In today’s comprehensive EURPLN forecast, we will first examine Poland’s current economic conditions. Then, we will meticulously examine the EURPLN pair’s technical analysis.

EURPLN Forecast – Easing in Manufacturing Contraction

Bloomberg—In October 2023, Poland’s manufacturing sector showed resilience despite continuous challenges. The S&P Global Poland Manufacturing PMI witnessed a modest rise, posting a figure of 44.5. This increment, though slight from September’s 43.9, met analysts’ expectations. The sector, however, is still facing a downturn, marking its 18th consecutive month of contraction.

Each of the five main components of the PMI indicated a decline, but the pace of this decline has decelerated. Notably, new orders decreased, hitting a four-month low, suggesting a demand reduction. Additionally, the frequency of job reductions has lessened, with the current rate being the lowest in the past four months, yet it remains considerable.

Supply Chain and Pricing Dynamics

On a positive note, the situation with stocked inputs improved marginally, with the depletion rate being the gentlest in five months. The supply chain also showed signs of recovery; the average lead times for materials have been shortening for six consecutive months.

Regarding pricing, manufacturers reported excess supplier stocks due to a dip in global demand. This oversupply has led to a reduction in input costs for the seventh month in a row, although the rate of decrease was the smallest noted since April. Concurrently, output prices declined for the seventh month as manufacturers reduced prices to attract customers and stay competitive.

The data indicates that Poland’s manufacturing activity is contracting less severely than before, hinting at a possible stabilization in the industry’s outlook.

The Polish economy is currently experiencing a period of contraction in its manufacturing sector, as indicated by the S&P Global Poland Manufacturing PMI remaining below the 50.0 threshold that separates growth from contraction. This has been the trend for the 18th consecutive month.

Despite a slight improvement in the PMI index from 43.9 to 44.5 in October 2023, the overall manufacturing activity is still shrinking, although the pace of decline has softened. This suggests that while the broader economy may have growth areas, the manufacturing sector faces persistent challenges.

EURPLN Technical Analysis and Forecast

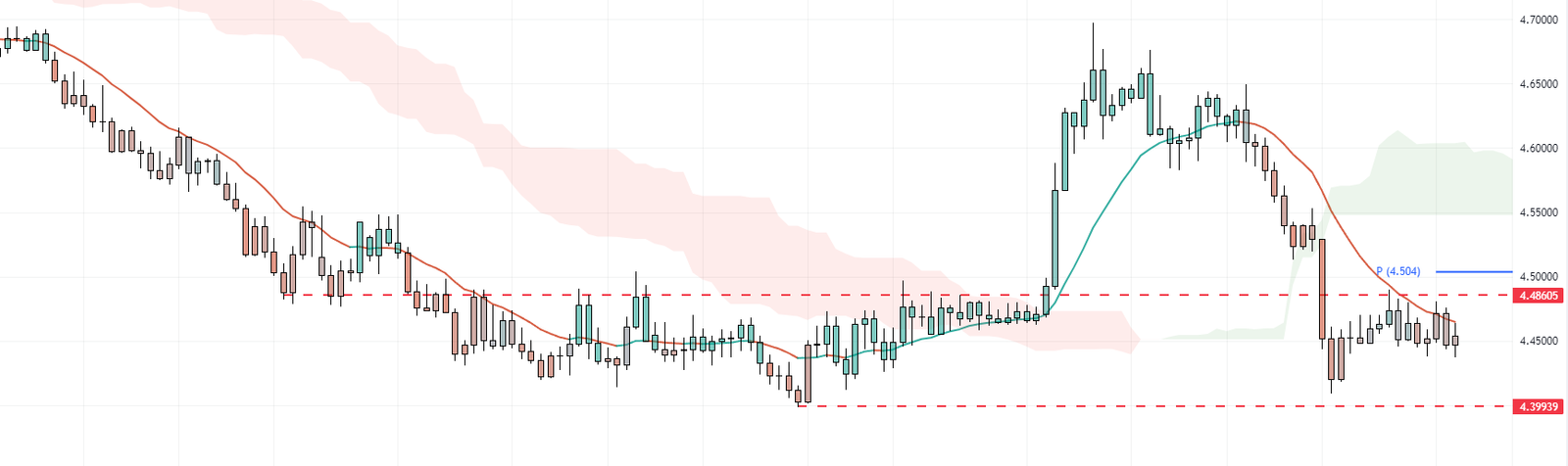

The EURPLN currency pair, currently trading below the 4.86 resistance level, is enveloped by the Ichimoku cloud, indicating a bearish bias. Presently, EURPLN is in the correction phase from its October low.

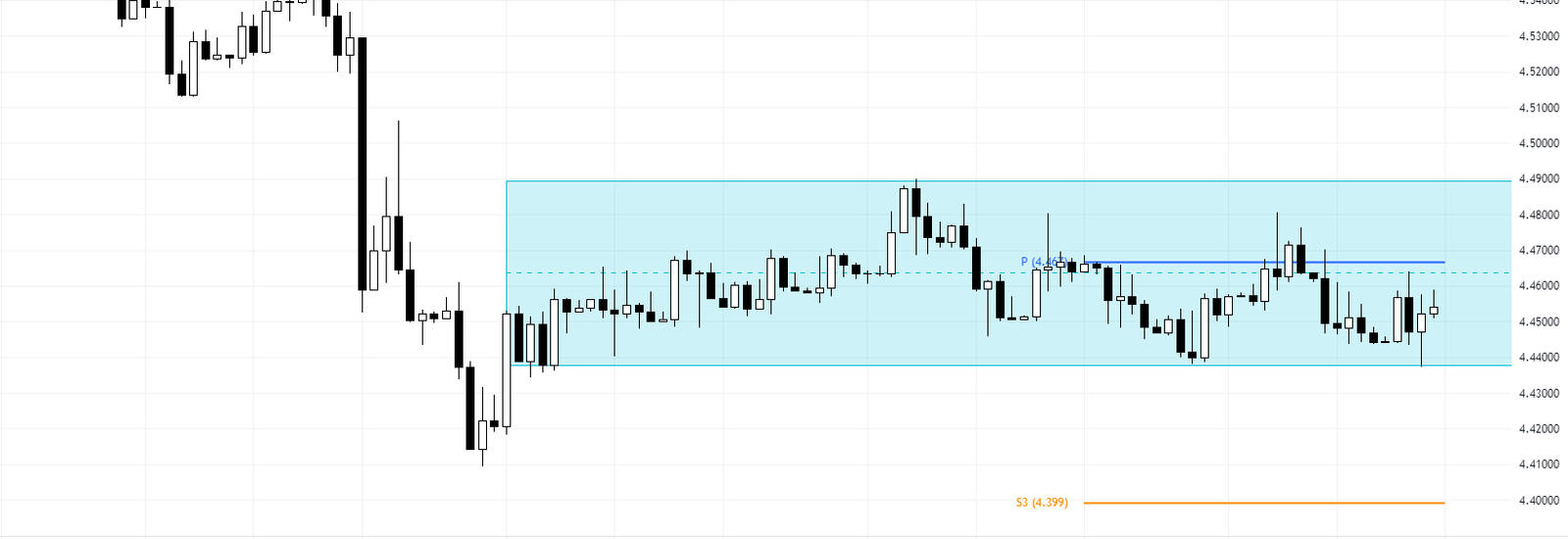

A closer look at the 4-hour chart reveals that EURPLN oscillates between 4.44 and 4.49. Analysts at FxNews recommend waiting for a definitive break from this range channel. Given the prevailing bearish market sentiment, the market is anticipated to breach the 4.44 support level. In such a scenario, we could witness a further decline in the EURPLN price to 4.399.