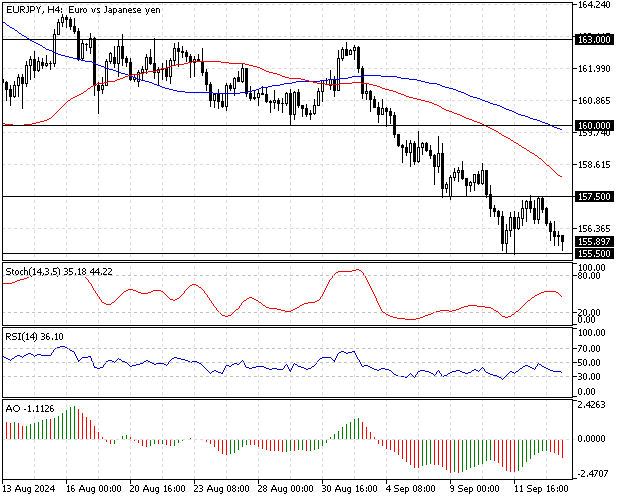

The 4-hour chart below demonstrates the price, key support and resistance levels, and the technical indicators utilized in today’s analysis.

EUR/JPY Technical Analysis – 13-September-2024

The primary trend is bearish because the price is below the 50- and 100-period simple moving averages. In addition to the moving averages, the Awesome oscillator bars are red and below the signal line, meaning the bear market prevails.

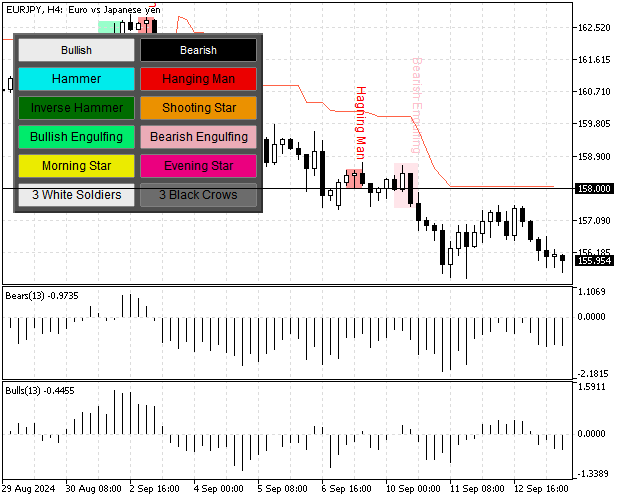

- The EUR/JPY price is below the super trend indicators, signifying the robust downtrend.

Overall, the technical indicators suggest the primary trend is bearish, and the downtrend will likely resume at lower support levels.

EURJPY Forecast – 13-September-2024

The immediate resistance lies at 155.5 (September 11 Low). If the EUR/JPY price dips below this level, the downtrend from 163.0 can potentially target the July 2024 low at 154.4. Furthermore, if selling pressure drives the price below 154.4, the bears’ patch to 153.0 will likely be paved.

Please note that the immediate resistance rests at the 158.0 mark. If the price exceeds 158, the bearish scenario should be invalidated.

EUR/JPY Bullish Scenario

As mentioned in the paragraph above, the immediate resistance is at 158. A bullish wave can be triggered if the bulls (buyers) close and stabilize the price above the 158.0 mark in conjunction with the Super trend indicator.

If this scenario unfolds, the EUR/JPY price can experience a new consolidation phase near the 100-period simple moving average at 160.

EUR/JPY Support and Resistance Levels

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 154.0 / 153.0

- Resistance: 157.5 / 160.0 / 163.0