FxNews—The Euro has dropped to just below $1.081 support, hitting its lowest point since early August, as financial markets expect further rate decreases from the European Central Bank (ECB).

The ECB has already reduced rates three times this year, pointing to better control over inflation but a poorer outlook for Europe’s economy. Remarks from ECB President Christine Lagarde were taken to mean a less positive view of the economy, prompting expectations of a steady 25-basis-point reduction at each future meeting until mid-2025.

Will Weak PMI Data Lead to ECB Rate Cuts?

Investors are now waiting for new economic reports, including PMI numbers, that might show ongoing weak economic activity in the region and could justify additional ECB measures.

A 25 basis point cut in December is widely expected, with a 30% possibility of a steeper 50 basis point cut. On the other hand, strong economic figures from the US have lessened the likelihood of significant rate cuts by the Federal Reserve.

- Also read: EUR/JPY Overbought at Key 163.6 Resistance

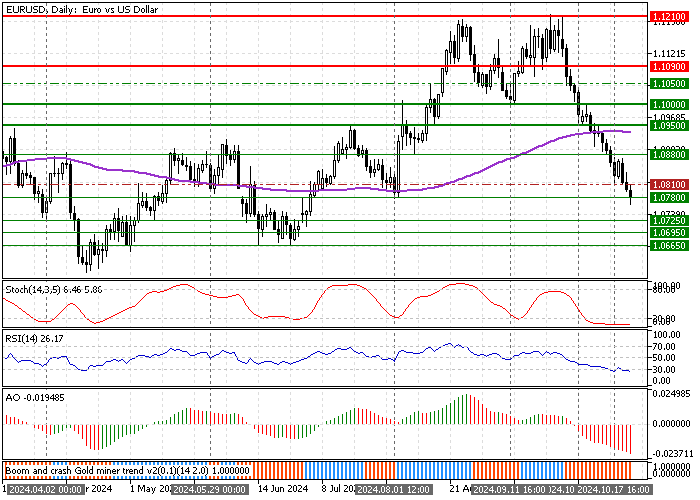

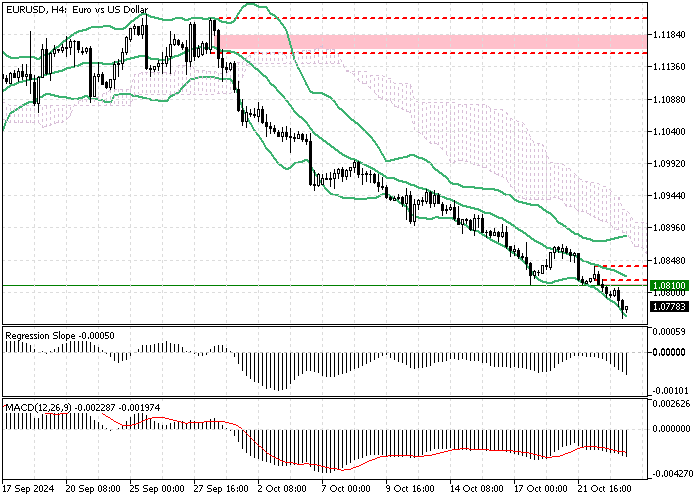

EURUSD Technical Analysis – 23-October-2024

The EUR/USD is trading bearish. Today, the price broke below $1.081 (October 10 Low) support. As of this writing, the price shifted below the August 2024 all-time low at $1.078, indicating the bear market will likely resume.

However, the RSI 14 and the Stochastic Oscillator hover in oversold territory, recording 25 and 6 in the description, respectively. Hence, we expect the EUR/USD price to experience a consolidation phase.

In this scenario, the Euro could rise to retest the $1.081 Fair Value Gap (FVG) before the downtrend resumes. This resistance zone could give retail traders and investors a decent bid to join the bear market.

That said, if the $1.081 resistance holds, the next bearish target will likely be the April 2 low at $1.072.

- Good reads: GBP/JPY Poised for Breakout from Sideways Market

EURUSD Support and Resistance Levels – 23-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 1.072 / 1.072 / 1.069 / 1.066

- Resistance: 1.081 / 1.088