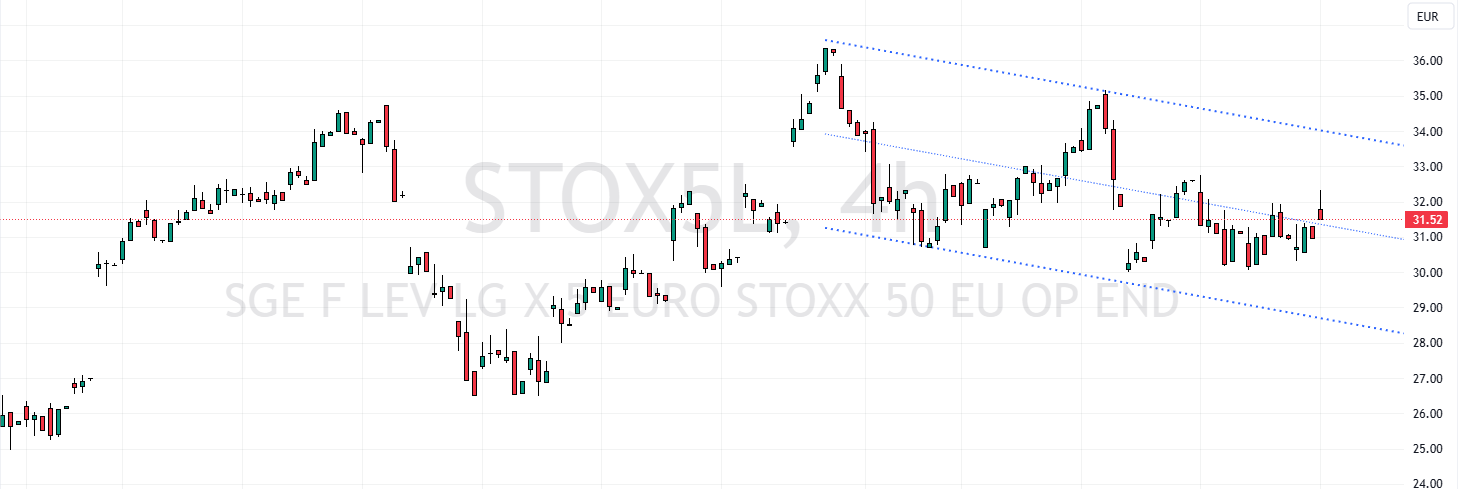

FxNews—On Monday, the STOXX 50 index rose by 0.4%, and the STOXX 600 increased by 0.2%, aiming to recover from the previous session’s losses as market sentiment turned more positive.

Oil Prices Drop as Israel’s Strikes Avoid Key Iran Sites

Over the weekend, Israel’s strikes on Iran did not hit oil or nuclear sites, and Iran did not immediately pledge any response, which caused oil prices to fall significantly as hopes grew for reduced tensions in the region. Traders also evaluated Japan’s election results, in which the ruling party lost its majority in parliament.

Travel and leisure stocks saw gains, while oil and gas shares declined by over 1%. Among companies, Vinci and Kering gained 1.6%, while Philips dropped more than 12% after cutting its sales forecast due to low demand in China. Eni and Repsol recorded losses, with 1.8% and 1.3% declines, respectively.

- Also read: GBP/JPY Holds Near 196 as FTSE Gains 0.2%

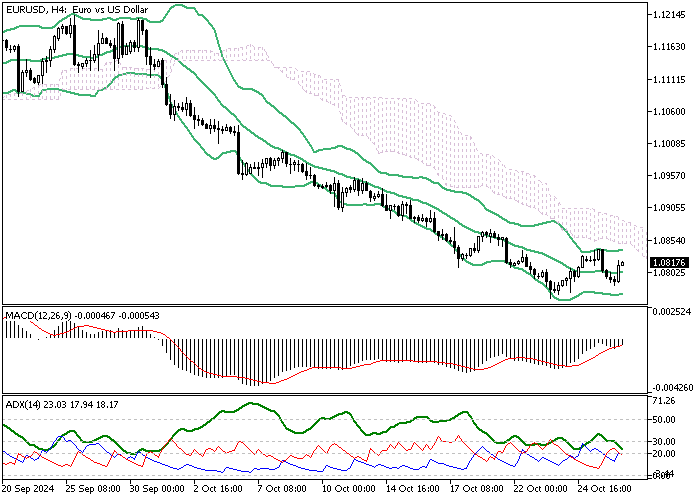

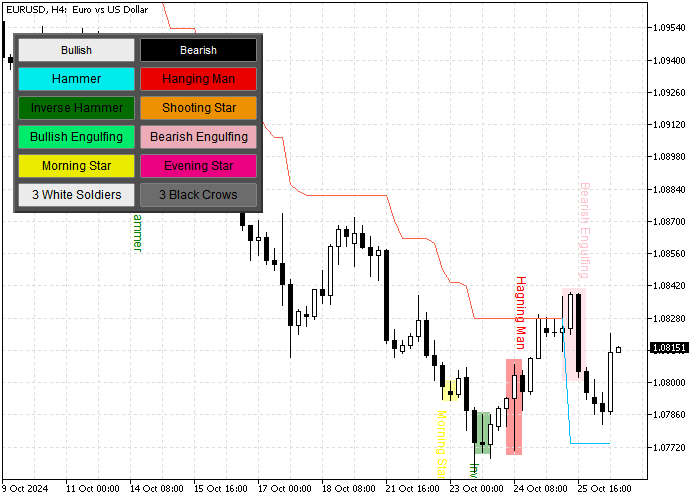

EURUSD Drops After Bearish Engulfing Signal

The EUR/USD currency pair trades bearish as the price is below the Ichimoku Cloud. On October 25, the Euro tested the 50-period simple moving average as resistance. Consequently, the downtrend resumed with a bearish engulfing pattern. As of this writing, the Euro trades at approximately $1.081, filling the previous Fair Value Gap.

The Stochastic Oscillator declines, depicting 46 in the description. But, the Awesome Oscillator histogram is green, nearing the signal line from below. Additionally, the RSI 14 flipped above the median line, demonstrating a weak bullish momentum.

Overall, the technical indicators suggest the primary trend is bearish, but EUR/USD began a low, sideways momentum, which can be interpreted as consolidation.

EURUSD Set to Hit New Lows Below $1.078

The immediate support is at $1.078 (August 1 low. From a technical perspective, the downtrend will likely resume if bears (sellers) close and stabilize the EUR/USD price below the $1.078 mark. If this scenario unfolds, the downtrend could extend to February 2024 low at $1.072.

The critical resistance rests at $1.088, backed by the 100-period SMA. The bearish outlook should be invalidated if bulls (buyers) pull the price above the $1.088 barrier. In this scenario, the consolidation phase could target $1.095 (October 4 Low).

EURUSD Support and Resistance Levels

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 1.078 / 1.072

- Resistance: 1.088 / 1.095