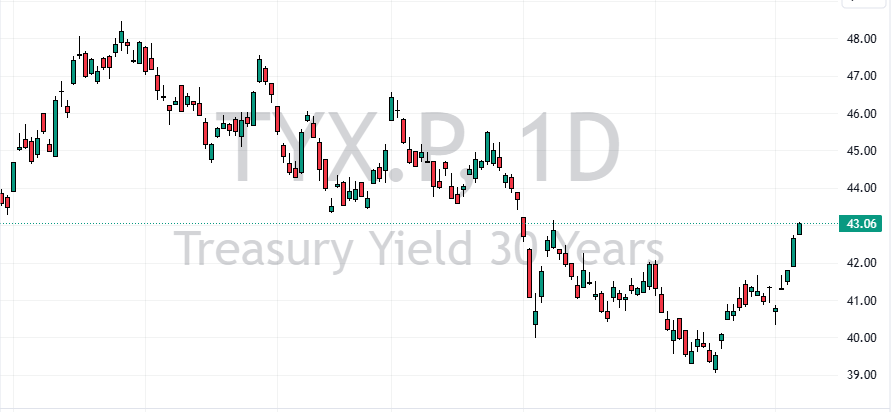

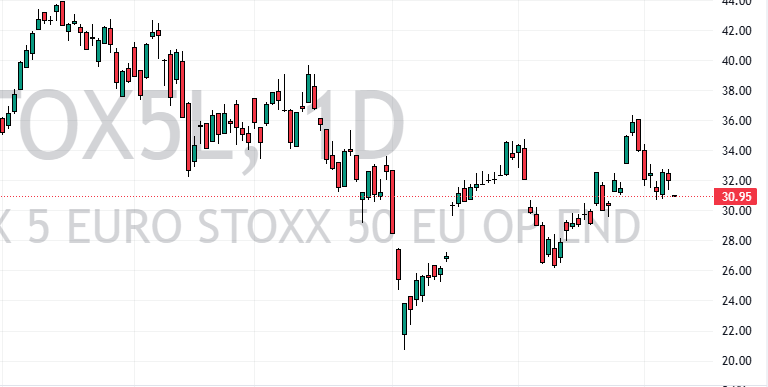

European stock markets are set to open lower this Tuesday. This drop is part of a broader downturn in global markets, partly due to increasing U.S. Treasury yields. As these yields rise, investors become alert, contributing to the sell-off.

The daily chart below shows the 30-year treasury yield price.

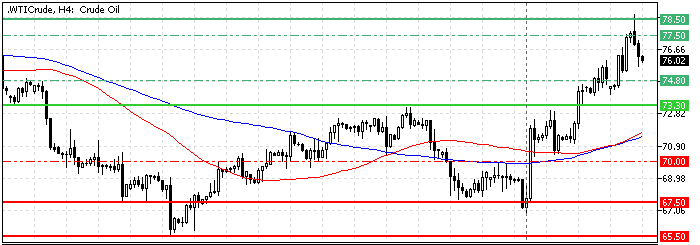

Oil Prices Fuel Inflation Worries

Rising oil prices are adding to the worries about inflation. Higher oil prices mean higher costs for goods and transport, which can increase prices across the board. This situation is putting additional pressure on already nervous markets.

China’s Rally Hits a Wall

After a holiday, investors in China hoped for positive news, but their expectations were dashed. The Chinese government did not announce any new significant economic stimulus measures at a key economic meeting, causing the stock market rally to lose momentum.

Critical Data on the Horizon

Today’s focus in Europe will be on important economic reports. Investors are keenly waiting for Germany’s industrial production data and France’s trade balance figures for August. These statistics are vital as they give insights into how the largest economies in Europe are performing.

- Also read: Oil Hit $76.5 Amid Middle East Tensions

Market Indicators: Downward Signals

Before the markets even opened, the indicators did not look optimistic. Futures for the EURO STOXX 50 and the STOXX 600, which predict how the stock market will perform, are already down by 0.8% and 0.7%, respectively. This suggests investors are bracing for a possibly tough day in the markets.