FxNews—The EUR/USD pair has been on an upward trend, reaching 1.0650 early Thursday. Despite the RSI indicator suggesting the pair is nearing an overbought condition, investors might overlook this if US inflation data is softer than expected.

US Dollar Slides as Fed Signals Softer Stance

Mid-week market dynamics were primarily influenced by risk flows, with the US Dollar struggling to maintain its position. Furthermore, dovish remarks from Federal Reserve (Fed) officials decreased US Treasury bond yields, putting additional pressure on the currency.

This week, the Euro (EUR) has shown strength against major currencies, notably the US Dollar.

As we head into Thursday, US stock index futures are trading positively, indicating a buoyant market sentiment.

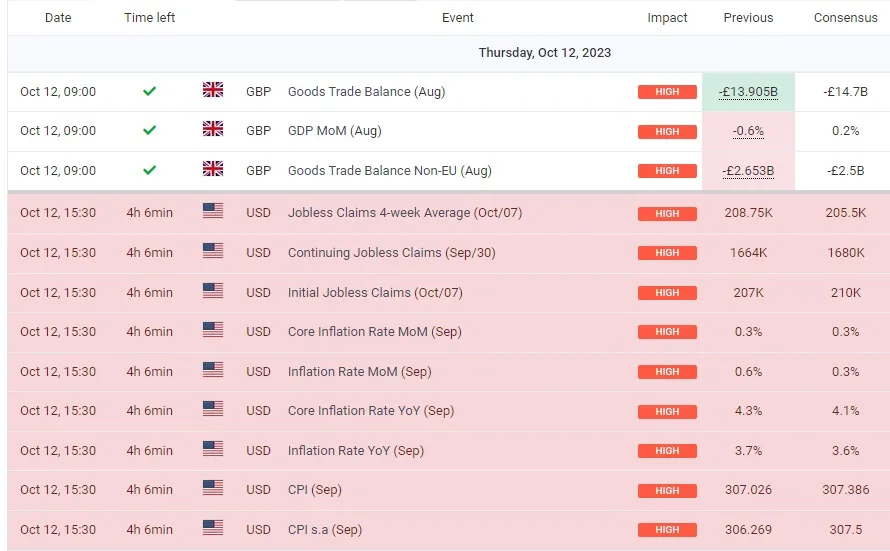

Later in the day, market participants will closely monitor the release of the September US Consumer Price Index (CPI) data. The expectation is for both the CPI and the Core CPI (which excludes volatile food and energy prices) to increase by 0.3% monthly.

According to the CME Group FedWatch Tool, markets predict a 72% chance that the Fed will maintain the current policy rate this year. If the monthly Core CPI is weaker than anticipated, dovish Fed bets could continue influencing market activity.

This could extend the weekly rally in US stocks and further weaken the USD. Conversely, a robust Core CPI reading of 0.5% or above could trigger a correction in the USD and cause EUR/USD to lose some of its weekly gains.

EURUSD Tests Key Resistance Level at 1.064

The EUR/USD pair is testing a significant resistance level at 1.064. This is part of a broader trend, with the currency pair consistently trading within a rising channel. From a technical perspective, the EURUSD pair also hovers above the Ichimoku cloud. This is generally seen as a bullish signal, indicating potential for further upward movement.

Looking ahead, several vital factors could influence the direction of this currency pair. One of these is the upcoming US inflation data release. If this data is softer than expected, the EURUSD pair could break through the 1.064 resistance level.

In such a scenario, the pair’s next target would be the 1.07 resistance level. This would represent a significant milestone and could open up further upside potential.