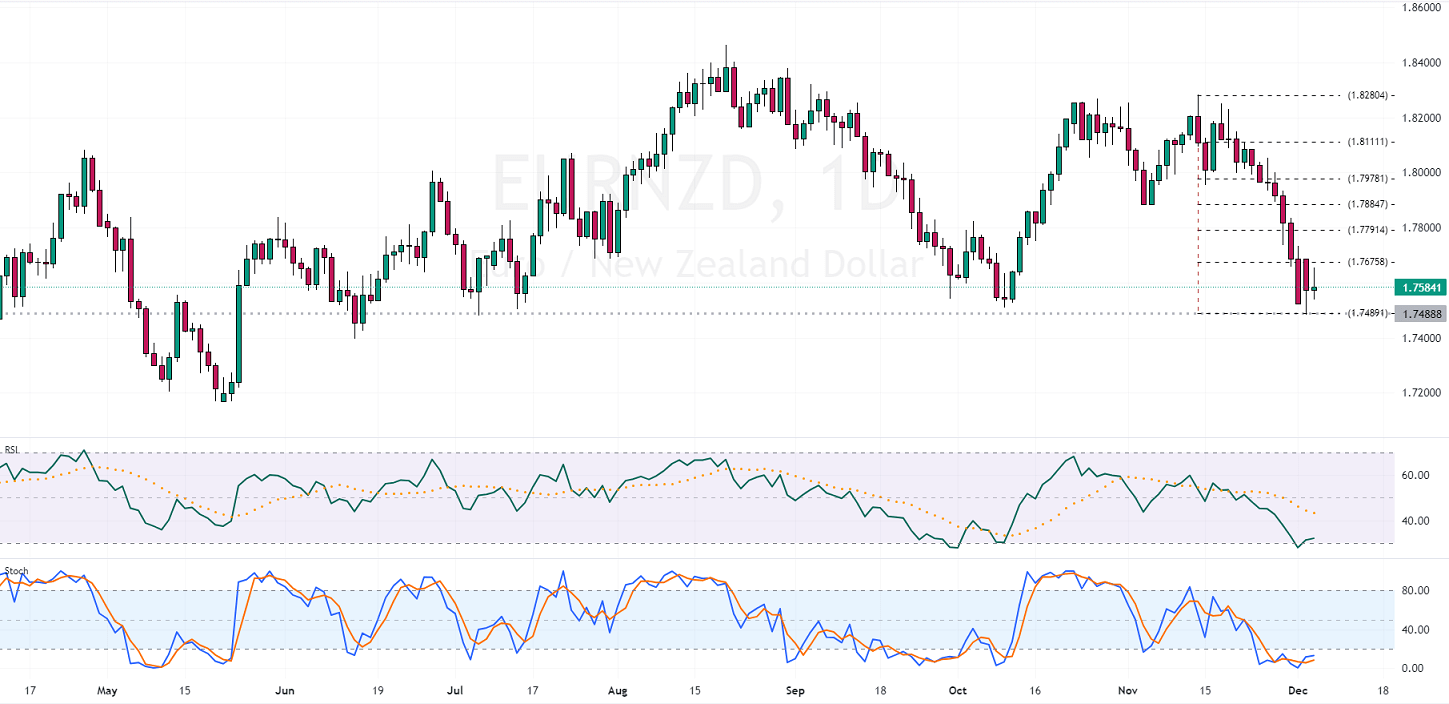

FxNews—The EURNZD recently experienced a notable rebound from the 1.7487 support level. In this short article, we delve into the technical details of the currency pair in the daily chart.

EURNZD Forecast – The Battle at Fibonacci Levels

The stochastic oscillator hinted at this upward momentum, especially after the pair reached an oversold status. Significantly, the 1.7487 support has been a consistent challenge for sellers since May 2023. However, today’s trading saw the pair struggle to surpass the 23.6% Fibonacci retracement level.

This poses a risk: if buyers don’t maintain the price above this threshold, the 1.7487 support might weaken considerably. Currently, the market outlook remains predominantly bearish. There’s a looming possibility of the 1.7487 support breaking, especially if the price stays below the 23.6% Fibonacci level.

Conversely, a shift in momentum could occur if the EURNZD pair successfully climbs above the 23.6% mark. Such a move could temporarily pause the downtrend, potentially leading the price toward the 50% Fibonacci retracement level.

NZX 50 Dips Amid Global and Local Tensions

Bloomberg—The stock market in New Zealand experienced a slight decline, dropping 10.8 points or 0.1% to end at 11,357 this Tuesday. This modest fall comes after a lackluster trading day, partly influenced by a retreat in U.S. stock futures. Investors are reconsidering their expectations that the Federal Reserve might reduce interest rates in the coming year. Additionally, there’s keen anticipation for China’s trade data for November and upcoming inflation reports, along with the U.S. job figures for the month.

Meanwhile, many Maori protesters have been demonstrating against the current government’s policies in New Zealand. They argue that these policies could undermine years of progress for indigenous communities. However, some positive news from China offered a bit of a buffer. The Caixin Services Purchasing Managers’ Index (PMI) for November showed encouraging signs, fueling hopes that Beijing may increase economic support to maintain growth.

Sectors like technology services, consumer services, and energy minerals were among the hardest hit on the New Zealand stock exchange. Notable declines were seen in shares of several companies, including Serko Ltd. (down by 4.9%), Fonterra Co. Op. (2.2% lower), Comvita NPV (decreasing by 2.0%), and Manawa Energy (falling 1.4%).