The EUR/JPY declined sharply to 160.6, reaching its lowest point in November. This drop followed the release of PMI data indicating continued weakness in Eurozone business activity.

In November, the HCOB Flash Eurozone Composite PMI fell to 48.1 from 50 in October, below the expected 50. The services sector contracted for the first time in ten months, reflecting the ongoing slump in manufacturing.

ECB Warns of Economic Shocks from Rising Tensions

Earlier this week, the European Central Bank (ECB) published its annual Financial Stability Review. The report warned that increasing geopolitical tensions and policy uncertainties make countries more vulnerable and noted that rising global trade tensions are raising the chances of negative economic shocks.

Adding to these concerns, the conflict between Russia and Ukraine has intensified. Russia recently launched a new type of ballistic missile targeting areas in Ukraine.

EURJPY Technical Analysis

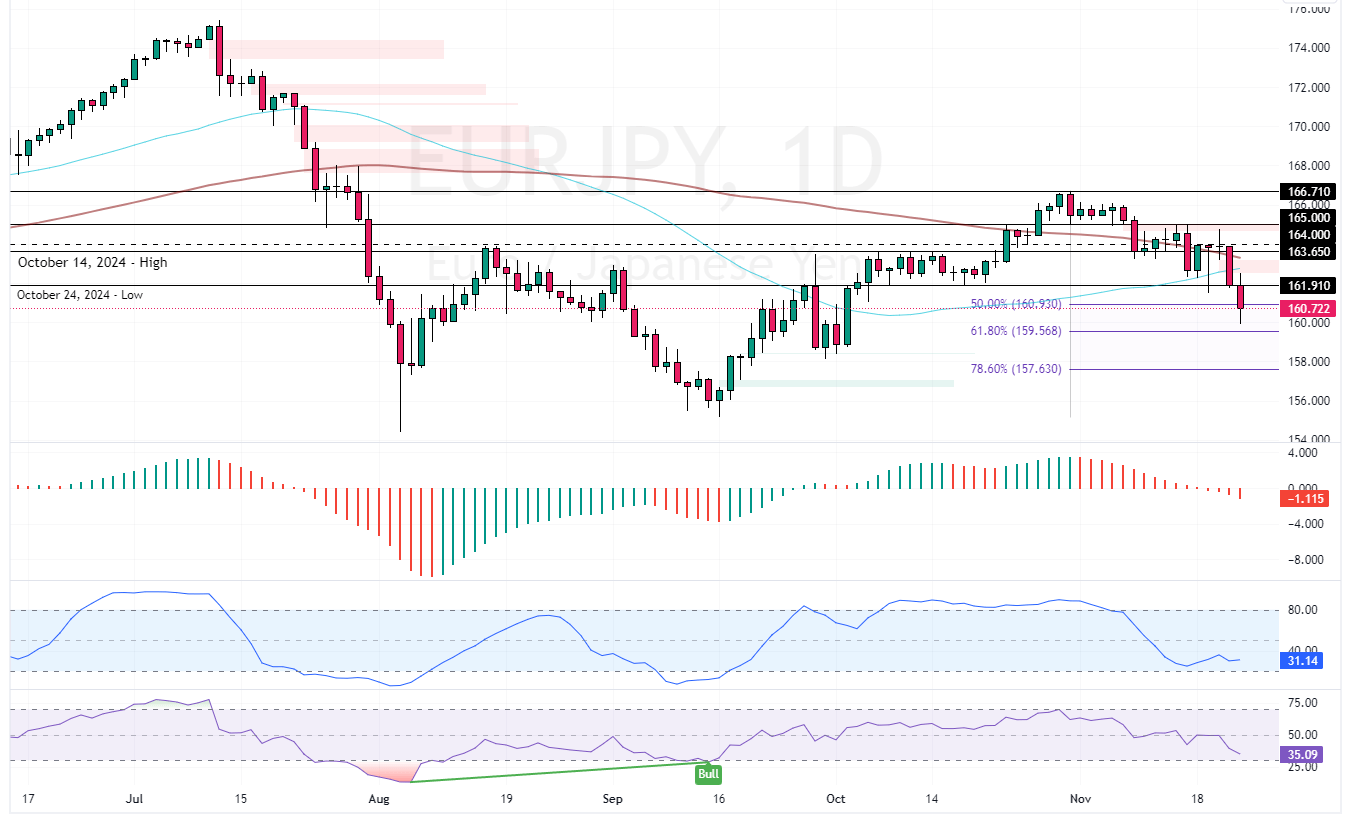

The EUR/JPY pair broke below the critical resistance of 161.9 in today’s trading session and surpassed the 50% Fibonacci retracement level, as mentioned in our previous technical analysis (EURJPY Drops from 165 as STOXX 50 Falls). As of this writing, the currency pair is testing the 50% Fibonacci level as resistance.

Meanwhile, the Stochastic Oscillator depicts 14 in the description, meaning the Japanese Yen is overpriced in the short term. Therefore, we expect EUR/JPY to consolidate before the uptrend resumes.

Overall, the technical indicators suggest that while the primary trend is bearish, EUR/JPY can potentially trade sideways or consolidate before the downtrend resumes.

- Good reads: EURUSD Bearish Below $1.06 Eyes $1.01

Track EURJPY as It Eyes 159.5 Bearish Target

Please note that the EUR/JPY downtrend remains valid as long as the currency pair trades below the 50-period simple moving average or the 163.65 mark. With this outlook, the next bearish target could be the 61.8% Fibonacci retracement level at 159.5.