The EUR/USD currency pair dropped to $1.05 on Thursday morning, reaching its lowest level since mid-October 2023. The new decline, which began at $1.06, is due to a stronger dollar and increasing tension between Russia and Ukraine. Potential downturns in the eurozone have added to the concerns, affecting the value of the Euro.

ECB Warns of Economic Shocks as Ukraine Uses UK Missiles

Recently, reports have surfaced that Ukraine used UK-made cruise missiles to strike targets in Russia for the first time. Meanwhile, the European Central Bank (ECB) released its annual Financial Stability Review. In this report, the ECB highlighted that rising geopolitical tensions and policy uncertainties make governments more vulnerable.

Additionally, growing global trade tensions heighten the risk of negative economic shocks.

Euro Area Wages Hit Record High with 5.4% Increase

On the other hand, wages agreed upon in the Euro Area increased by 5.4% in the third quarter compared to the same period last year. Since the euro was introduced, this is the largest rise, complicating the ECB’s plans to cut interest rates. Despite these challenges, the central bank is still expected to implement its fourth 25-basis point rate cut in December.

EURUSD Technical Analysis – 21-November-2024

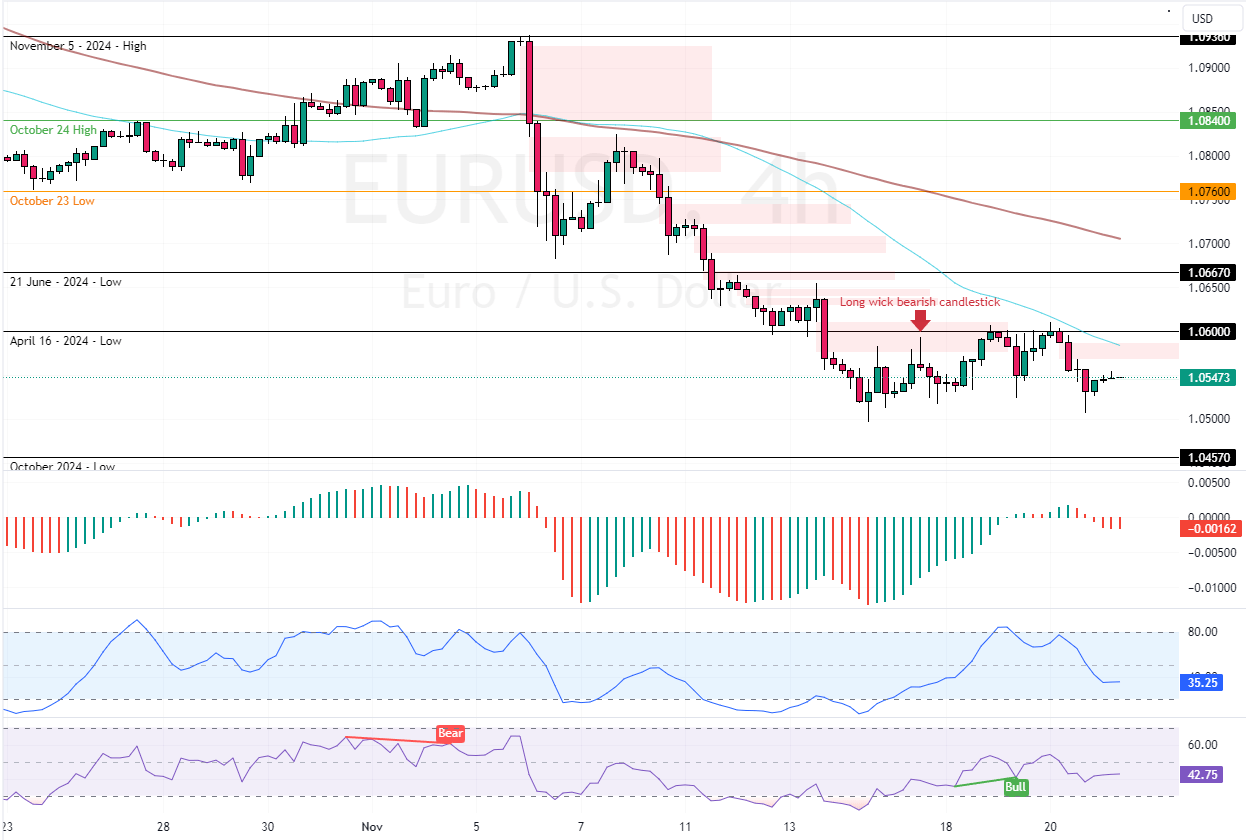

The immediate resistance of the currency pair in discussion stayed valid at $1.06. The EUR/USD trend outlook remains bearish as long as the prices are below the resistance. In this scenario, the bears are expected to push the price toward October 2024 at $1.04.

Please note that the bearish outlook should be invalidated if EUR/USD exceeds $1.06. If this scenario unfolds, a consolidation phase could begin, driving prices to the 21 June low at $1.066.