In October 2024, the HCOB Eurozone Manufacturing PMI was slightly revised upward to 46 from the initial estimate of 45.9. This is an improvement over September’s reading of 45.

Although the PMI remains below 50—signaling that the manufacturing sector is still contracting—the higher number suggests the decline is slowing down. This marks the mildest contraction since May.

October Marks Record 28-Month Factory Downturn

However, October is also the 28th consecutive month of contraction, making it the longest downturn since records began in 1997. Production volumes fell for the 19th month in a row due to a continued drop in new factory orders, which led to more job cuts. On a positive note, the decreases in output, sales, and employment were less severe than before. Yet, business confidence dropped to its lowest level in a year.

EURUSD Technical Analysis – 4-November-2024

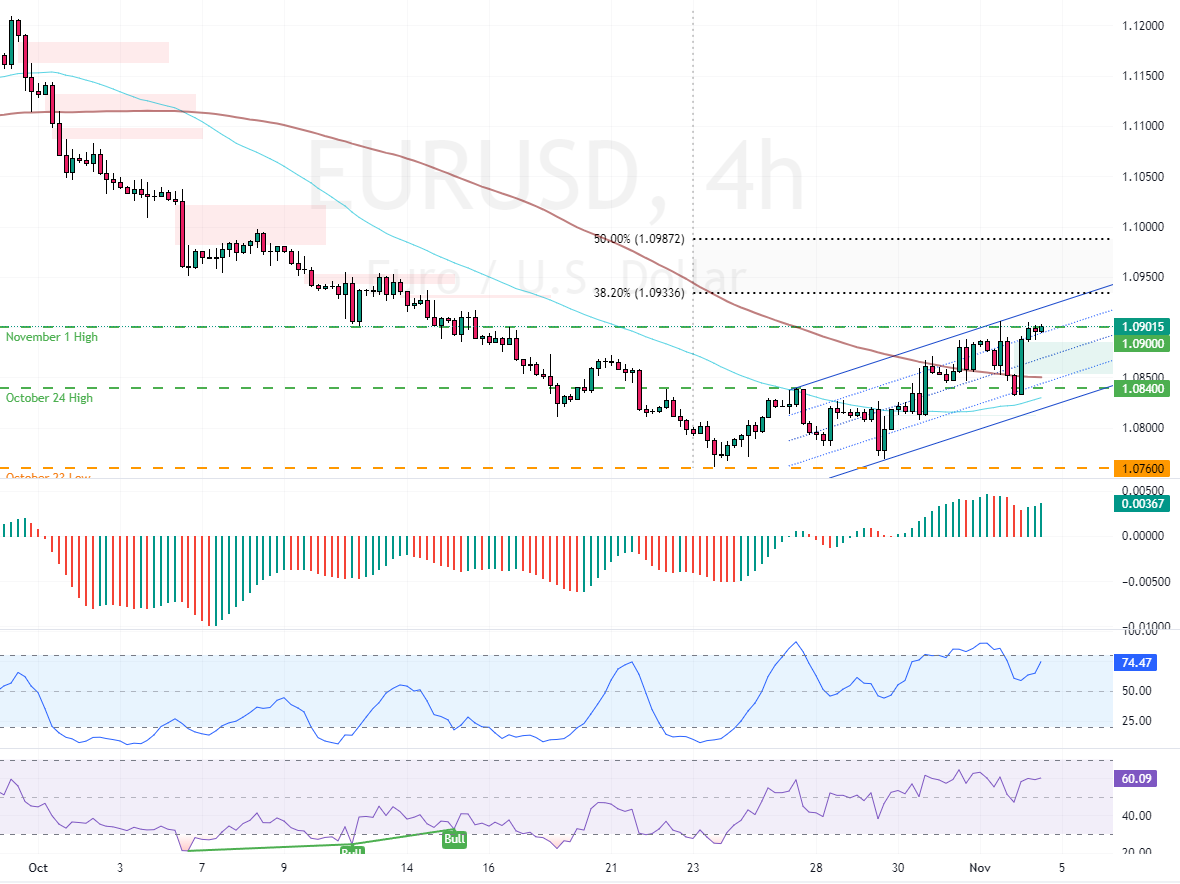

The EUR/USD made a Fair Value Gap in the 4-hour chart, meaning the price has the potential to decline toward $1.084 to fill the gap.

As for the technical indicators, the Awesome Oscillator histogram is green and above the signal line, meaning the uptick momentum should resume. Furthermore, the RSI 14 and the Stochastic Oscillator depict 59 and 74 in the description, interpreted as the market is not overbought and the current uptrend having the potential to resume.

Overall, the technical indicators suggest the EUR/USD bullish momentum should resume.

EURUSD Forecast – 4-October-2024

The immediate resistance rests at the November 1 high of $1.09. If EUR/USD surpasses $1.09, the bullish wave from late October would extend to the 38.2% Fibonacci retracement level.

Furthermore, if the price exceeds $1.093 (38.2% Fibonacci), the path to the %50 Fibonacci at $1.098 will likely be paved. Please note that the bullish scenario should be invalidated if EUR/USD falls below the October 24 high at $1.084.

- Next read: USDILS Bulls Eye New High If 3.765 Breaks

EURUSD Support and Resistance Level – 4-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 1.084 / 1.076

- Resistance: 1.09 / 1.093 / 1.098