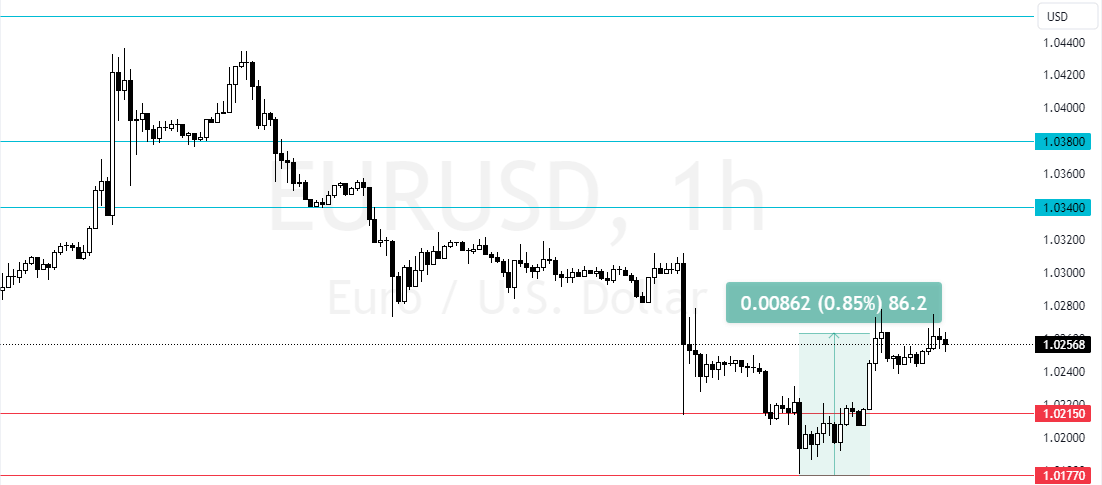

EURUSD began consolidating from 1.017 and rose 0.85%, trading at about $1.025. A close below the immediate support at $1.0233 could trigger the downtrend, targeting $1.017.

EURUSD Technical Analysis – 14-January-2025

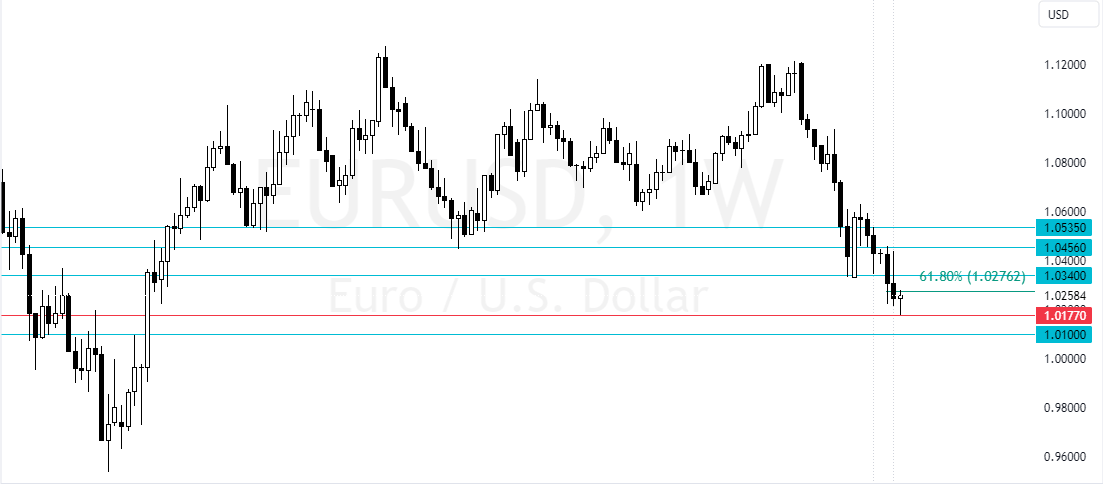

FxNews—The Euro has been in a bear market, below the 50—and 100-period simple moving averages, and has lost 1.6% of its value since January 7. However, the selling pressure eased at $1.017, as expected, because RSI 14 signaled that the market was oversold.

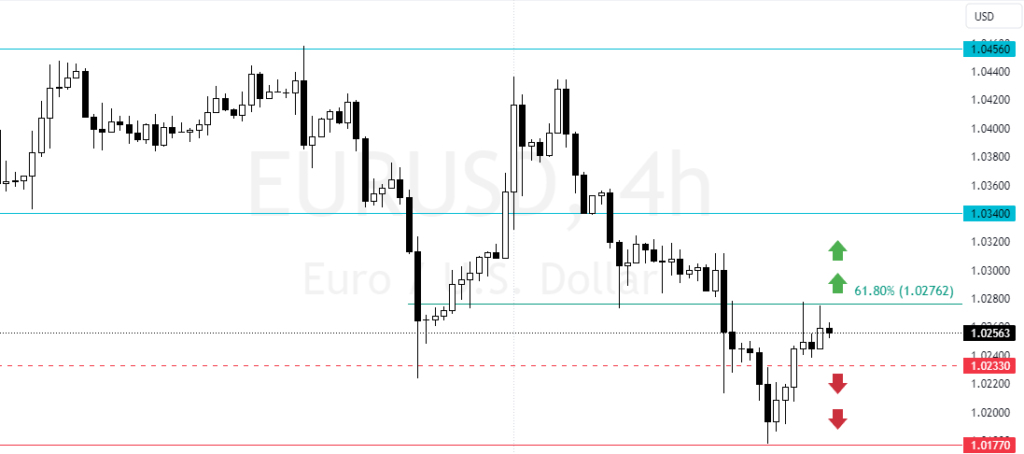

As of this writing, the currency pair trades at approximately $1.025, testing the 61.8% Fibonacci as resistance.

What Do Technical Indicators Reveal?

- The prices are below 100-SMA, interpreted as a bearish market.

- The RSI 14 value is 45.0 and rising, meaning the bear market weakened.

- The Stochastic Oscillator value is 54.0, supporting the RSI 14’s signal.

- The Awesome Oscillator histogram is green, below zero, signifying the bull market gains more momentum.

Overall, the technical indicators suggest that while the primary trend is bearish, EUR/USD requires a bearish break out for the downtrend to resume.

EURUSD began consolidating from 1.017: The Bearish Scenario Explained

The immediate support is at $1.0233. From a technical perspective, the downtrend will likely be triggered if EUR/USD falls below $1.0233. In this scenario, the next bearish target could be retesting the $1.017 support.

Furthermore, if the selling pressure pushes the prices below $1.017, the next bearish target could be the $1.01 mark. Please note that the bearish outlook should be invalidated if EUR/USD exceeds the 100-SMA at approximately $1.034.

- Good read: GBPJPY consolidates at 192.2: Up By 1.2%

The Bullish Scenario

The resistance level that has divided the bear market from a bull market is $1.034. From a technical standpoint, the uptick in momentum from $1.017 could extend to a higher resistance level if the value of EUR/USD exceeds $1.034.

If this scenario unfolds, the next bullish target could be the January 6 high at $1.038.

EURUSD Support and Resistance Levels – 14-January-2025

Traders and investors should closely monitor the EUR/USD key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

| EURUSD Support and Resistance Levels | |||

|---|---|---|---|

| Support | 1.0233 | 1.0177 | 1.0100 |

| Resistance | 1.0276 | 1.0340 | 1.0456 |