FxNews—The European currency has been in an uptrend against the U.S. Dollar since June 9 from the $1.066 mark. The robust buying pressure exceeded yesterday’s trading session’s December 12, 2023 high, 1.113. As of writing, the EUR/USD currency pair trades slightly below 1.113, testing the December 2023 all-time high.

The weekly chart below demonstrates the key support and resistance levels for the trading product in discussion.

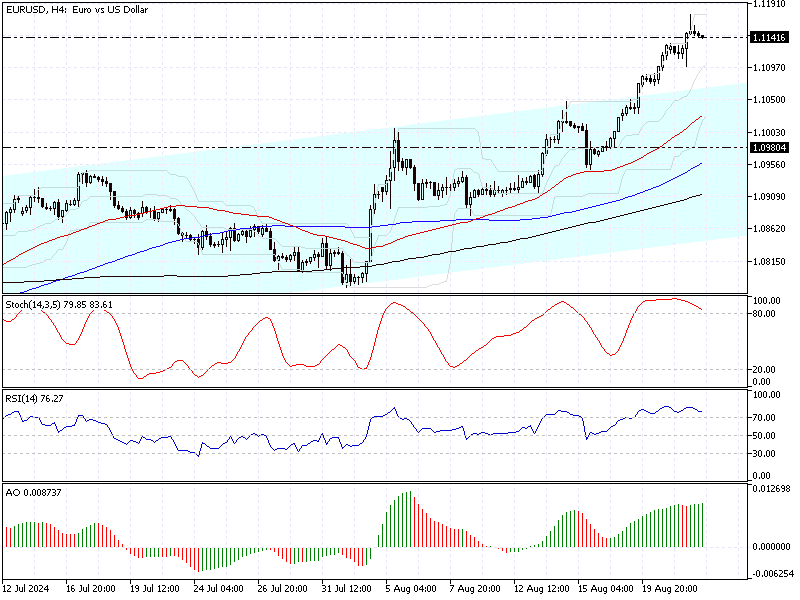

EURUSD Technical Analysis – 22-August-2024

Zooming into the 4-hour chart, we notice that momentum indicators such as the stochastic and the RSI are overbought.

- The relative strength index indicates 75 in the value, meaning the currency pair is overbought.

- The stochastic oscillator value is 83, which is inside the overbought area. This indicates that the European currency is overpriced against the U.S. Dollar.

- The awesome oscillator bars are above the signal line with green bars, signifying the prevailing bullish trend.

- The price is also above the 50- and 100-period simple moving average, showing the bullish primary trend.

Overall, the technical indicators suggest the primary trend is bullish. Still, it is overbought, and therefore, the price of the EUR/USD could dip or consolidate near the lower support levels.

EURUSD Forecast – 22-August-2024

As shown in the 4-hour chart above, the EUR/USD chart formed a shooting star candlestick pattern, interpreted as a bearish signal. From a technical perspective, the bearish candlestick pattern and the overbought signal from the momentum indicators suggest that a price decline could be on the horizon.

That said, the immediate support is at $1.1133. If the EUR/USD bears close below this point, the next support will be the August 21 low at $1.1099. Furthermore, if the selling pressure exceeds $1.1099, the bears’ path to the next supply area, the August 14 high at $1.104, will likely be paved.

- Also read: GBP/USD Technical Analysis – 20-August-2024

EURUSD Bullish Scenario – 22-August-2024

As explained earlier in this post, the market is overbought. Therefore, going long on the EUR/USD this week is not advised when the momentum indicators are overbought in higher timeframes such as 4-hour and daily.

Hence, we suggest traders and investors wait patiently for the price to consolidate near key support levels such as 1.1099 and 1.1048.

Suppose the chart forms bullish candlestick patterns, such as a hammer or a bullish engulfing candlestick, and the price is above the 50-period simple moving average. In that case, it presents a favorable opportunity to join the primary bullish trend.

EURUSD Support and Resistance Levels – 22-August-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 1.113 / 1.1099 / 1.1048

- Resistance: 1.127