FxNews—In today’s comprehensive EURUSD technical analysis, we will first scrutinize the current economic conditions in the Eurozone. Then, we will meticulously delve into the details of the EURUSD pair’s technical analysis.

EURUSD Futures – Euro Area in Profit

In a remarkable turnaround, the Euro Area, a group of countries that use the Euro as their currency, reported a current account surplus of EUR 30.67 billion in August 2023. This is a significant improvement from the same period in the previous year when the region faced a deficit of EUR 26.57 billion.

The surplus was primarily driven by a positive shift in the goods account, which swung from a deficit of EUR 30.99 billion last year to a surplus of EUR 25.48 billion this year. This indicates that the Euro Area countries successfully exported more goods than they imported during this period.

In addition, the secondary income deficit decreased, falling to EUR 12.22 billion from EUR 14.19 billion. Secondary income typically includes transfers like pensions and workers’ remittances.

However, it wasn’t all positive news. The services surplus slightly declined, falling to EUR 12.38 billion from EUR 13.09 billion. Similarly, the primary income surplus, which includes earnings from investments such as interest and dividends, also narrowed slightly to EUR 5.04 billion from EUR 5.52 billion.

Despite these minor setbacks, the overall picture for the January-August period was positive. The Euro Area posted a current account surplus of EUR 130.05 billion, marking a significant improvement from the deficit of EUR 80.18 billion recorded during the same period in 2022.

This economic turnaround signals a robust recovery for the Euro Area economies and bodes well for future financial stability.

EURUSD Technical Analysis

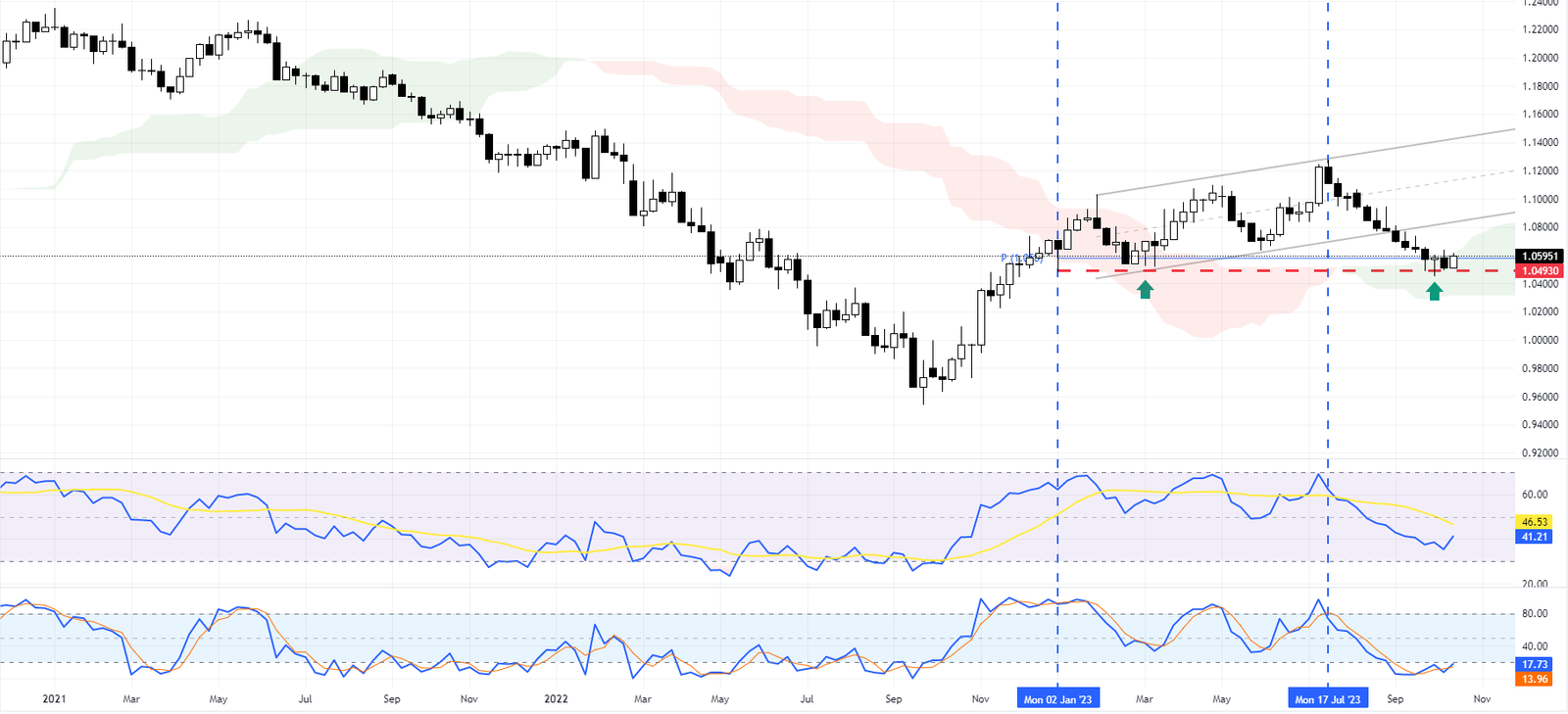

The EURUSD currency pair has been downward since July 17th, extending to a low of around 1.0493 in January 2023. This decline was triggered by the EURUSD bears’ breakout of the bearish channel. Currently, the pair is trading within the Ichimoku cloud, and a hammer candlestick pattern was observed two weeks ago near the support zone. Given that the stochastic oscillator is in the oversold area on the weekly chart, we might see a correction or reversal in the EURUSD futures price.

Let’s examine the daily chart more closely for a more detailed analysis of the future price of EURUSD.

Despite the bulls’ unsuccessful attempts to break out of the bearish channel and pivot at 1.065, the pair is now trading between 1.0493 and 1.065. These two key levels are crucial for the future price of EURUSD. If the bulls close above the pivot, we could see a continuation of the upward momentum, with initial targets at R1 (1.081) followed by R2 (1.104).

Conversely, if the pair closes below 1.0493, we could see a continuation of the decline that began on July 17th, with a target at S1 (1.025).