In today’s comprehensive EURMXN forecast, we will first examine the current economic conditions in Mexico. Then, we will meticulously delve into the details of the EURMXN pair’s technical analysis.

EURMXN Potential Shift at Fibonacci Resistance

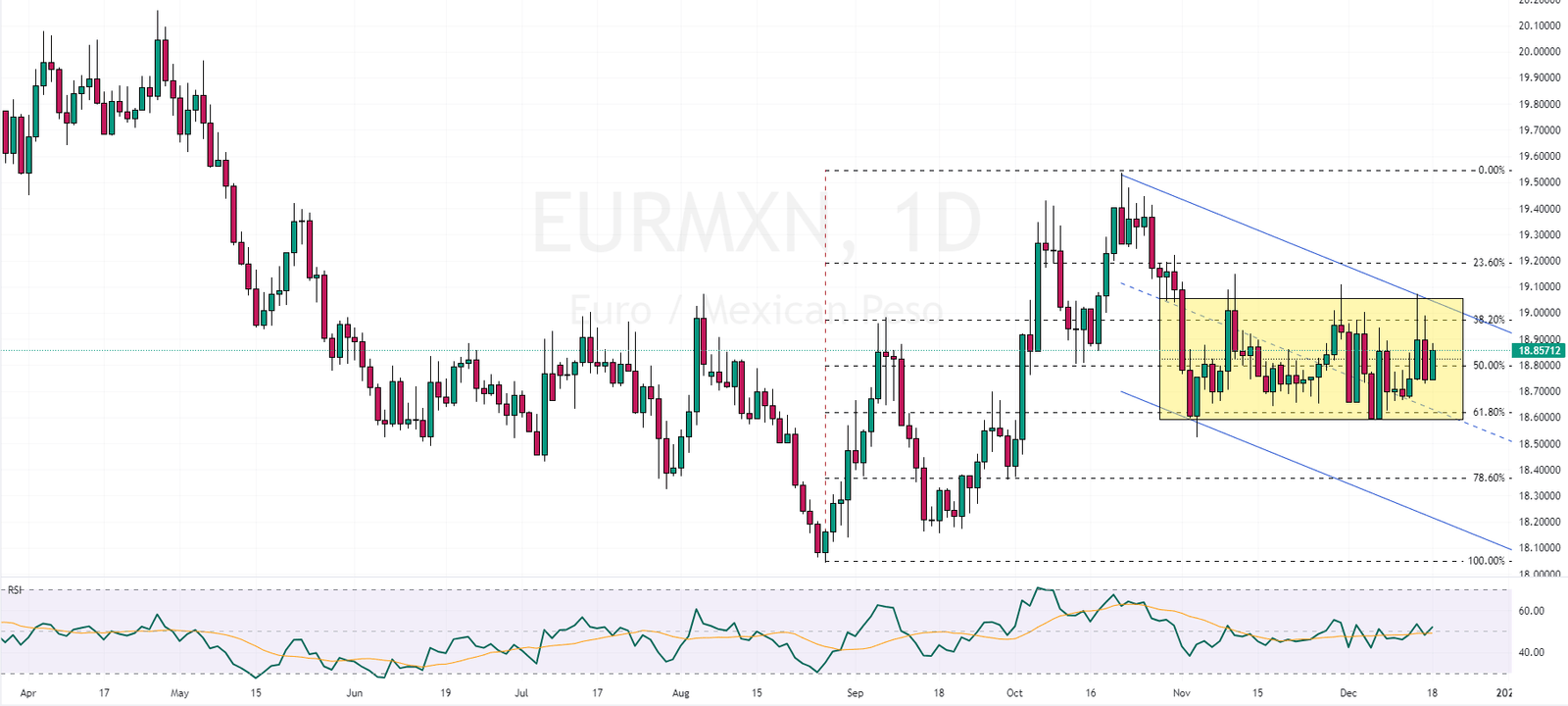

FxNews – The currency pair (Euro to the Mexican Peso) currently trades within a broad range, as highlighted by the yellow box on the daily chart. Despite some uncertainty indicated by the RSI indicator, the overall trend for EURMXN appears to be bearish, remaining within a bearish channel.

Our technical analysis shows that a downward trend is likely if the pair stays below the 38.2% Fibonacci resistance level. In this context, the 78.6% Fibonacci resistance level may emerge as the next target for bearish movements.

However, this technical analysis would be negated if the EURMXN price breaks above the 38.2% resistance level. The upper boundary of the bearish channel reinforces this key level, making it a significant point to watch in the EURMXN forecast.

Analyzing Peso Trends: Inflation and Policies

Bloomberg—The Mexican Peso is hovering around 17.2 against the USD, influenced by the Federal Reserve’s softer stance and the Bank of Mexico’s (Banxico) tighter monetary policy. Following the Federal Reserve’s decision to maintain interest rates, marking the third consecutive meeting without a change, the U.S. dollar saw a retreat. Concurrently, Banxico, in its December 2023 meeting, opted to keep its benchmark policy rate at a record 11.25%.

This decision aligns with the November inflation rise to 4.32%, predominantly due to non-core elements, while the core inflation rate lingered at 5.30%.

The 2023 outlook suggests a reduction in overall inflation but an increase in core inflation rates. Additionally, indicators like the Purchasing Managers’ Index point to sustained economic growth, and Industrial Production figures have surpassed forecasts, painting a positive picture of Mexico’s financial future.