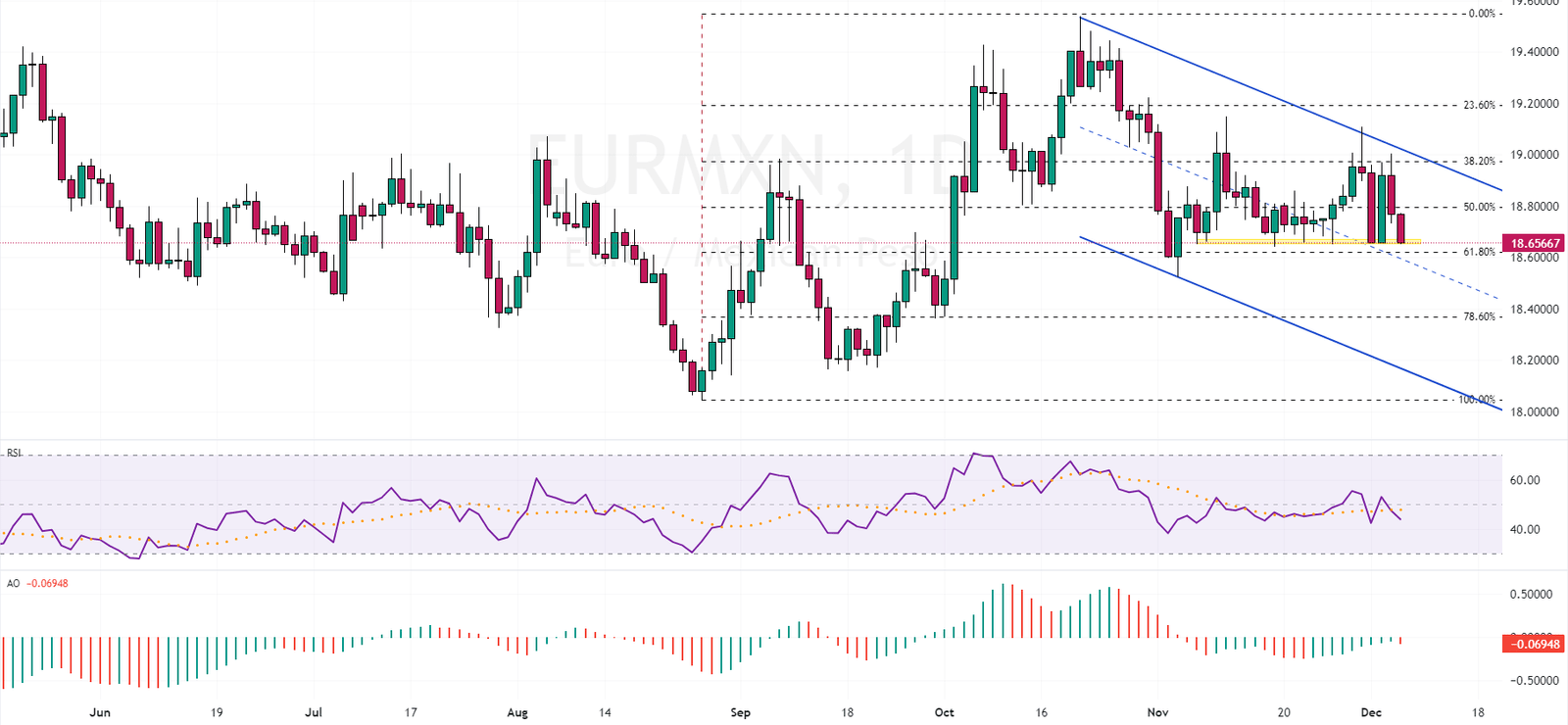

FxNews – The currency pair is currently at a critical juncture, revisiting the 61.8% Fibonacci support level. Indicators like the awesome oscillator, which is showing red bars, and the RSI, lingering below 50, suggest that a downward trend might be on the horizon. This means the bears could potentially break through this key support area.

EURMXN Forecast – Critical Support and Market Trend

If this downward momentum continues, the bears’ next focal point might be the 78.6% Fibonacci support level. The overall market sentiment for the EURMXN remains bearish, especially while trading within a declining flag pattern.

Mexico’s Consumer Confidence Soars to Four-Year High

Bloomberg – In Mexico, consumer confidence is at its highest since February 2019, reaching 47.3 in November 2023, a notable increase of 1.1 points. This upswing in optimism is reflected in several areas. Firstly, there’s an improved outlook on households’ financial status, moving from 51.3 in October to 51.8. Also, perceptions of the current state of Mexico’s economy have brightened slightly, from 43.8 to 44.2.

Moreover, looking ahead, expectations for the next year are also positive. Households’ financial prospects for the coming 12 months have risen from 57.1 to 58.1, and confidence in the nation’s economy for the same period has grown from 49 to 50.5. Additionally, consumers are more willing to make significant purchases, with the indicator increasing from 29.8 to 31.4.