In today’s comprehensive EURNZD forecast, we will first examine New Zealand’s current economic conditions. Then, we will meticulously examine the EURNZD pair’s technical analysis.

The Impact of US Inflation Data

Bloomberg—The New Zealand dollar has significantly recovered, almost reaching a value of 0.6 against the US dollar. This development occurred on Tuesday and was primarily driven by investors’ sell-off of the US dollar.

The sell-off reacted to releasing the Consumer Price Index (CPI) data in the United States. The data revealed a widespread deceleration in US inflation for October. This slowdown suggests that the Federal Reserve may have reached the end of its cycle of interest rate hikes. The anticipation of this change has led to a shift in investor sentiment, strengthening the New Zealand dollar. This is a clear demonstration of how international economic indicators can have a profound impact on currency values.

Investors are also beginning to accept that the Reserve Bank of New Zealand (RBNZ) may have concluded its rate hikes. In its third consecutive meeting in October, the central bank maintained the cash rate at 5.5%. This decision was influenced by the continued easing inflation in the third quarter.

On the domestic front, recent data revealed a decrease in food prices, which rose by only 6.3% year-on-year in October. This is the smallest increase in nearly two years and marks the fourth month of easing.

However, despite these positive signs, investors are cautious. They eagerly await the release of key October data from China, New Zealand’s leading trading partner. This data includes figures for industrial output and retail turnover, which could potentially influence the New Zealand dollar’s trajectory.

The Economic Implications

The strengthening of the New Zealand dollar could positively and negatively affect the economy. On the one hand, it could make imports cheaper, potentially reducing inflation further. On the other hand, it could make exports more expensive, potentially hurting industries that rely heavily on exporting goods.

EURNZD Forecast – NZD Comes Back

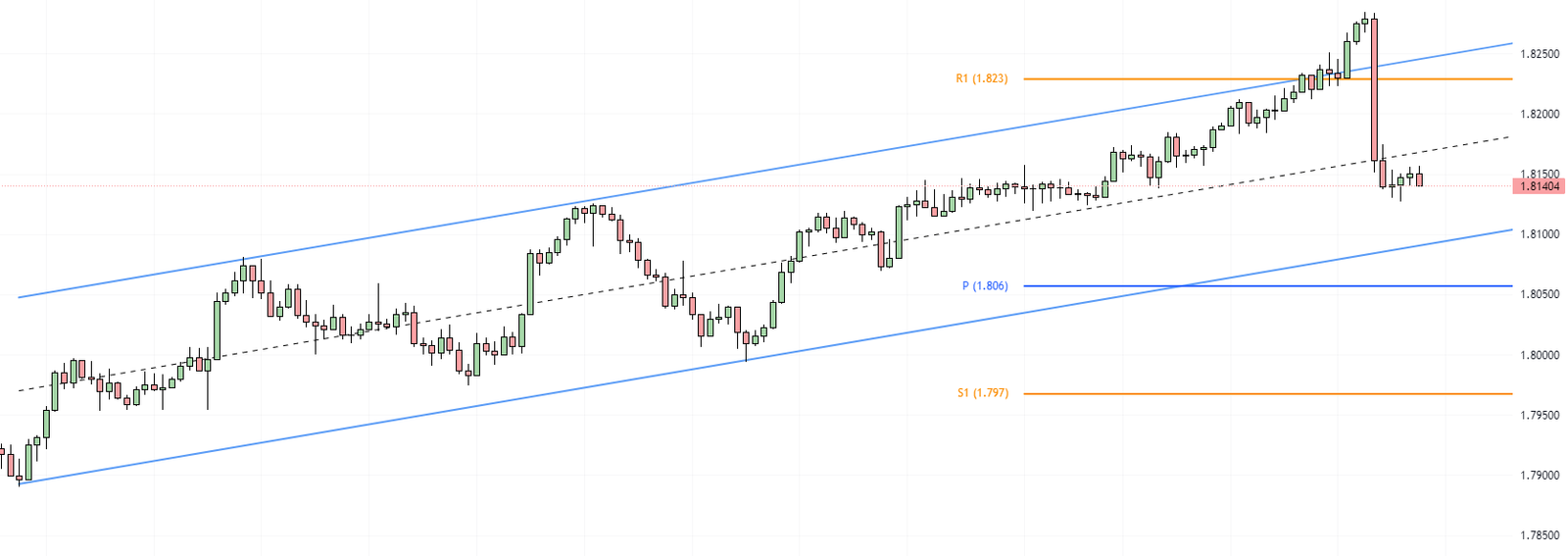

The EURNZD pair’s bullish momentum was significantly hampered after reaching October’s high, around the 1.8265 resistance level. The RSI indicator was overbought, leading to expectations of a correction in the EURNZD price.

We zoomed into the EUR/NZD 1-hour chart to understand the price action better. Here, the pair is trading within a bullish flag. However, it broke down the median line. This suggests that the EURNZD price will likely continue its bearish momentum towards the lower line of the bullish flag. Should the flag break down, the next target will be the S1 support level at 1.797.

Conversely, the R1 resistance level at 1.823 is pivotal. If the bulls close and stabilize the ERU/NZD price above this level, we could see a continuation of the uptrend momentum.