FxNews—The EUR/USD restarted its bearish trajectory after bulls failed to stabilize above the immediate resistance of $1.06. This decrease is due to a strong U.S. dollar and growing concerns about potential economic problems in the Eurozone.

In its annual Financial Stability Review, the European Central Bank (ECB) noted that increased geopolitical tensions and uncertain policies make countries more vulnerable. Additionally, rising global trade disputes increase the chances of negative economic impacts.

Euro Struggles Amid Rising Ukraine Tensions

The possibility of the Russia-Ukraine conflict worsening is also putting extra pressure on the euro. Meanwhile, wages in the Euro Area rose 5.4% in the third quarter compared to last year—the biggest increase since the euro was introduced—mainly driven by Germany. This wage growth is making it harder for the ECB to plan interest rate cuts.

Despite these challenges, the central bank is still expected to announce its fourth 25-basis point rate cut in December.

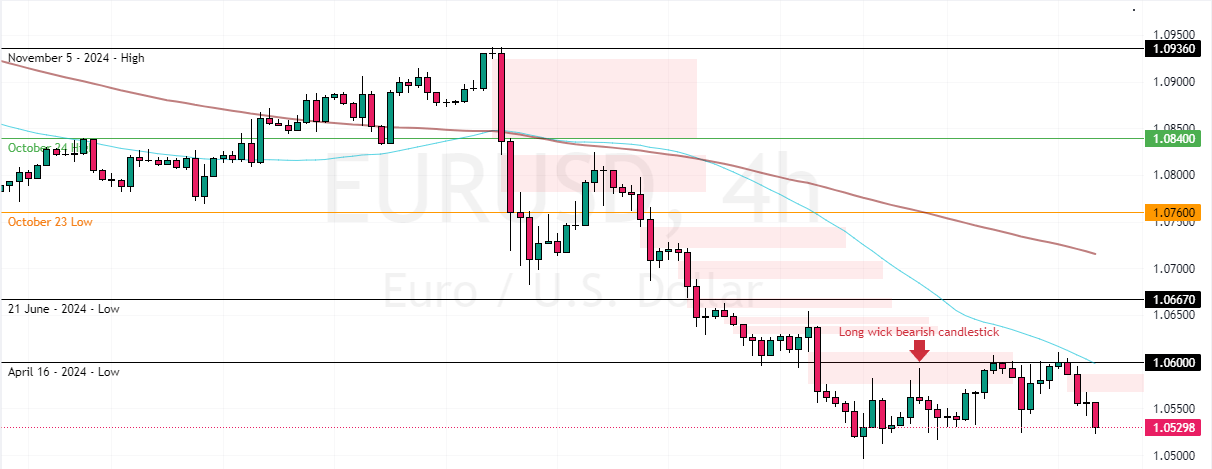

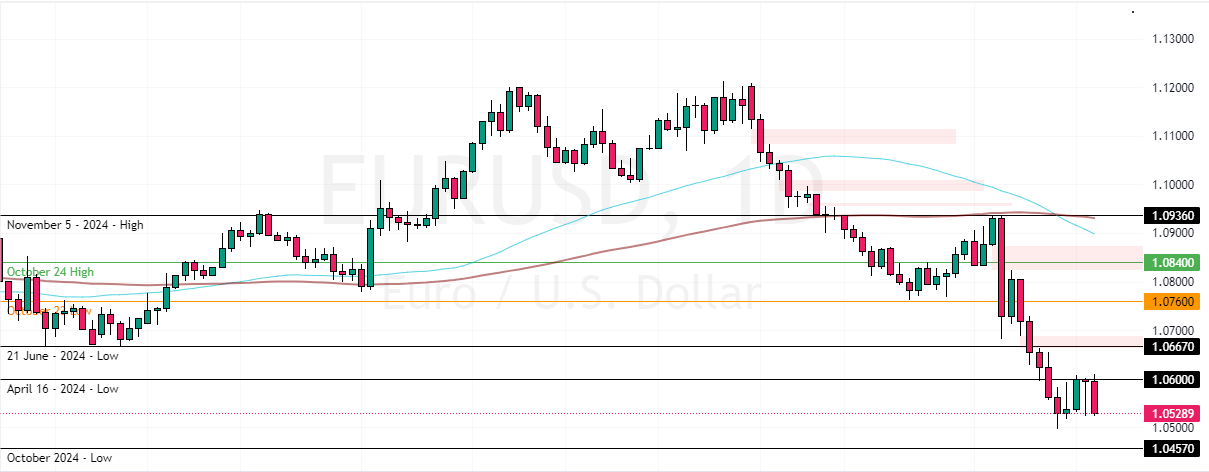

EURUSD Technical Analysis

The primary trend of EUR/USD is bearish because the prices remained below the 50-period simple moving average. As for the technical indicators, the Awesome Oscillator histogram is red, nearing zero from above, indicating the downtrend should prevail.

Furthermore, RSI 14 and the Stochastic Oscillator records show 37 and 48 declining, meaning EUR/USD is not oversold, and the downtrend should extend.

From a technical perspective, the outlook for the trend remains bearish below $1.06, with the next target at the October 2024 low, the 1.045 mark.

EURUSD Price Forecast

Please note that the downtrend strategy should be invalidated if EUR/USD bulls pull the prices above $1.06. If this scenario unfolds, a new consolidation phase could start, targeting the June 21 low at 1.066.

EURUSD Support and Resistance Levels

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 1.05 / 1.045

- Resistance: 1.06 / 1.066