FxNews—The European currency trades bullishly from 155.5, the September 2024 low, against the Japanese yen. As of this writing, the EUR/JPY currency pair has increased in value, trading inside the bullish flag.

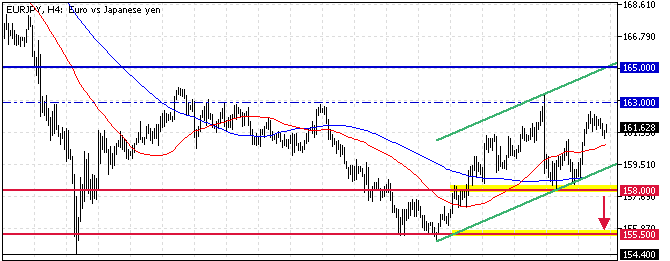

The 4-hour chart below demonstrates the price, support, resistance levels, and technical indicators utilized in today’s analysis.

EURJPY Technical Analysis – 4-October-2024

The primary trend of the currency pair in discussion is bullish because the security’s price is above the 50- and 100-period simple moving averages. Furthermore, the buying pressure resulted in the Stochastic oscillator crossing into overbought territory, signaling a saturated market. On the other hand, the RSI 14 and Awesome oscillators provide mixed signals.

The relative strength index indicates 57 in the description, meaning the EUR/JPY is not overbought, and the uptrend should resume. The Awesome oscillator’s histogram is red, above the signal line, which indicates that the bull market is weakening.

Overall, the technical indicators suggest the primary trend is bullish, but the EUR/JPY price could move sideways or decline to lower support levels before the uptrend resumes.

EURJPY Forecast – Bullish Above 163 Mark

The immediate resistance is at the September 27 high, in conjunction with the upper line of the bullish flag. From a technical perspective, if bulls (buyers) close and stabilize the price above 163.0 (September 27 high), the uptrend will likely extend further.

The next bullish target in this scenario could be the July 25 low at 165. Please note that the bull market should be invalidated if the EUR/JPY price falls below the 158.0 (September 30 Low) key resistance level.

EURJPY Bearish Scenario – 4-October-2024

If bears (sellers) drive the Euro below the 158.0 mark against the Japanese yen, a new downtrend will likely be triggered. If this scenario unfolds, the price of the EUR/JPY pair can dip to the low of September 16 at 155.5.

Please note that if the EUR/JPY falls below 158.0, the 100-period simple moving average will be broken, and it will play the primary resistance for the bearish scenario.

EURJPY Support and Resistance Levels – 4-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 158.0 / 155.5 / 154.4

- Resistance: 163.0 / 165.0