FxNews—The European currency (Euro) dipped against the U.S. dollar from $1.121 (September 25 High). Robust selling pressure pushed the currency pair below the 100-period simple moving average and, subsequently, the $1.109 resistance.

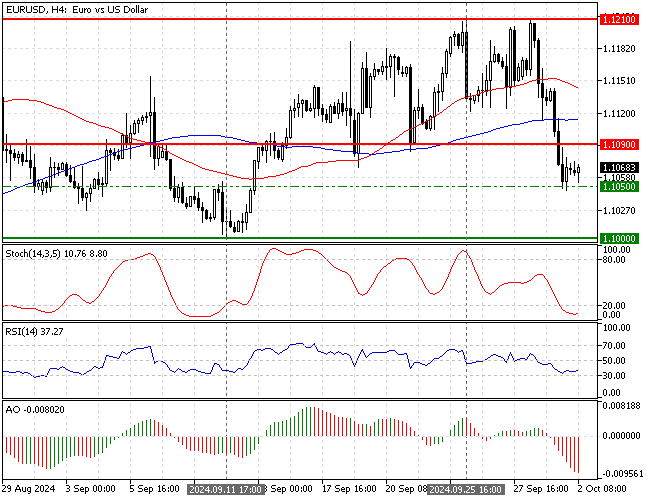

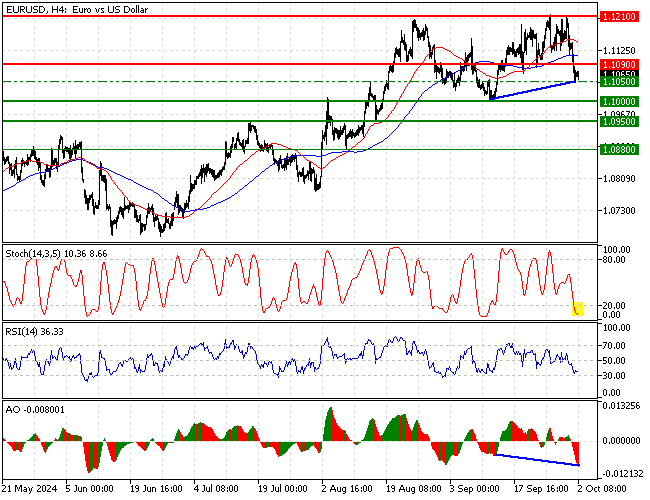

As of this writing, the EUR/USD pair is consolidating at approximately $1.106. The 4-hour chart below demonstrates the price, support, resistance levels, and technical indicators used in today’s analysis.

EURUSD Technical Analysis – 2-October-2024

The primary trend is bearish because the EUR/USD price is below the 50- and 100-period simple moving averages. However, the robust selling pressure drove the Stochastic oscillator into oversold territory, signaling a trend reversal or an imminent consolidation phase.

Additionally, the Awesome oscillator signals divergence, backing the Stochastic oscillator for a possibility in the trend reversal or a consolidation era that can potentially test the upper resistance levels.

Overall, the technical indicators suggest the primary trend is bearish. Still, the EUR/USD price can potentially rise to upper demand zones.

EURUSD Forecast – 2-October-2024

Going short or joining a bear market is not recommended when technical indicators signal oversold. Therefore, retail traders and investors should closely monitor the $1.109 (September 23 Low) key resistance for bearish signals, such as a long-wick candlestick or a bearish engulfing pattern.

That said, the immediate support level is at $1.105. The downtrend will likely resume if the price dips below $1.105 (August 14 High). The next bearish target in this scenario could be the September 11 low at $1.10.

Please note that the bear market should be invalidated if the EUR/USD bulls close and stabilize the rate above the 100-period simple moving average.

EURUSD Support and Resistance Levels – 2-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $1.105 / $1.10 / $1.095

- Resistance: $1.109 / $1.121